Can SoFi Stock Help You Retire a Millionaire?

Financial services is an industry desperate for some innovation. In an age when just about anything can be accomplished online, the idea of going to a brick-and-mortar bank to complete a basic transaction is not appealing.

Fintech businesses that operate at the intersection of technology and finance, such as Stripe, Chime, Plaid, and others, have brought some much-needed disruption to legacy financial services. But investors can only access those companies through special investment vehicles as they are still private.

However, one emerging publicly traded fintech is SoFi Technologies (NASDAQ: SOFI). SoFi went public a few years ago following a merger with a special purpose acquisition company (SPAC) led by billionaire investor Chamath Palihapitiya.

With shares trading at a modest $7, investors might be wondering if SoFi is a lucrative opportunity in the budding fintech realm. Let’s dig into why it’s a unique investment prospect and see if the company has potential to generate returns strong enough to help make you a millionaire.

SoFi’s business model is interesting

SoFi is creating a one-stop shop for members on its platform, with access to a host of online services including student loans, mortgages, and stock market investing. This variety of products under one roof has allowed SoFi to cross-sell to its user base.

This approach is known as a flywheel business model. In theory, by cross-selling at a high rate, SoFi does not need to allocate as many resources to customer acquisition over time. Subsequently, the company can use its capital to double down on additional product innovation, thereby making SoFi a formidable competitor for traditional financial services companies.

But the long-term potential could be enormous

SoFi’s business model might look attractive on the surface, but investors need to understand that this has been costly to create. Over the last several years, the company has completed a number of acquisitions to help build out its platform. These transactions, combined with efforts to amass a large member base, have resulted in staggering operating losses. Until now, that is.

During the fourth quarter, ended Dec. 31, SoFi surprised investors by posting its first-ever profit on the basis of generally accepted accounting principles.

What’s even better is that management told investors that ongoing profitability can be expected through 2026. This is encouraging because it legitimatizes SoFi’s differentiated business model.

With consistent profitability on the horizon, investors might wonder if SoFi has untapped potential capable of producing lucrative returns.

Could SoFi stock make you a millionaire?

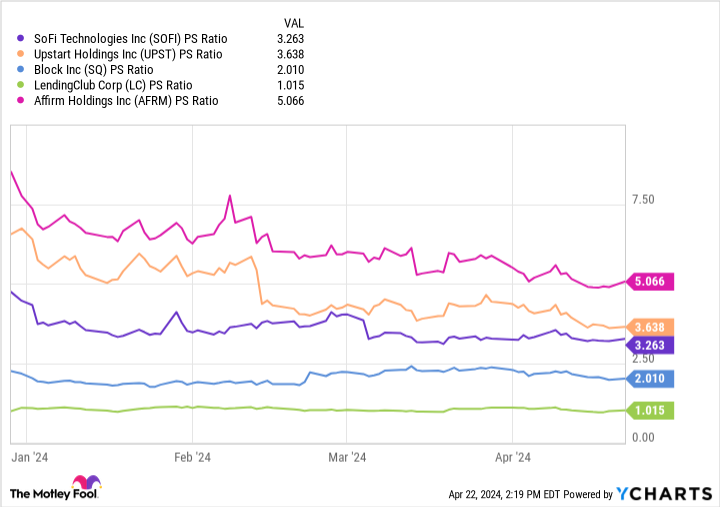

The chart below compares SoFi with peers in fintech on a price-to-sales (P/S) basis. At a P/S of just 3.3, it is in the middle of this cohort.

The important idea for investors is to double down on their winners and hold their highest-conviction positions over the course of many years or even decades.

Take Warren Buffett as an example. The Oracle of Omaha has owned a lot of different stocks over the years. But financial services have consistently remained a top sector for him, with companies like Bank of America, American Express, Visa, and Mastercard representing pillars of the Berkshire Hathaway portfolio.

Investors with a long horizon should consider SoFi’s potential amid a growing fintech sector. The company’s ecosystem of services could make it a future leader as the sector evolves, and I am optimistic that management will make good on its guidance and that steady profits will become more of a staple of its business.

These factors should play a role in SoFi’s growth over time. I think the company’s best days could be ahead, and it has the potential to be a millionaire maker in the long run.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Block and SoFi Technologies. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Block, Mastercard, Upstart, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Can SoFi Stock Help You Retire a Millionaire? was originally published by The Motley Fool