Cable One (NYSE:CABO) Reports Sales Below Analyst Estimates In Q4 Earnings

Internet, cable TV, and phone provider Cable One (NYSE:CABO) fell short of analysts’ expectations in Q4 FY2023, with revenue down 3.2% year on year to $411.8 million. It made a GAAP profit of $19.39 per share, improving from its loss of $13.38 per share in the same quarter last year.

Is now the time to buy Cable One? Find out by accessing our full research report, it’s free.

Cable One (CABO) Q4 FY2023 Highlights:

-

Revenue: $411.8 million vs analyst estimates of $418.5 million (1.6% miss)

-

Adjusted EBITDA: $226.9 million vs analyst estimates of $229.8 million (1.2% miss)

-

EPS: $19.39 vs analyst estimates of $12.05 (60.9% beat)

-

Free Cash Flow of $36.07 million, down 64.8% from the previous quarter

-

Gross Margin (GAAP): 74.2%, in line with the same quarter last year

-

Residential Data Subscribers: 960,500

-

Market Capitalization: $2.67 billion

“Our return to sequential residential high-speed data customer growth in the fourth quarter, as expected, is very encouraging,” said Julie Laulis, Cable One President and CEO.

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

Cable and Satellite

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

Sales Growth

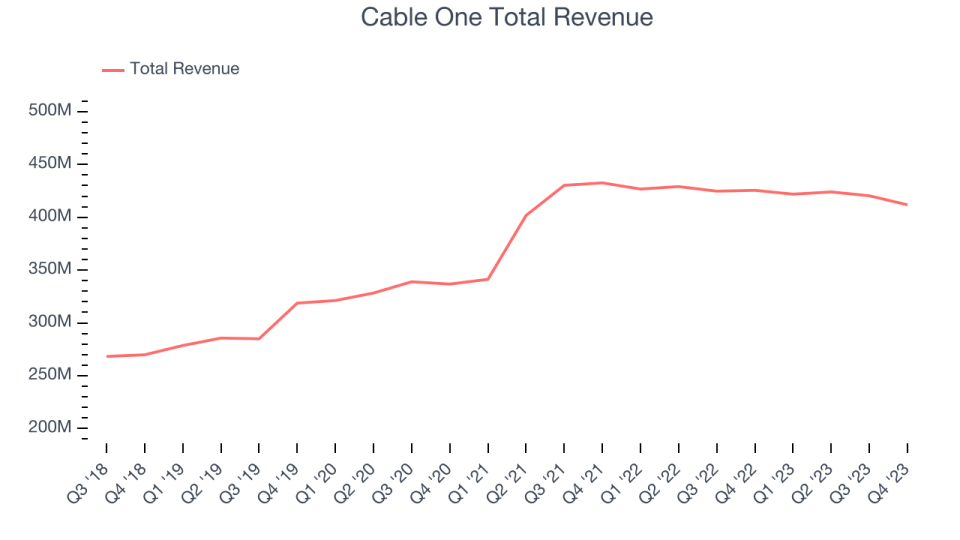

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Cable One’s annualized revenue growth rate of 9.4% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That’s why we also follow short-term performance. Cable One’s recent history shows the business has slowed as its annualized revenue growth of 2.2% over the last two years is below its five-year trend.

