Forget the Nasdaq — Invest in This Unstoppable ETF Instead

The technology-heavy Nasdaq Composite index has been on a remarkable tear over the past decade, outperforming the S&P 500 by a wide margin. But one popular exchange-traded fund (ETF) has done even better: the Invesco QQQ Trust (NASDAQ: QQQ).

No, don’t write off the Nasdaq. That said, the QQQ could still be the better buy. It has been unstoppable over the past decade, appreciating by 400% and never falling further than 36% from its high. Will that continue in the years ahead?

Riding the “Magnificent Seven” to big gains

Exchange-traded funds are collections of stocks that trade under one ticker symbol. This makes them an easy way for investors to diversify their portfolios. The Invesco QQQ Trust holds shares of 101 companies in its portfolio.

However, it is often the case that a small group of relative outliers has the most impact on a system’s performance. That’s true here. The Invesco QQQ Trust’s portfolio is weighted heavily toward the “Magnificent Seven” stocks. All sit among its top 10 holdings, and they collectively account for roughly 40% of the fund’s value.

That’s not necessarily a bad thing. The Magnificent Seven are among the largest, most deep-pocketed U.S. technology companies, and have firm footings in some of the hottest growth sectors, such as cloud computing, digital advertising, and artificial intelligence (AI).

Will the fund’s hot performance continue?

Nobody can predict with any certainty what the market or specific stock prices will do. However, the Federal Reserve recently indicated that it still plans to reduce the benchmark federal funds rate later this year.

Whether it does so, when, and by how much will depend largely on how inflation trends over the coming months and what the macroeconomic picture looks like, but those rate cuts could be a positive for technology stocks, which tend to thrive in lower-rate environments. (Just look at what happened to their share prices when rates were too low in 2021.)

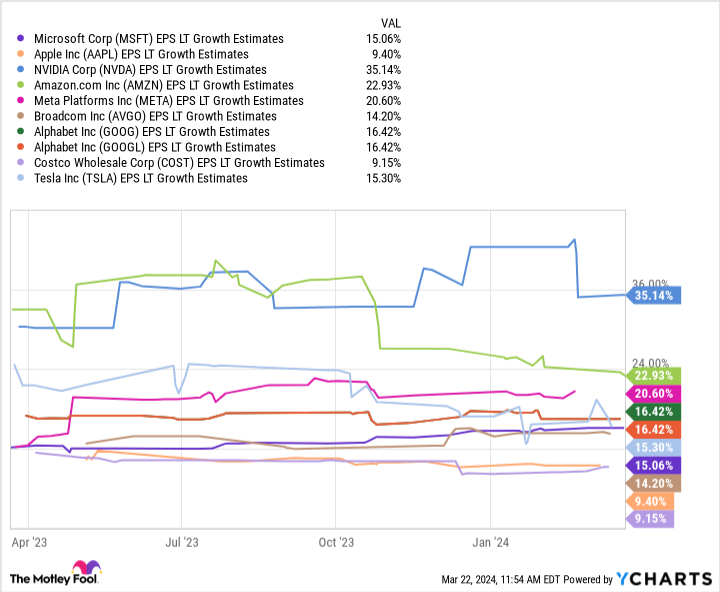

Additionally, AI has become a central growth trend in the tech sector that could drive years of investment and expansion in data centers, software, and other industries where the Invesco QQQ Trust’s largest holdings operate. Check out long-term earnings growth estimates for the fund’s top 10 holdings.

Analysts are least optimistic about Apple and Costco Wholesale, but even they are still expected to deliver over 9% annualized earnings growth. Predictions for all the others are in the mid-teens percentages or higher. In other words, the combination of a friendly interest rate policy and earnings growth could mean the fund’s holdings (and the fund itself) will perform well for years.

How to invest in the Invesco QQQ Trust today

The Invesco QQQ Trust has proven fairly steady over the years. Many individual stocks have fallen far further than 36% from their highs. Still, you can’t take that for granted; investors must be prepared for volatility, even if the long-term trends point to higher share prices.

Don’t be impatient and buy all your Invesco QQQ Trust shares at once. Instead, consider adding to your position gradually through small, scheduled purchases — a strategy called dollar-cost averaging. That’s a way to build a position in an asset with a blended cost, ensuring that the cost basis of your investment won’t be at the very top of the asset’s medium-term range — nor at the very bottom.

You’ll be glad you didn’t jump in with both feet on day one if the market gets volatile and offers up better buying opportunities later.

Should you invest $1,000 in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget the Nasdaq — Invest in This Unstoppable ETF Instead was originally published by The Motley Fool