Can iRobot Stock Bounce Back After Crashing 72% This Year?

When Amazon‘s deal to acquire iRobot (NASDAQ: IRBT) fell through earlier this year, it was as if the air was let out of the robot vacuum maker’s stock. Almost in an instant, shares went over a cliff. The company has been struggling to gain traction ever since. Its sales have been declining, the business is struggling to stay out of the red, and cash burn is also a concern.

After all of this, iRobot’s stock is down 72% year to date. However, the company recently brought on a new CEO with experience in leading turnarounds. And at a fairly sizable discount, the stock may appear to be a cheap buy for contrarian investors. Can the stock bounce back this year, and could now be a good time to buy shares of iRobot?

iRobot gets a new CEO with “turnaround experience”

On May 7, iRobot announced that Gary Cohen would be coming on as the company’s new chief executive officer, effective immediately, to help steer its turnaround. With 25 years of experience, including dealing with turnarounds, Cohen has experience helping multiple businesses improve their sales and profits through cost-cutting initiatives, corporate restructuring, and product innovations.

For iRobot, it’s the type of leadership that could help put the company on a much more positive trajectory, as its financial performance has been abysmal in recent years. Sales of $891 million in 2023 have fallen by 38% from 2020, when they topped $1.4 billion. During that time, the company’s bottom line has flipped from a profit of $147 million into a loss of nearly $305 million this past year.

The company faces a tough road ahead

At a time when consumers are facing higher inflation and there’s potentially a recession on the horizon, it won’t be easy for iRobot to get on the right track. Its high-priced robots may find it hard to do well with more competition in the market, and people may be less likely to spend as much as they have in the past.

In iRobot’s most recent quarter, which ended on March 30, its average gross selling price per robot unit was $346 — down from $402 in the same period last year. Even with a lower selling price, revenue totaling $150 million was still down 6% year over year. For 2024, the company expects its revenue to come in between $815 million and $860 million, and it projects a net loss per share of at least $2.23.

And while it did generate positive cash flow from its operations last quarter of $1.4 million, that wouldn’t have been the case if not for a $75 million termination fee which Amazon had to pay the company due to its failed acquisition attempt.

Is iRobot’s stock cheap enough?

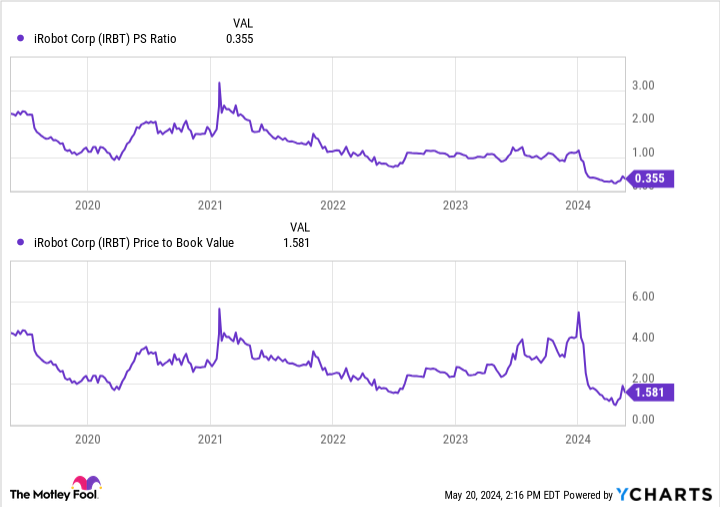

Shares of iRobot are trading at just 0.3 times sales and only 1.5 times book value. These are at far lower levels than what the stock has averaged in the past. It has come off its 52-week lows, but it’s still down 78% from its 52-week high of $51.49.

iRobot stock is trading at a discount, but determining whether it’s a good value will ultimately depend on what the company’s financials look like in the future. And with iRobot in the middle of a turnaround, it’s hard to decipher just how strong the business will end up being.

Should investors take a chance on iRobot stock?

iRobot has turned into a speculative investment, and it’s only suitable for investors with a high risk tolerance. Its sales are crashing, the company is burning through cash, and dilution is a real threat for investors in future quarters.

At the very least, I would wait a few quarters to see how the new CEO is doing and how well the turnaround is going. Unless there’s a drastic improvement in the company’s fundamentals and a reason to be more optimistic about iRobot’s future growth, this is a stock most investors are likely better off avoiding for the time being. While it’s possible for the stock to bounce back if there are signs that the business is going in the right direction, investors would be taking on a big risk by buying the stock right now and assuming that will happen.

Should you invest $1,000 in iRobot right now?

Before you buy stock in iRobot, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iRobot wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and iRobot. The Motley Fool has a disclosure policy.

Can iRobot Stock Bounce Back After Crashing 72% This Year? was originally published by The Motley Fool