Cryptocurrency Investing Is a Psychological Game. Here Are the 3 Core Tricks to Winning

When you dare to venture into what’s perhaps the most speculative market of our time, you need to be mentally prepared for what’s to come. Cryptocurrency investments are not for the faint of heart, nor are they for those who are intolerant of volatility as well as risk. If you habitually give in to your emotions during the market’s fluctuations and run with the herd, losses are guaranteed.

The good news is that you can develop the mentality you need to succeed in cryptocurrency investing with a bit of effort. Here are three core tricks that will help.

1. Zoom out

The first trick is to keep your focus on the right timescale, which is the long term.

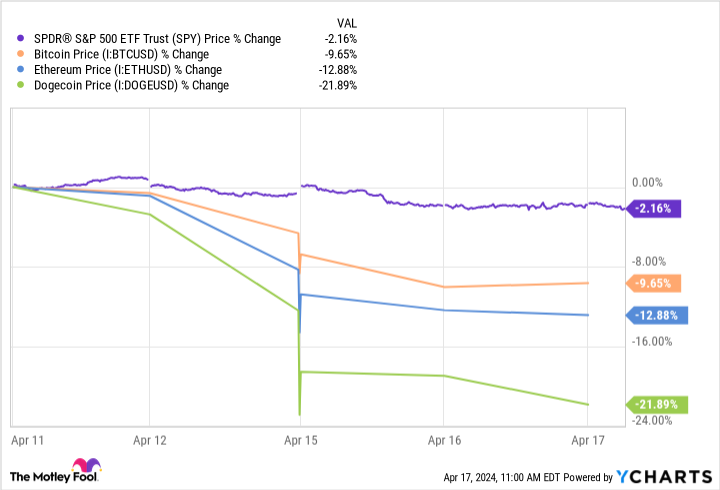

Look at the performance of Bitcoin, (CRYPTO: BTC) Ethereum, (CRYPTO: ETH) and Dogecoin (CRYPTO: DOGE) versus the SPDR S&P 500 ETF Trust (NYSEMKT: SPY) during a recent five-day stretch:

Looks like none were good investments. In fact, after such a sharp drop on Dogecoin, nobody would blame you if you thought about selling. And it’s obvious that Bitcoin is nowhere near as stable as the market-tracking exchange-traded fund (ETF).

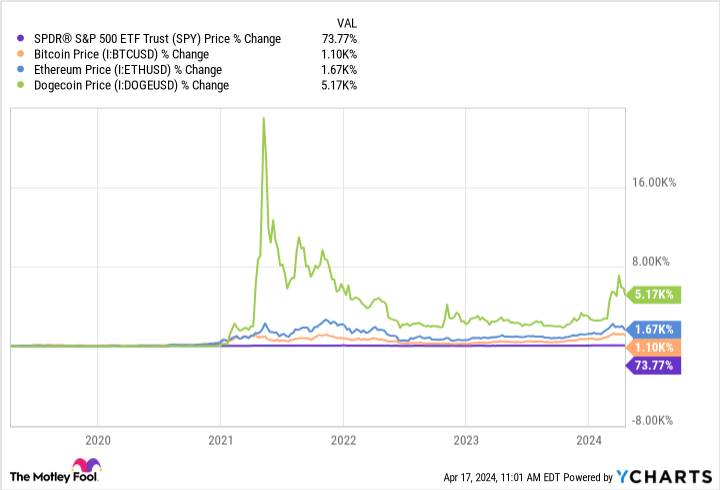

Now look at the chart for the past five years:

The long-term performance of these assets is entirely the opposite of what we saw for the short term. It is possible to argue for all sorts of narratives for why the situation was so bearish during the past few days. Similarly, there is likely more than one correct explanation for why the longer view is so favorable for these coins.

