Boeing’s Big News Makes These 2 Stocks a Buy

Boeing (NYSE: BA) recently confirmed it was in discussions to make Spirit AeroSystems (NYSE: SPR) “a part of Boeing again,” after selling the business back in 2005. The news is extremely important, but neither of these companies might be the primary beneficiary. Instead, investors should look to aerospace suppliers like Hexcel (NYSE: HXL) and Carpenter Technology (NYSE: CRS). Here’s why.

Boeing’s production problems

While a deal hasn’t been agreed upon at the time of writing, Boeing’s management said in a press release “the reintegration of Boeing and Spirit AeroSystems’ manufacturing operations would further strengthen aviation safety, improve quality and serve the interests of our customers, employees, and shareholders.”

What wasn’t explicitly mentioned was the critical necessity of enabling Boeing to meet its delivery targets, notably on the 737 MAX program. As previously discussed, Boeing’s medium-term plan is to hit 400 to 450 deliveries of the 737 in 2023 and then hike its monthly production rate on the 737 to 50 a month (implying an annual rate of 600) in the 2025/2026 time frame.

Unfortunately, Boeing is falling behind on those targets by only delivering 396 of the 737 MAX in 2023 and expects to move toward a rate of 38 a month in the second half, subject to Federal Aviation Administration oversight following the passenger door blowout on Alaska Air flight in early 2024.

Why Boeing wants to take back control of Spirit AeroSystems

Unfortunately, Spirit AeroSystems, the manufacturer of fuselages on the 737, is front and center of the manufacturing quality issues that have dogged Boeing over the last year. Its former CEO, Tom Gentile, complained in September that its contracts with Boeing and Airbus were “not sustainable” in the current environment.

In a nutshell, a combination of the supply chain crisis created by the pandemic lockdowns and soaring raw material costs, partly as a result of the conflict in Ukraine, has led to severe financial pressure on suppliers. In turn, that’s put stress on production rates at Boeing and Airbus.

Gentile resigned in October and was promptly replaced by Boeing veteran Pat Shanahan, with Boeing moving to sign a memorandum of agreement (MoA) with Spirit to help ensure the production of fuselages.

Whether it’s a financially supportive MoA with Spirit, an acquisition of the company, or any other form of agreement, one thing is clear: Boeing needs fuselages from Spirit, and it needs to resolve manufacturing quality issues on them to get back on track with its 2025/2026 delivery targets.

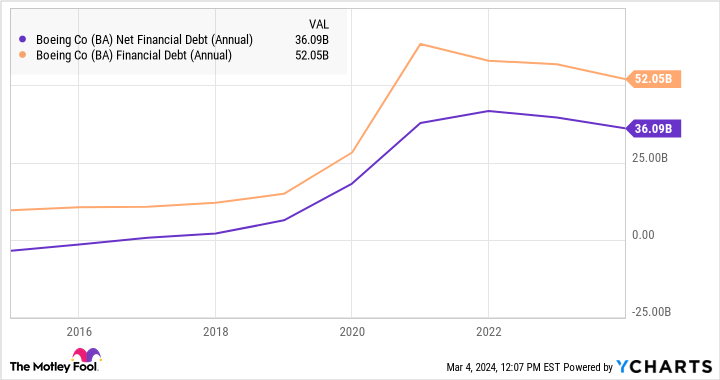

Given Boeing’s debt situation, this isn’t precisely what Boeing shareholders had in mind for 2024, but derisking its delivery aims is necessary.

Hexcel

While Boeing is likely to face more financial pressure and operational complexity due to a deal, it has little choice. That might not be an ideal scenario for Boeing. Still, it is good news for aerospace suppliers who need an increase in production to sell their solutions to original equipment manufacturers (OEM) on Boeing programs.

Advanced composite company Hexcel is one example. Advanced composites offer weight and strength advantages over traditional materials that tend to more than offset their additional costs in terms of long-term productivity gains.

There’s very little aftermarket demand for its products, so it needs airplane manufacturers to ramp up production. Its composites are the industry’s future, and its content per plane tends to increase with the launch of any updated model. As such, Hexcel stands to benefit from both an increase in production and the development of new models using more composite technology.

Carpenter Technology

Another example comes from an aerospace supplier like Carpenter Technology, which makes engine parts, fasteners, and structural and avionics parts. Unlike Hexcel, Carpenter also has a significant maintenance, repair, and operations (MRO) business, meaning it also profits from increased flight departures as airplanes will need more servicing.

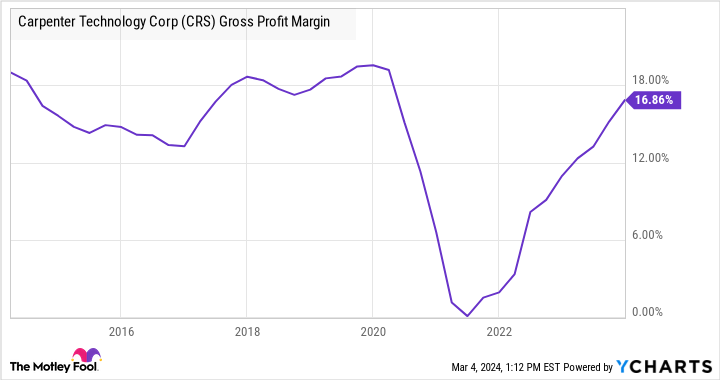

Given its relatively high fixed costs, Carpenter’s margins can expand dramatically with increasing revenue, and a derisking of airplane manufacturers’ production expansion plans is a significant benefit to the company. It’s already on track to increase its profit margin as the aerospace recovery continues, and the latest news from Boeing is a plus for the company.

Stocks to buy

The big news from Boeing is more of a plus for aerospace suppliers like Hexcel and Carpenter Technology, who rely on Boeing to bolster production, than it is for Boeing itself. Meanwhile, the massive jump in Spirit AeroSystems’ share price might indicate you have missed the boat if you were not in the stock before the news was announced.

Should you invest $1,000 in Boeing right now?

Before you buy stock in Boeing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Boeing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Alaska Air Group and Hexcel. The Motley Fool has a disclosure policy.

Boeing’s Big News Makes These 2 Stocks a Buy was originally published by The Motley Fool