Can This Beaten-Down Stock Skyrocket More Than the “Magnificent Seven” Over the Next 5 Years?

The “Magnificent Seven” stocks are the cornerstone of today’s tech market. These stocks, which include Amazon, Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla, have collectively gained thousands of percentages in value over the many years they’ve built up their businesses and powered the global economy.

Are the good days over? Almost definitely not. However, there are other companies that might provide greater opportunities right now. Consider streaming company Roku (NASDAQ: ROKU). Roku stock is still down more than 80% from its highs, and it’s been crushed this year, down almost 30%.

Can Roku skyrocket and outdo the Magnificent Seven over the next five years? Let’s dive in and see.

Is streaming still exploding?

Roku’s business differs in fundamental ways from premium streaming companies like Netflix and Walt Disney. First of all, it makes streaming devices, which is an entire business itself. Roku offers a range of devices that connect TVs to streaming services as well as its own screens. This is its smaller business, accounting for only about 10% to 15% of total sales.

Its main business is selling ad space to advertising clients on its free channels. The premium companies are now moving into this territory, but they still charge a monthly subscription fee even for the ad-supported tier, while Roku is completely free. Roku is the top TV streaming platform by hours streamed in the U.S. even though it’s up against strong competition.

Roku has been feeling the pressure of inflation on its ad business as advertisers curtail their ad budgets. The platform business posted its first quarterly decline since going public last year, but it’s moved beyond that. Platform revenue increased 13% over last year in the fourth quarter, and total revenue increased 14%.

While the premium companies are fighting over paid subscriptions, Roku enjoys a growing account base. Active accounts increased 14% year over year in the 2023 fourth quarter to 80 million, and viewing hours were up 21%. Average revenue per user decreased 4% since advertising dollars didn’t keep up with subscriber growth. These are the numbers that matter to advertisers.

Roku highlighted some important details about streaming trends that work in its favor. According to Nielsen, traditional broadcast TV hours decreased 16% in the fourth quarter. Not only were Roku’s hours up 21%, taking a huge chunk of those hours, but hours on the Roku channel were up 63%. Streaming hours per active account increased from 3.8 to 4.1.

Watching Roku’s channels is as free as watching broadcast TV, but it has the benefits of a broader on-demand content lineup. That’s attractive to viewers who aren’t interested in paying for streaming and only need to invest in one of Roku’s devices to connect.

Can Roku beat the Magnificent Seven?

Considering the big names in the Magnificent Seven, it may be hard to believe that many of their stocks have faced huge declines over the years, wiping out significant amounts of their value. Investors who held on through thick and thin have benefited enormously.

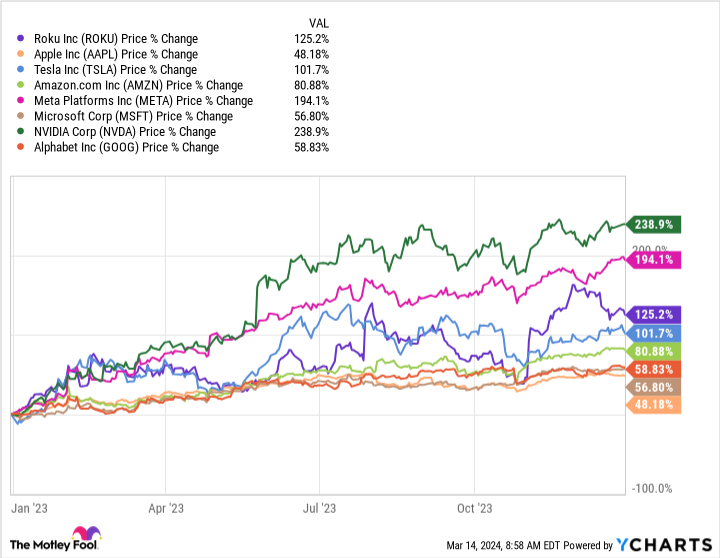

Roku stock was in favor last year, gaining 125% and outperforming five Magnificent Seven stocks.

The Federal Reserve has promised to cut interest rates this year and could be getting started. Inflation hasn’t been moderating as quickly as it seemed, but so far, the cuts are still meant to be coming. If that stimulates the economy, as expected, advertisers should increase their budgets, and Roku is well-positioned to benefit.

It’s not always easy to keep the long-term picture in mind when considering an investment, but Roku’s story looks compelling. It’s holding its own against Amazon’s streaming devices and content as well as the other big names getting into ad-supported streaming, gaining new customers and becoming the go-to choice for free streaming. Streaming continues to increase, and Roku, more than paid streaming networks, is likely to gain viewers switching over from completely free TV viewing over the next five years.

As Roku leverages its strong platform and popular model to gain customers and advertising dollars, it can definitely outperform many of the big tech stocks including the Magnificent Seven over the next five years and longer.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Walt Disney. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Roku, Tesla, and Walt Disney. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Can This Beaten-Down Stock Skyrocket More Than the “Magnificent Seven” Over the Next 5 Years? was originally published by The Motley Fool