Got $3,000? 3 Tech Stocks to Buy and Hold for the Long Term

Although the market continues to hit all-time highs, plenty of stocks are worth buying right now. While some may be overpriced, plenty look like good deals.

If you’ve got $3,000 lying around, buying this trio is a wise idea.

Meta Platforms

Meta Platforms (NASDAQ: META) is probably known better by its previous name, Facebook. Meta changed its name to signal a shift to focus on the metaverse, but this also included augmented and virtual reality products that are starting to generate some interest thanks to the rise of artificial intelligence (AI). For example, Meta is working on its Ego AI product, which, through the use of glasses, can teach users activities like cooking or playing tennis.

But this is just a product that’s still years away. Fortunately, Meta’s primary business is doing great.

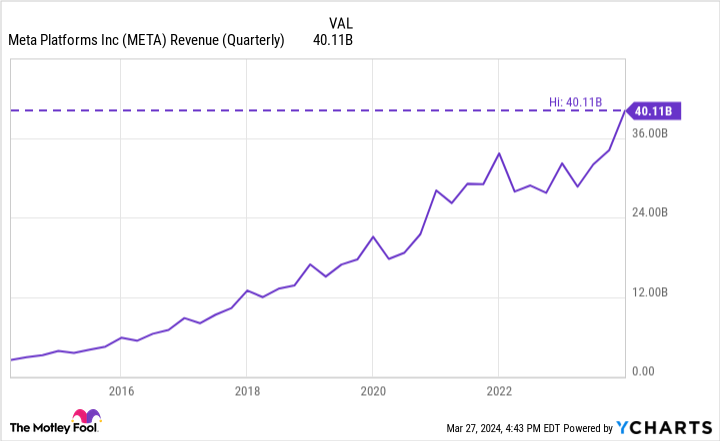

Most of Meta’s revenue and profits come from advertising on its social media platforms. While this industry wasn’t successful in late 2022 and early 2023, it came roaring back, and Meta is doing as well as ever. In Q4, revenue was up 25% to $40.1 billion, a new all-time high. Its profits also skyrocketed, up 20% to $14 billion.

Management also gave bullish commentary for 2024, which should excite investors because it shows Meta isn’t done growing. With Meta’s stock priced around 25 times forward earnings, it’s a stock that investors should be willing to buy now.

Adobe

Adobe (NASDAQ: ADBE) is the industry leader in digital media creation software. However, with the rise of AI-generated images, many questioned if Adobe’s products were necessary. This came to a focus during Adobe’s first quarter of 2024 (ending March 1), as Adobe’s Firefly product has to compete with many free programs.

However, Adobe saw strong demand, with companies like Accenture, Starbucks, and IBM adopting the software add-on. Still, investors were worried about Q2 growth projections, as they only indicated 9.4% growth at the midpoint. This caused investors to panic, and the stock is down over 11% since the company reported earnings.

This seems like an overreaction and allows investors to scoop up Adobe shares much cheaper than they previously could. Wall Street is certainly convinced that Adobe is undervalued, as the average analyst has a one-year price target of $620 on the stock — a 24% increase from its current levels. With Adobe trading for 28 times forward earnings, it seems like another no-brainer buy.

UiPath

UiPath (NYSE: PATH) is a leader in robotic process automation (RPA). Its software helps clients automate repetitive tasks, freeing up employees to do work that requires original thinking. It also utilizes the power of AI to help increase the number of tasks it can automate, a key factor in today’s environment.

Unlike most stocks, UiPath has had a down 2024, losing around 25% of its value. This has nothing to do with its business, as its fourth quarter of fiscal year 2024 (ending Jan. 31) was quite positive. Its annual recurring revenue (ARR) rose 22% to $1.46 billion and it posted an operating profit of 4%.

It also wasn’t overvalued, as it trades around 10.5 times sales — pretty cheap compared to its peers with similar growth.

As a result, I think UiPath is a great stock to buy right now, as its stock hasn’t benefited from the AI trend that many others have. This means it’s only a matter of time before UiPath gets the recognition it deserves and becomes a more highly valued stock.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Adobe, Meta Platforms, and UiPath. The Motley Fool has positions in and recommends Accenture Plc, Adobe, Meta Platforms, Starbucks, and UiPath. The Motley Fool recommends International Business Machines and recommends the following options: long January 2025 $290 calls on Accenture Plc and short January 2025 $310 calls on Accenture Plc. The Motley Fool has a disclosure policy.

Got $3,000? 3 Tech Stocks to Buy and Hold for the Long Term was originally published by The Motley Fool