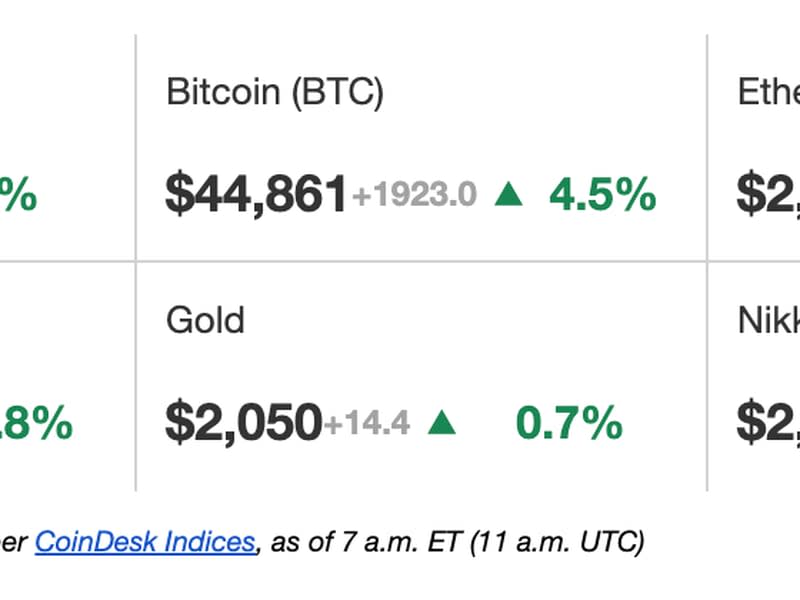

Bitcoin Approaches $45K; Crypto Trading Volumes Rise

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin rallied to a four-week high approaching $45,000 on Thursday amid record highs in U.S. equity indexes. Bitcoin, which fell as low as $42,700 on Wednesday, climbed almost 5% to $44,800, the highest since Jan. 11, according to CoinDesk data. “Technically speaking, bitcoin has broken out of a range and could be looking for a push to a fresh yearly high through $50,000,” said LMAX Digital in a morning note. According to Laurent Kssis, a crypto ETP specialist at CEC Capital: “This pump is driven by leverage, i.e the open interest on BTC contracts has increased by $982 million in less than 24 hours.” Kssis said he remains cautious, and the $40,000 level could be tested over the weekend. “But overall liquidation indicates a further small appreciation for BTC which will break the key 45k support barrier.” Ether also gained, adding 3% to a two-week high after asset managers Ark Invest and 21Shares amended their joint spot ETH exchange-traded fund (ETF) filing. The CoinDesk 20 rose 4%.

Spot trading volume across centralized crypto exchanges rose for the fourth consecutive month in January, climbing to a level last seen in June 2022 as the approval of bitcoin ETFs sparked renewed interest in digital assets. Volume increased 4.45% from December to $1.40 trillion, according to CCData. The price of bitcoin (BTC) surged going into the Jan. 10 ETF approval but mostly fell after that. “The price action following the highly anticipated approval suggests that the sell-off marked the end of an uptrend that had persisted for months,” said CCData. Binance remains the largest cryptocurrency exchange by trading volume, with volume rising 2.73% in January to $473 billion. It holds a market share of 31.3% but did see its spot share gradually decline over 2023 as the company faced an array of charges from regulators that eventually forced founder and CEO Changpeng “CZ” Zhao to step down.

There is evidence the Blackrock (BLK) and Fidelity spot bitcoin (BTC) exchange-traded funds (ETFs) already have an advantage over Grayscale when it comes to certain liquidity metrics linked to market breadth, JPMorgan (JPM) said in a research report Wednesday. Even though outflows from Grayscale’s GBTC slowed in the fourth week following approval by the U.S. Securities and Exchange Commission (SEC), the fund is expected to lose out to the newly created ETFs, and in particular to the Blackrock and Fidelity products, if it doesn’t make a meaningful cut to its fees, the report said. Grayscale charges the most among spot bitcoin ETF issuers. It dropped its 2% management fee to 1.5% as part of its conversion to a spot bitcoin ETF, but is still much more expensive than rival offerings.