But if you make all of your decisions on the basis of the short-term chart views, you will never have the conviction to hold onto your coins for long enough to reap the outsized rewards of more patient investors. So don’t get distracted by the day-to-day ups and downs of the market, even if seeing your portfolio in the red is frustrating. If you can think in terms of years spent in the market, you can outperform those who can’t.

2. Build conviction slowly

Building off of the previous trick, the second trick is to build your conviction in your investments slowly rather than trying to do so all at once.

For example, let’s say you’ve heard of Ethereum, and you know that it’s hot right now. You even learned that there was a recent catalyst for the Ethereum blockchain in the form of a technology upgrade.

One option would be to allocate a lump sum. The idea would be to capture the rise in price and optimism caused by the catalyst.

But imagine how you’d feel if Ethereum’s price plunged right after committing your capital. To say that the original investing thesis would suddenly seem a lot less ironclad is an understatement. You might even be scared into selling fairly quickly, taking a loss.

Whether we like it or not, our investing impressions are malleable based on what’s happening to our investments. And in a market as volatile as crypto, decisions made confidently and quickly right off the bat are likely to be decisions that we revisit too soon, typically during a pessimistic state caused by steep declines and a panicked frame of mind.

Give yourself the benefit of time by dollar-cost averaging (DCAing) into your cryptocurrency positions. The best circumstances for this tactic are when you can add to your best-performing positions. As the size of your holdings in a coin grows, you’ll start to more fully appreciate the reasons that make it worth investing in. Then, if the market takes a tumble, you’ll have the conviction you need to hold on until things improve, assuming they do.

3. Buy proven assets when there’s panic

Cryptocurrencies are subject to much more hype and panic than stocks. Knowing this fact and using it is key to success.

The period when you are the most likely to hear about a new cryptocurrency is at the apex of its hype curve. Read that again.

Now, consider another point: The period when you are the least likely to hear about an established cryptocurrency is at the nadir of its hype when most investors have given up and moved on.

See where this is going? If you decide to invest in a new and highly speculative cryptocurrency with no utility, precisely when everyone is talking about it — say, like buying Dogecoin in mid-2021 — the most likely outcome is that you will lose money. The hype bubble always pops eventually, and it will probably do so right after you buy the coin (it’ll feel that way, at least).

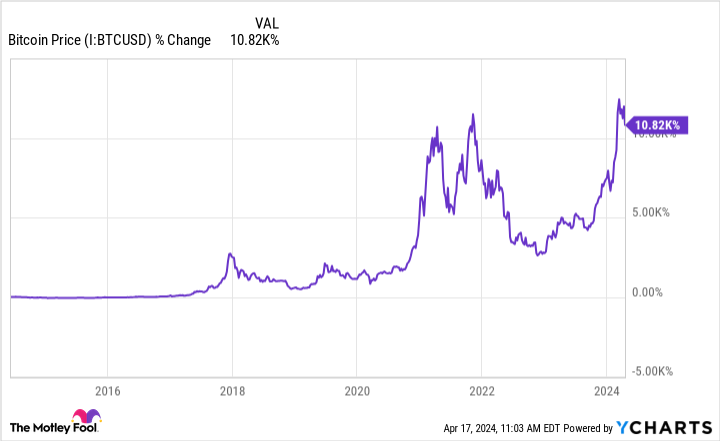

In contrast, if you decide to invest in a proven contender when nobody cares about it due to a punishing decline, you have a much better chance of getting in at a price that’s not inflated by hype. Look at this chart of Bitcoin during the past 10 years:

Obviously, buying after a plunge would result in making more money than buying at a peak.

If you’re DCA-ing into your position, you don’t have to worry about whether you timed things just right. Just slow your purchasing when the price starts to look too frothy, and pick up the buying pace after a steep decline.

Will this strategy work 100% of the time? No. The point is to recognize that shifting your mindset is the path to victory, and that it’s something largely in your control.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Alex Carchidi has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.

Cryptocurrency Investing Is a Psychological Game. Here Are the 3 Core Tricks to Winning was originally published by The Motley Fool