Calm returns to Europe as focus shifts toward Fed: Markets Wrap

(Bloomberg) — Calm returned to European markets after a day of tumult when heightened political risks reverberated across assets, with focus turning toward US inflation data and the Federal Reserve’s interest rate decision.

Most Read from Bloomberg

The euro was little changed on Tuesday after hitting a one-month low the day before. The benchmark stock index held steady while French bonds stabilized after yields on the country’s 10-year debt reached their highest level this year on Monday.

French bank Societe Generale SA extended losses following a Reuters report that the lender is struggling to reach a deal to sell its securities services unit.

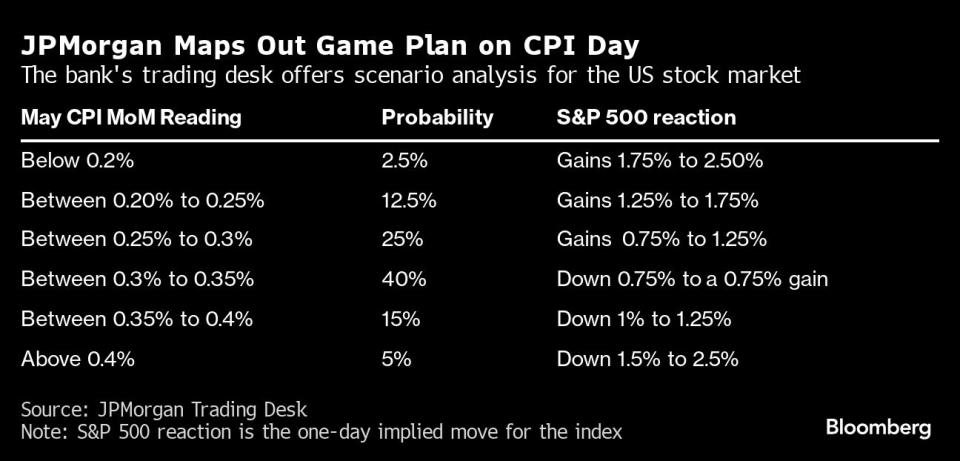

Regional markets were hit Monday by the fallout from the European Parliament election, with French President Emmanuel Macron calling a legislative vote to halt the advance of his far-right rivals. Investors are now preparing for the likelihood of another volatile session Wednesday with both the latest monthly print for US consumer prices and Fed decision due.

While policymakers are widely expected to keep borrowing costs on hold, there’s less certainty on officials’ rate projections. A 41% plurality of economists expect policymakers to signal two cuts in their “dot plot,” while an equal number expect the forecasts to show just one or no cuts at all, according to the median estimate in a Bloomberg survey.

US stock futures contracts held steady while Treasuries rose. The dollar posted small gains.

In Asia, Chinese shares led losses on concerns over the weak property sector and uncertain growth outlook. Shares linked to electric-vehicle makers slumped before the European Commission’s decision of provisional duties expected this week.

Oil held its biggest gain since March ahead of an OPEC report that will provide a snapshot on the market outlook. Gold retreated as traders look to this week’s Fed meeting for more clues on when it may pivot to monetary easing, while iron ore prices slumped to the lowest level in two months.

Key events this week:

-

China PPI, CPI, Wednesday

-

Germany CPI, Wednesday

-

US CPI, Fed rate decision, Wednesday

-

G-7 leaders summit, June 13-15

-

Eurozone industrial production, Thursday

-

US PPI, initial jobless claims, Thursday

-

Tesla annual meeting, Thursday

-

New York Fed President John Williams moderates a discussion with Treasury Secretary Janet Yellen, Thursday

-

Bank of Japan’s monetary policy decision, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

-

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:26 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures fell 0.1%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The MSCI Asia Pacific Index fell 0.5%

-

The MSCI Emerging Markets Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.0764

-

The Japanese yen fell 0.1% to 157.27 per dollar

-

The offshore yuan was little changed at 7.2706 per dollar

-

The British pound fell 0.1% to $1.2717

Cryptocurrencies

-

Bitcoin fell 2.6% to $67,784.13

-

Ether fell 3.6% to $3,538.62

Bonds

-

The yield on 10-year Treasuries declined three basis points to 4.44%

-

Germany’s 10-year yield declined one basis point to 2.66%

-

Britain’s 10-year yield declined three basis points to 4.29%

Commodities

-

Brent crude was little changed

-

Spot gold fell 0.3% to $2,304.48 an ounce

This story was produced with the assistance of Bloomberg Automation.

—With assistance from Aya Wagatsuma and Jason Scott.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.