British American Tobacco Jumped Today — Is the Stock a Buy for 2024?

British American Tobacco (NYSE: BTI) stock climbed Thursday after the company published preliminary results for its recently completed fiscal year. The company’s share price closed out the daily session up 6.8%, according to data from S&P Global Market Intelligence.

Sales in the annual period were down 1.3% to 27.3 billion British pounds but would have been up 3.1% on an organic basis assuming constant-currency rates. While revenue for the company’s combustibles segment climbed 0.6% on a constant-currency basis, it was progress outside of the cigarette business that really stood out.

Sales for the company’s new categories segment, which includes vapes, heated-tobacco products, and oral tobacco products, were up 21% on a currency-adjusted basis. The segment also shifted into profitability on a full-year basis, achieving that feat two years ahead of the company’s initial target.

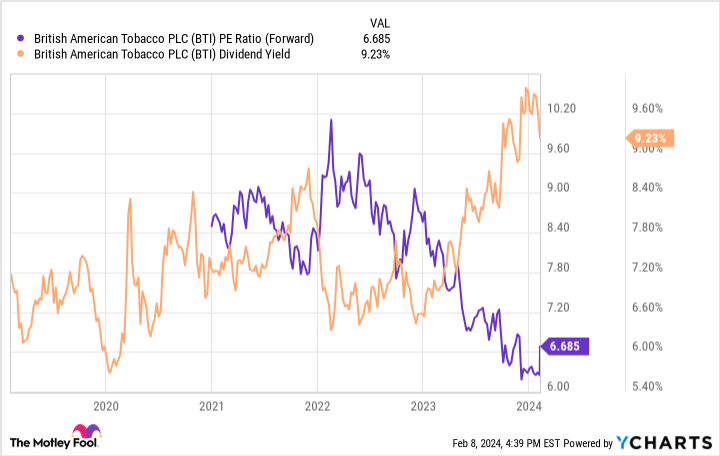

The company also announced that it would be raising its dividend 2%. While that hike comes in below the rate of inflation over the last year, the stock is still yielding roughly 9.2% at today’s prices. Should investors be buying this high-yield dividend stock?

Is British American Tobacco stock a buy right now?

British American Tobacco has set a target for non-combustibles products to account for 50% of its overall revenue by 2035. That goal signals a massive shift in the company’s sales by category, but it looks like the business is making some encouraging progress toward that goal.

With shares at current levels, the big risk here continues to be regulatory uncertainty. Both the combustibles segment and vapes and other alternative products within the new categories segment could face new legislative or judicial roadblocks that meaningfully weaken performance.

On the other hand, some of that risk is already priced in. With the company trading at roughly 6.7 times this year’s expected earnings and paying a large dividend, British American Tobacco stock looks like a powerful passive-income generator trading at a non-prohibitive price.

The proposition isn’t as cut and dried as a quick look at the company’s current income generation and dividend payout would suggest, but the overall value profile appears to be worthwhile. With key impairment charge issues and patent disputes now settled and the business making progress outside of combustibles, the stock still looks cheap.

Should you invest $1,000 in British American Tobacco P.l.c. right now?

Before you buy stock in British American Tobacco P.l.c., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco P.l.c. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco P.l.c. and short January 2026 $40 puts on British American Tobacco P.l.c. The Motley Fool has a disclosure policy.

British American Tobacco Jumped Today — Is the Stock a Buy for 2024? was originally published by The Motley Fool