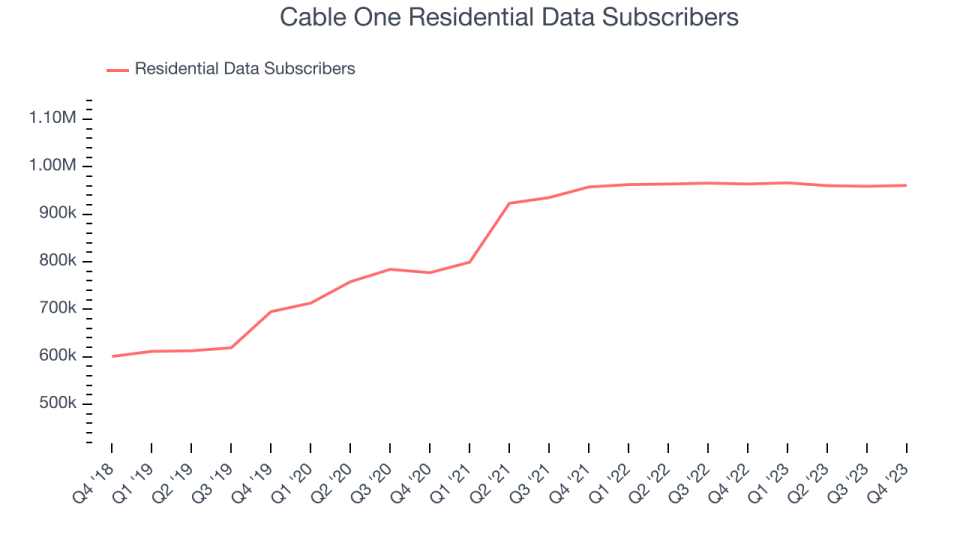

We can dig even further into the company’s revenue dynamics by analyzing its number of residential data subscribers and residential video subscribers, which clocked in at 960,500 and 134,200 in the latest quarter. Over the last two years, Cable One’s residential data subscribers averaged 3.5% year-on-year growth. On the other hand, its residential video subscribers averaged 24.3% year-on-year declines.

This quarter, Cable One missed Wall Street’s estimates and reported a rather uninspiring 3.2% year-on-year revenue decline, generating $411.8 million of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

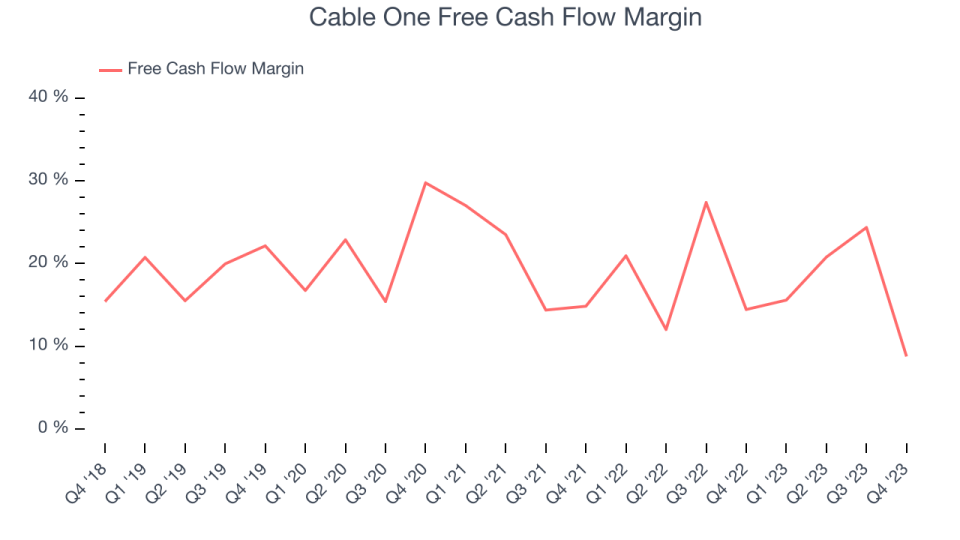

Over the last two years, Cable One has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company’s free cash flow margin has averaged 18%, quite impressive for a consumer discretionary business.

Cable One’s free cash flow came in at $36.07 million in Q4, equivalent to a 8.8% margin and down 41.3% year on year. Over the next year, analysts predict Cable One’s cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 17.4% will increase to 20.6%.

Key Takeaways from Cable One’s Q4 Results

Cable One’s revenue unfortunately missed and its operating margin fell short of Wall Street’s estimates. One bright spot was that the company returned to sequential residential high-speed data customer growth in the fourth quarter. Providing residential customers (homes) with internet is the bread-and-butter of this business. Zooming out, we think this was a mixed quarter. The stock is flat after reporting and currently trades at $478.44 per share.

So should you invest in Cable One right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.