BJ’s (NYSE:BJ) Reports Sales Below Analyst Estimates In Q4 Earnings

Membership-only discount retailer BJ’s Wholesale Club (NYSE:BJ) fell short of analysts’ expectations in Q4 FY2023, with revenue up 8.7% year on year to $5.36 billion. It made a non-GAAP profit of $1.11 per share, improving from its profit of $1 per share in the same quarter last year.

Is now the time to buy BJ’s? Find out by accessing our full research report, it’s free.

BJ’s (BJ) Q4 FY2023 Highlights:

-

Revenue: $5.36 billion vs analyst estimates of $5.40 billion (0.7% miss)

-

EPS (non-GAAP): $1.11 vs analyst estimates of $1.06 (4.6% beat)

-

EPS (non-GAAP) guidance for 2024 of $3.88 below analyst estimates of $3.99

-

Free Cash Flow of $155.2 million, up 83.2% from the same quarter last year

-

Gross Margin (GAAP): 18%, down from 18.3% in the same quarter last year

-

Same-Store Sales were up 0.5% year on year

-

Store Locations: 244 at quarter end, increasing by 9 over the last 12 months

-

Market Capitalization: $9.62 billion

“We ended fiscal 2023 on a strong note,” said Bob Eddy, Chairman and Chief Executive Officer, BJ’s Wholesale Club.

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE:BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Sales Growth

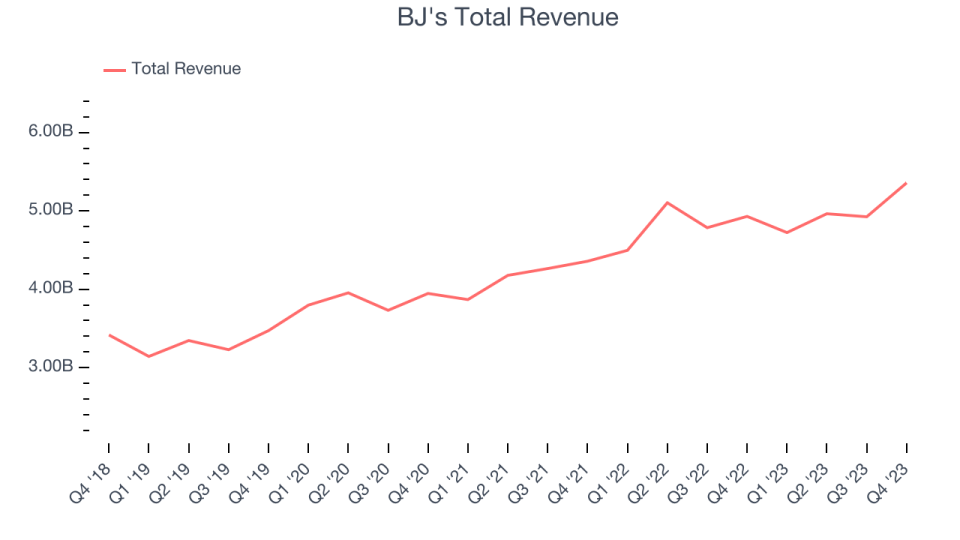

BJ’s is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

As you can see below, the company’s annualized revenue growth rate of 10.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and grew sales at existing, established stores.

This quarter, BJ’s revenue grew 8.7% year on year to $5.36 billion, missing Wall Street’s expectations. Looking ahead, Wall Street expects sales to grow 2.8% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

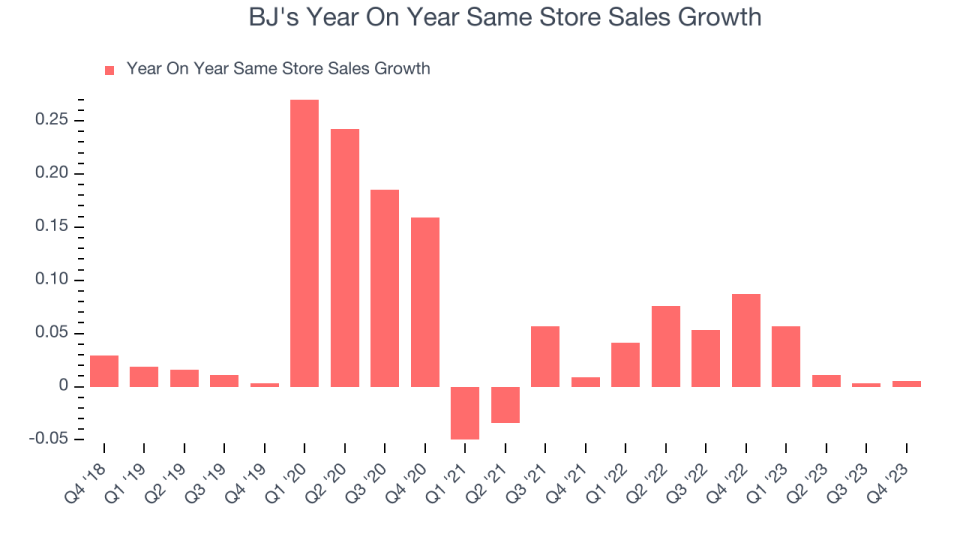

Same-Store Sales

A company’s same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

BJ’s demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company’s same-store sales have grown by 4.2% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, BJ’s is reaching more customers and growing sales.

In the latest quarter, BJ’s year on year same-store sales were flat. By the company’s standards, this growth was a meaningful deceleration from the 8.7% year-on-year increase it posted 12 months ago. We’ll be watching BJ’s closely to see if it can reaccelerate growth.

Key Takeaways from BJ’s Q4 Results

It was encouraging to see BJ’s slightly top analysts’ EPS expectations this quarter. On the other hand, its full-year earnings forecast missed analysts’ expectations. Overall, the results could have been better, but the market seems to be shrugging off the negatives. The stock is up 2.5% after reporting and currently trades at $74.14 per share.

So should you invest in BJ’s right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.