Four Tech Stocks To Buy With Recession-Proof Balance Sheets

DNY59

Thesis

When rates are high, which now seem to be destined for a more persistent nature than originally thought, wouldn’t it be nice to invest vicariously through the best balance sheets in the world? When or if rates dive, M&A activity will pick up with lower costs of capital. Even with a pristine balance sheet, there’s usually some level of debt and some level of cash used while making the sausage. These 4 companies should not only be able to access the most rock bottom rates as they fall, but also avoid excessive syndication when making a deal, since cash reserves are a near bottomless pit.

The below portfolio is the strongest balance sheets I could find. Ones where liquid investments are normally double or more long-term debt. This results in a positive net interest expense where these companies are being paid to wait for a place to deploy capital. With so many “great idea, not great cash flow” tech companies in a cash crunch, diluting investors at the bottom, these companies can wait to strike like a viper. All the while swimming in a vault of cash like Scrooge McDuck. I own all these names and remain bullish on the majority, they anchor a good portion of my portfolio.

If we both fall into the camp that a secular bull will keep running combined with M&A starting up on the tail end of the year should the FED move to cuts, this portfolio provides an investor with companies that can take advantage of the high interim rates and non-organic growth opportunities as they come into view. Intelligent use of liquidity can keep the top line compounding for the foreseeable future.

The list of companies with my favorite balance sheets is the following four:

Low to no dividends with massive buyback power

If we are looking to add long-term growth and quality to our portfolios while still in a raging bull market, buybacks can be our friend should a sell-off ensue. These companies pay low to no dividends but are some of the most furious buyers of their shares, utilizing growth in cash flow and cash from the balance sheets.

Buying shares in the open market can stabilize prices should shares get into a sell-off and most importantly, continue to increase free cash flow per share. The retention of most of the cash flow rather than the funds being paid out in dividends will put these companies at an advantage over others as it pertains to price stabilization.

Alphabet

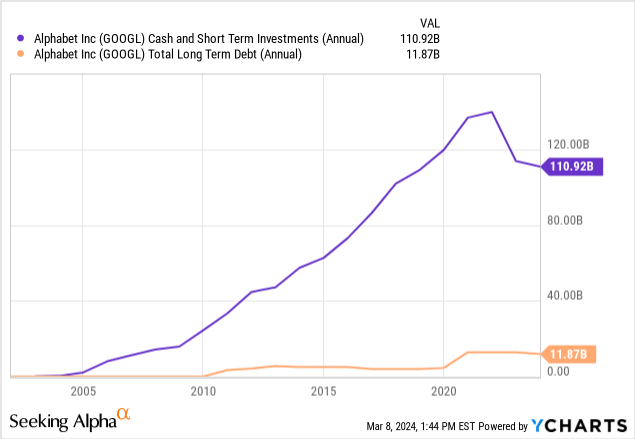

First up is Alphabet. This is the one stock out of the bunch that I would rate a strong buy. About $12 Billion in long-term debt against over $100 Billion in cash and short-term investments. This is the winner for the strongest balance sheet at the moment in my humble opinion.

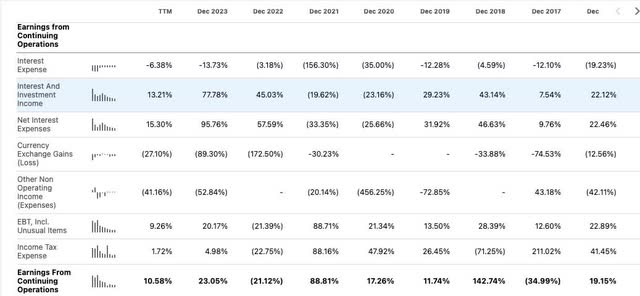

Let’s take a look at the net interest expense line:

Seeking Alpha

The company is in the positive to the tune of USD 3.55 Billion. The negativity as of late surrounding Alphabet’s AI failures is way overblown and has created a buying opportunity. They are ahead of Tesla (TSLA) when it comes to full self-driving taxis with Waymo and the ad business remains the strongest in the game. You just don’t end up with this much cash by chance. You have to have a very strong free cash flow-producing business.

