Forget the “Magnificent Seven:” This Beaten-Down Growth Stock Is the Next Trillion-Dollar Company

Investing in “Magnificent Seven” stocks has proven a reliable way to make big profits. Many of these companies — Apple, Amazon, Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla — have seen their share prices double, triple, or even quadruple in value over just a handful of years.

While investing in the Magnificent Seven may still be a smart decision, investors looking for the biggest growth opportunities should look elsewhere. After huge runs, nearly every company in the Magnificent Seven is now worth at least $1 trillion, the exception being Tesla, which has a market capitalization of around $650 billion.

These megacorporations should continue to grow, but doubling or tripling in size will be increasingly difficult. It’s unlikely any of these stocks will soar 1,000% over the coming years. If you want that type of rapid growth, you need to focus on stocks like Shopify (NYSE: SHOP).

The next trillion-dollar company

If you are looking for the next Magnificent Seven stock, it makes sense to ask why these companies were so successful in the first place. Each company followed its own growth trajectory, but they all share a common trait: exposure to platforms.

What exactly is a platform? As the name suggests, it is a foundation upon which other things can be built. Consider Amazon. It offers a platform on which buyers and sellers can transact. Importantly, Amazon isn’t the one building everything. It is the buyers and sellers themselves who populate the platform with utility. In this way, Amazon can have a business that has millions of merchants without needing to operate millions of stores itself.

Google parent Alphabet is another great example of a platform-like business. The company didn’t create the internet, but its business in many ways allows today’s internet model to operate. The web’s billions of websites and applications aren’t all built directly on Google, but they generate revenue for the company without requiring Google to launch or run these websites itself.

Not every company in the Magnificent Seven is the perfect definition of a platform, but they all benefit from platform economics. That is, they are able to leverage the growth of millions of other businesses and consumers without needing to build all the infrastructure themselves. Outside app developers made Apple’s App Store a giant success, not Apple alone. Meta’s user base builds the vast majority of content on the company’s platforms, not Facebook. Tesla has open-sourced much of its charging technology so that other companies can develop alongside it. Microsoft’s Windows operating system is one of tech’s earliest platform success stories. And even Nvidia, which arguably has the fewest platform characteristics to its business model, is directly exposed to the growth of platforms as it sells millions of chips every year to companies like Alphabet, Microsoft, Apple, Meta, and Amazon.

Want to find the next Magnificent Seven stock? Look for platform businesses.

Shopify is the perfect platform stock

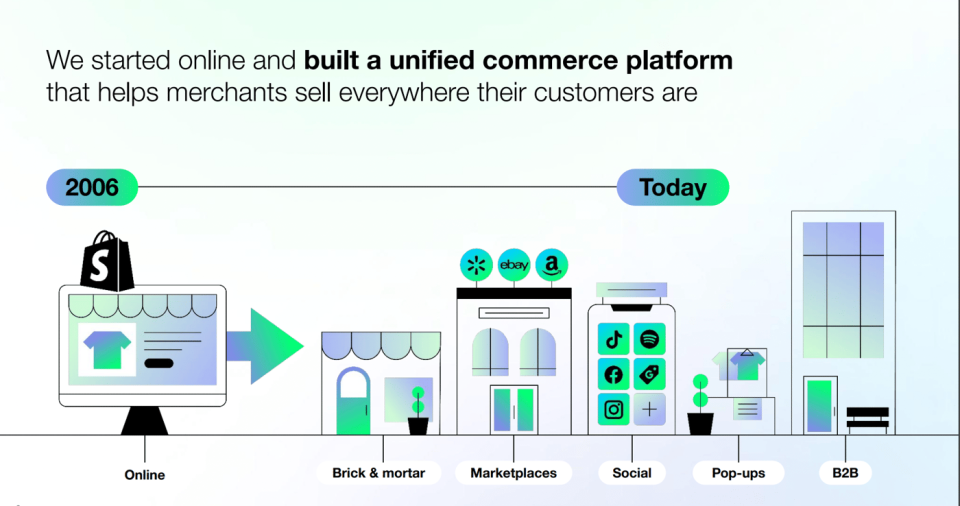

Shopify is an e-commerce platform primarily focused on independent merchants. While Amazon’s growth relies on merchants using its website, Shopify allows anyone to use its platform for launching their own e-commerce site. Shopify’s technology, which includes crucial features like payment processing, inventory management, and marketing analytics, silently runs in the background.

