Bitcoin Stable Above $64K While ETF Outflows Hit $200M

Bitcoin {{BTC}} is trading above $64K in the early afternoon of East Asia’s trading day, even as outflows from bitcoin exchange-traded funds (ETFs) pick up significantly.

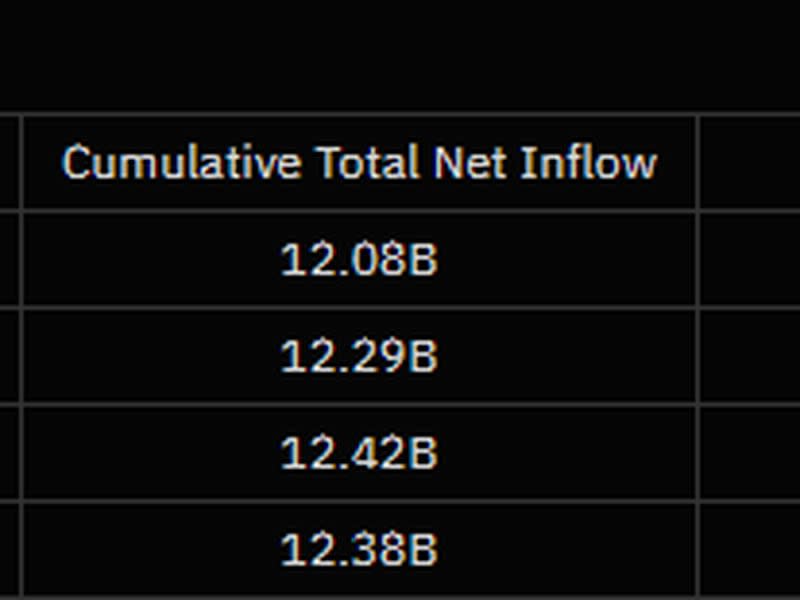

Market data shows that the U.S.-listed ETFs had a daily total net outflow of $217 million. This brings the total outflow so far this week to $244.49 million.

In comparison, bitcoin is up around 3.7% in the last week.

According to JPMorgan, the correlation between bitcoin ETF prices and inflows has weakened, dropping from a high of 0.84 in January to 0.60 in recent assessments. This indicates a decrease in the alignment between BTC prices and spot ETF flows, CoinDesk reported in February.

Given its size, the outflow from Grayscale’s converted bitcoin ETF (GBTC) is of particular interest to traders. Data from SoSoValue shows that since Monday, GBTC has experienced an outflow of $417 million during the last week—yet BTC prices still increased in the face of it.

Liquidation data is also fairly flat, according to GoinGlass, with $60 million in liquidations in the last 24 hours. Of this $60 million, BTC made up $13.48 million worth, and $6.17 million longs were liquidated against roughly $7 million in shorts.

Meanwhile, the CoinDesk 20 (CD20), a measure of the largest digital assets, is flat, trading at 2,246.