Seeking Alpha

The year-over-year growth rates for interest income are striking. I’m happy to watch Alphabet collect cash and spit out interest until the next best thing pops up for them. Be it an internal creation or an inorganic acquisition, the balance sheet is the toolset to keep the future compounding machine alive.

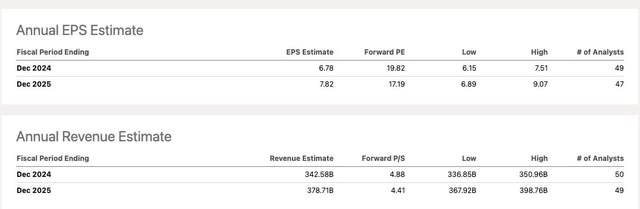

Seeking Alpha

Analysts have a high end 2025 EPS estimate of $9.07 a share, I’m in the high-end camp.

- FY 2024 high end is at $7.51/share. High end 24 to high end 25 is a 20.7% GAAP growth rate.

- With the stock trading at $135, that’s 14.88 X 2025 GAAP high end EPS with a 20.7% growth rate.

- That’s a possible .71 FWD PEG ratio. Fair price at PEG 1 would be 20.7 X 9.07= $187.74.

This is the best buy and hold of the group in my opinion.

Revenue sources from FactSet:

| Source | Percentage |

| Web-based data and services [advertising] | 78.48% |

| Internet Hosting Services | 10.76% |

| Marketing and Advertising Services | 10.19% |

| Wireless Services | 0.50% |

| Multi-service revenue | 0.08% |

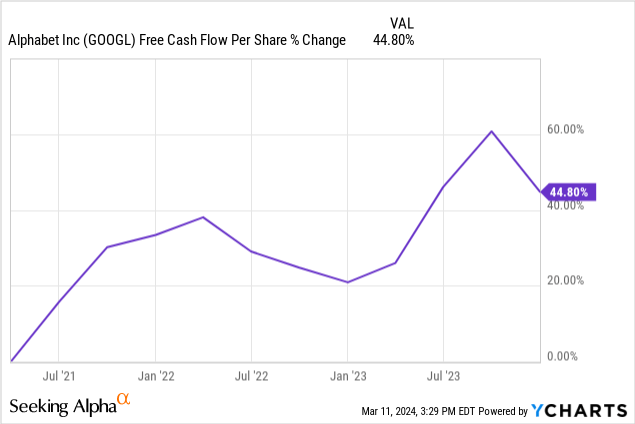

3 year Free cash flow per share growth:

At an over 44% increase in free cash flow per share growth over the past 3 years, this is an impressive number because Alphabet has consistently been one of the largest revenue generators on this list during this duration. They weren’t moving from a small number to a larger number, they were going from a larger to a larger number.

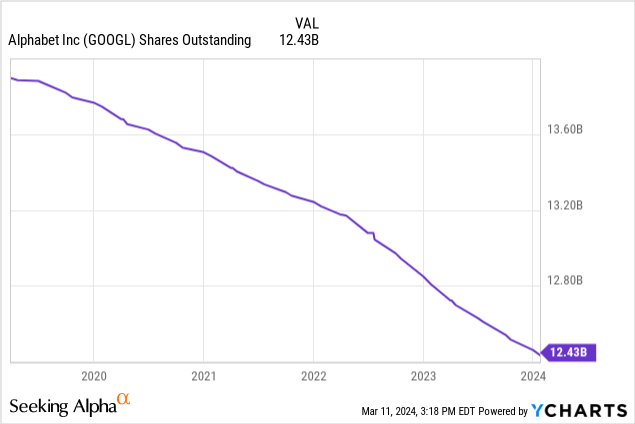

5 Year share reduction:

A common theme we’ll see in these names is a horizontal drop from…

Read More: Four Tech Stocks To Buy With Recession-Proof Balance Sheets