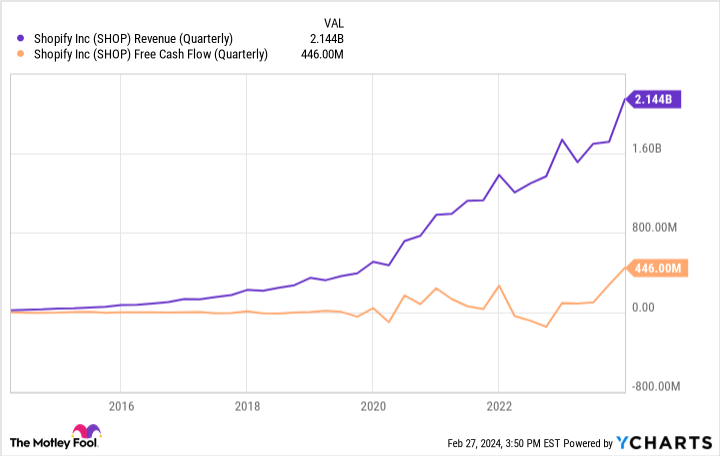

This is not an early-stage growth company. More than one million merchants already use Shopify’s platform, from small upstarts to megabrands like Nike and Everlane. Revenue growth rates have consistently remained in the double digits, while free-cash-flow levels have improved considerably with the maturity of the business.

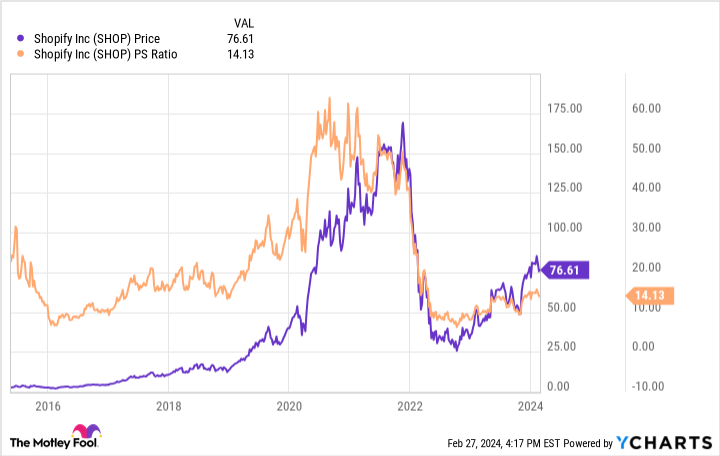

Since its initial public offering (IPO) in 2015, Shopify stock has increased in value by 2,900%. Now with a $100 billion market cap, it is likely that the company’s fastest growth rates are behind it. Still, there’s plenty of reason to believe its growth can match or exceed that of the Magnificent Seven in the years to come.

In general, the e-commerce industry should provide Shopify with a rising tide for at least another decade. Global e-commerce sales are expected to exceed $6 billion in 2024, surpassing $8 trillion by 2027. Even if Shopify simply maintained its market share and pricing power, it could add another $30 billion to its market cap in the coming years just by riding industry growth.

Industry growth, however, is just a starting point for Shopify’s future. Currently, the company has between 1 million and 2 million merchants using its platform. According to some estimates, there are at least 26 million e-commerce merchants operating worldwide. Shopify already has a solid share of this market, but it’s easy to see how it could double or triple its user base over time, especially considering it held just a tiny fraction of the market when shares went public in 2015.

To be sure, Shopify stock is expensive at 14 times sales, but that’s a bargain compared to its recent past, when shares traded at a price-to-sales ratio of more than 50. Shares have rebounded from their 2022 lows, but remain around 50% below their previous highs.

Can Shopify hit a $1 trillion market cap?

It may take another decade for Shopify to potentially join the Magnificent Seven, but as with many platform businesses, the company is getting stronger and stronger. More Amazon buyers, for example, attract more Amazon sellers, which attracts yet more buyers. It’s a positive feedback loop that can generate trillion-dollar businesses. The same is true for Shopify. The more buyers shop on Shopify-powered websites, the more trust, data, and resources the company accumulates, which it can use to strengthen its platform and attract more merchants, thus attracting more buyers.

Amazon’s $1.8 trillion market cap should be a North Star for Shopify’s potential. Amazon conquered the centralized e-commerce market, and Shopify appears poised to conquer the independent e-commerce market, providing a growth trajectory that could fuel the stock to Magnificent Seven levels.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Shopify made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Ryan Vanzo has positions in Shopify. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nike, Nvidia, Shopify, and Tesla. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget the “Magnificent Seven:” This Beaten-Down Growth Stock Is the Next Trillion-Dollar Company was originally published by The Motley Fool