CRWD) Vs The Rest Of The Cybersecurity Stocks

As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the cybersecurity industry, including CrowdStrike (NASDAQ:CRWD) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.4%. while next quarter’s revenue guidance was 0.5% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the cybersecurity stocks have fared somewhat better than others, they collectively declined, with share prices falling 3.4% on average since the previous earnings results.

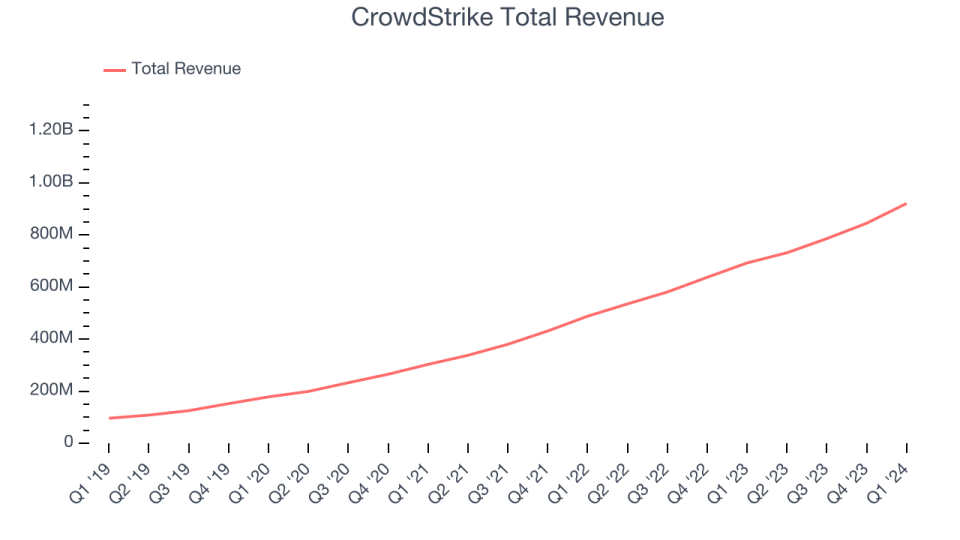

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $921 million, up 33% year on year, topping analysts’ expectations by 1.8%. It was a strong quarter for the company: CrowdStrike narrowly topped analysts’ revenue and ARR (annual recurring revenue) expectations, showing customers continue investing in its products. Looking ahead, it raised its full-year revenue and EPS guidance, which beat Wall Street’s projections.

“CrowdStrike started the fiscal year from a position of momentum and exceptional strength, with net new ARR of $212 million growing 22% year-over-year and ending ARR growing 33% year-over-year to reach $3.65 billion,” said George Kurtz, CrowdStrike’s president, chief executive officer and co-founder.

The stock is up 27.6% since the results and currently trades at $390.

Is now the time to buy CrowdStrike? Access our full analysis of the earnings results here, it’s free.

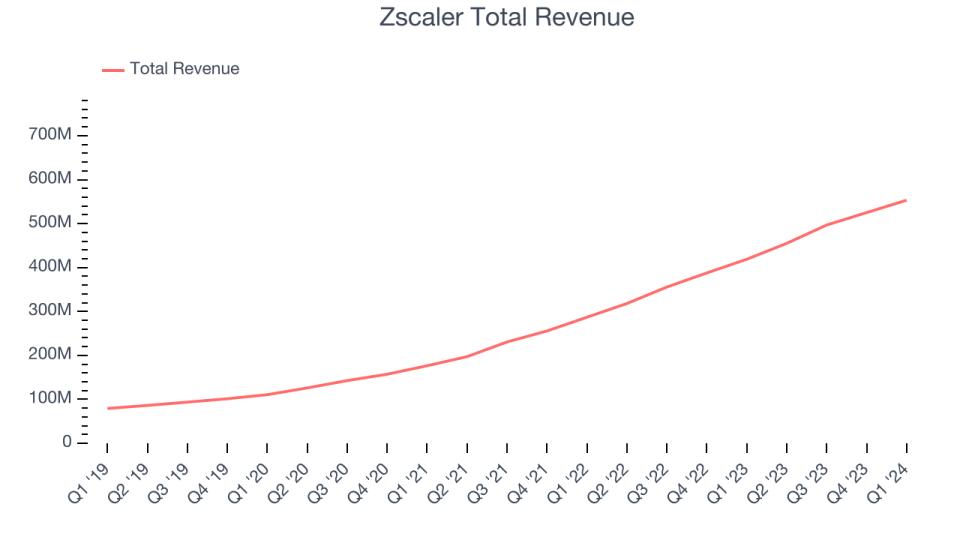

Best Q1: Zscaler (NASDAQ:ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry’s fifth venture, Zscaler (NASDAQ:ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $553.2 million, up 32.1% year on year, outperforming analysts’ expectations by 3.2%. It was a very strong quarter for the company, with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ ARR (annual recurring revenue) estimates.

Zscaler achieved the biggest analyst estimates beat among its peers. The stock is up 15.7% since the results and currently trades at $179.97.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Rapid7 (NASDAQ:RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $205.1 million, up 12% year on year, in line with analysts’ expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and decelerating customer growth.

Rapid7 had the weakest full-year guidance update in the group. The company lost 64 customers and ended up with a total of 11,462. The stock is down 20.7% since the results and currently trades at $36.33.

Read our full analysis of Rapid7’s results here.

Palo Alto Networks (NASDAQ:PANW)

Founded in 2005 by cybersecurity engineer Nir Zuk, Palo Alto Networks (NASDAQ:PANW) makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches, and malware threats.

Palo Alto Networks reported revenues of $1.98 billion, up 15.3% year on year, in line with analysts’ expectations. It was an ok quarter for the company: Revenue beat by a small amount and operating profit as well as EPS beat by more convincing amounts. Billings and revenue guidance for next quarter was roughly in line.

The stock is down 2.2% since the results and currently trades at $316.99.

Read our full, actionable report on Palo Alto Networks here, it’s free.

Qualys (NASDAQ:QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Qualys reported revenues of $145.8 million, up 11.6% year on year, in line with analysts’ expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts’ billings estimates.

Qualys had the weakest performance against analyst estimates among its peers. The stock is down 20.1% since the results and currently trades at $132.78.

Read our full, actionable report on Qualys here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.