Bitcoin breaks $50,000 for the 1st time in over 2 years due to ETFs, Fed cuts, and the upcoming halving

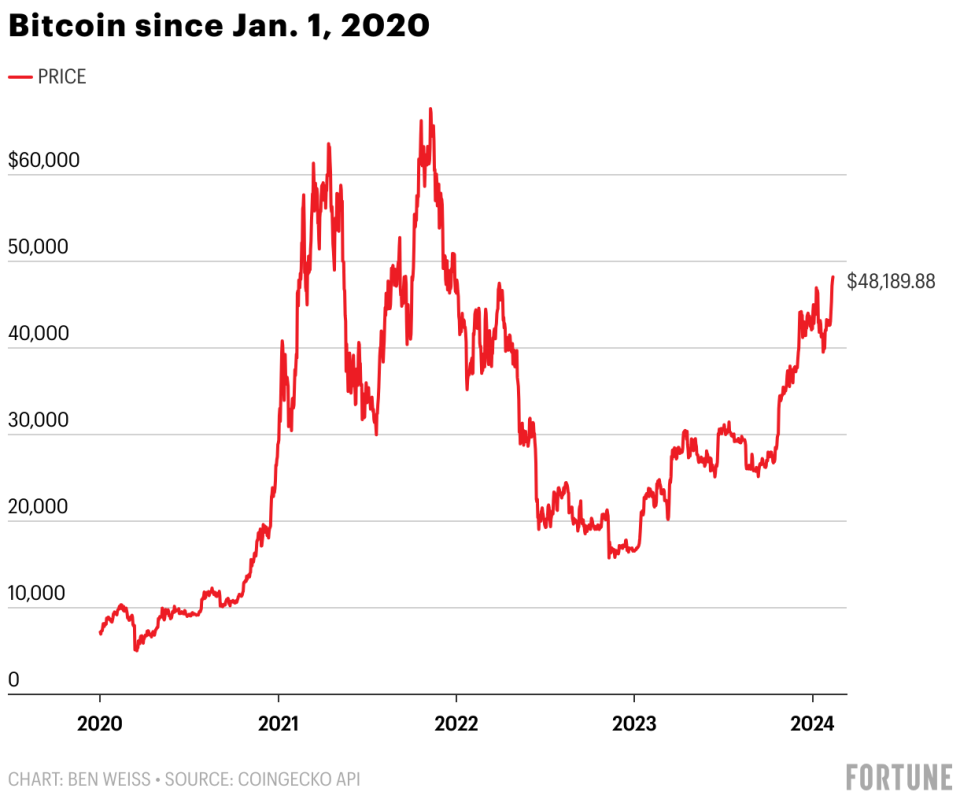

Bitcoin topped $50,000 on Monday for the first time since December 2021, according to CoinGecko data, suggesting confidence in the digital currency is growing after a turbulent two years of scandals and bankruptcies.

Thanks to inflows into exchange-traded funds, speculation of future monetary easing, and the upcoming halving, “tailwinds for digital assets are the strongest they’ve been in quite some time,” Christopher Newhouse, a DeFi analyst at Cumberland Labs, told Fortune.

BTC plunged 64% in 2022, reaching lows of $16,000, owing in part to the implosion of FTX. But over the past 12 months, it has increased approximately 129%—although the price remains below the all-time high of almost $69,000 reached in November 2021.

When the Securities and Exchange Commission approved 10 spot Bitcoin ETFs on Jan. 11, retail and institutional investors gained exposure to BTC without the need to hold the underlying asset. The merging of traditional finance with digital assets, with firms like BlackRock and Fidelity launching funds, has been hailed as watershed moment for crypto.

But despite anticipation that new retail and institutional investors would turbocharge a bull market, BTC initially looked volatile.

The underwhelming impact of the SEC’s approval on BTC prices was largely caused by outflows of over $6 billion from the decade-old Grayscale Bitcoin Trust, which had operated as a closed-end trust, previously locking in investors who are now free to liquidate, according to Bloomberg. The GBTC exodus helped push prices down to $39,505, with BTC falling approximately 15% from the approval date.

But it’s now clear that outflows are slowing, and the price is catching back up. In the first few weeks of trading, daily outflows averaged $500 million, but they’ve been steadily declining since Jan. 26. On Friday, outflows totaled just $51.8 million, according to Bloomberg data, the lowest since the approvals.

Meanwhile, inflows into the other nine ETFs have been accelerating: Last week, the cumulative net inflow was approximately $1.2 billion—almost half of the total so far.

“This strong buying-spot pressure is driving the price up, and that’s the main driver of the recent growth,” Matteo Greco, a research analyst at investment firm Fineqia International, told Fortune.

If the ETF inflows continue at this pace, gaining roughly $1 billion per week, “Bitcoin will go up every day,” said Geoff Kendrick, Standard Chartered’s head of digital assets research.

On top of this, the Federal Reserve has indicated that interest rates will be cut in the spring, which “provides another tailwind for Bitcoin prices,” Markus Thielen of 10x Research told Fortune. During periods of high interest rates, riskier assets like Bitcoin, which are highly liquid and more volatile, tend to be less attractive.

Meanwhile, Dave Nadig, recently VettaFi’s financial futurist, attributes growth to baked-in optimism ahead of April’s halving, where the financial reward miners receive halves, thereby cutting supply, as smaller miners are forced out of the market.

“The halving gives a reason for everybody to be paying attention to Bitcoin,” he told Fortune. “There is a mechanical reason that we should expect the number to go up, which is that the supply is going offline.”

Indeed, a bull market has followed each of the previous four halving events. When the first took place in November 2012, the price of BTC was around $12. One year later, it had risen to over $1,000. BTC was at $8,755 at the time of the most recent halving in May 2020 before its mad rush toward $69,000 the following year.

This story was originally featured on Fortune.com