Boston Beer (NYSE:SAM) Reports Sales Below Analyst Estimates In Q4 Earnings, Stock Drops 10.5%

Beer company Boston Beer (NYSE:SAM) fell short of analysts’ expectations in Q4 FY2023, with revenue down 12% year on year to $393.7 million. It made a GAAP loss of $1.49 per share, down from its loss of $0.92 per share in the same quarter last year.

Is now the time to buy Boston Beer? Find out by accessing our full research report, it’s free.

Boston Beer (SAM) Q4 FY2023 Highlights:

-

Revenue: $393.7 million vs analyst estimates of $413.6 million (4.8% miss)

-

EPS: -$1.49 vs analyst estimates of -$0.23 (-$1.26 miss)

-

Free Cash Flow of $17.44 million, down 85.1% from the previous quarter

-

Gross Margin (GAAP): 37.6%, up from 37% in the same quarter last year

-

Market Capitalization: $4.34 billion

“The investments we made in our brands, marketing mix changes and supply chain enhancements drove improvement in operational and financial performance in 2023 and position us well to further fortify our business in 2024 and beyond,” said President and CEO Dave Burwick.

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Beverages and Alcohol

The beverages and alcohol category encompasses companies engaged in the production, distribution, and sale of refreshments like beer, wine, and spirits, along with soft drinks, juices, and bottled water. These companies’ performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. The industry is highly competitive, with a diverse range of products from large multinational corporations, niche brands, and startups vying for market share. It’s also subject to varying degrees of government regulation and taxation, especially for alcoholic beverages.

Sales Growth

Boston Beer carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Boston Beer can still achieve high growth rates because its revenue base is not yet monstrous.

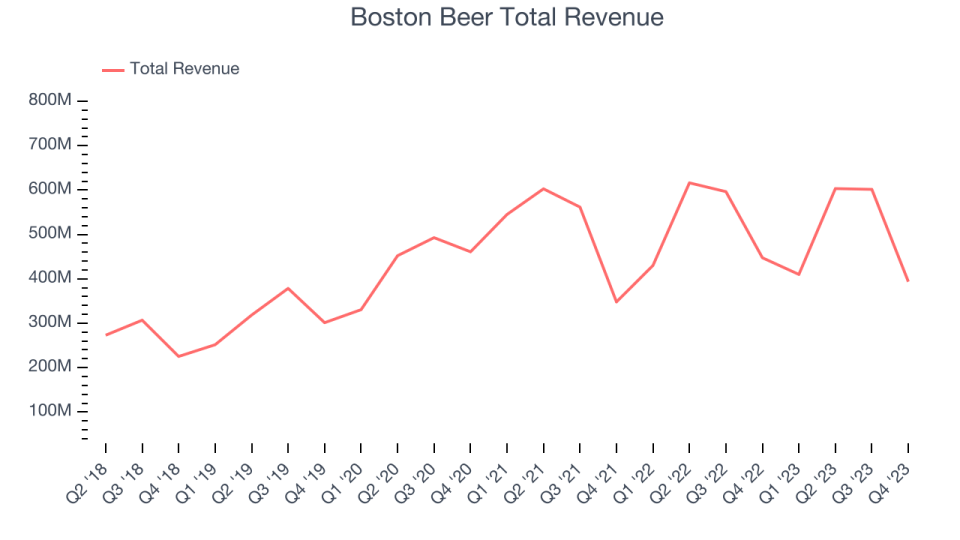

As you can see below, the company’s annualized revenue growth rate of 5% over the last three years was weak for a consumer staples business.

This quarter, Boston Beer missed Wall Street’s estimates and reported a rather uninspiring 12% year-on-year revenue decline, generating $393.7 million in revenue. Looking ahead, Wall Street expects sales to grow 5.4% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

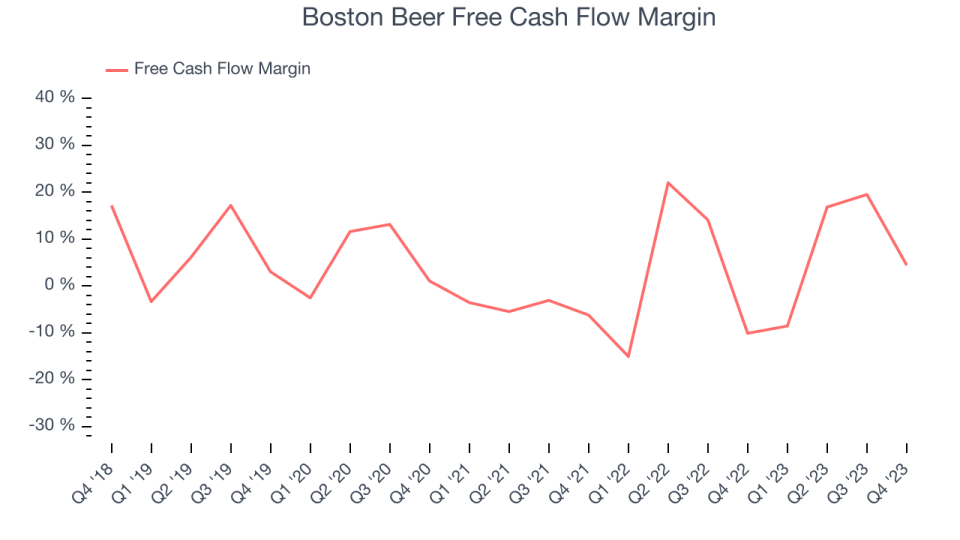

Boston Beer’s free cash flow came in at $17.44 million in Q4, representing a 4.4% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

Over the last eight quarters, Boston Beer has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company’s free cash flow margin has averaged 7.6%, above the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 4.8 percentage points over the last 12 months. This likely pleases the company’s investors.

Key Takeaways from Boston Beer’s Q4 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts’ expectations and its operating margin also missed Wall Street’s estimates. Overall, this was a mediocre quarter for Boston Beer. The company is down 10.5% on the results and currently trades at $331 per share.

Boston Beer may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.