Billionaires Can’t Stop Buying These 3 Energy Stocks. Should You Join Them?

It is always interesting to watch how billionaires are investing their money. They have a knack for enriching themselves and other investors. Because of that, following their stock market moves can prove to be profitable.

Several billionaire investors are currently betting big on energy stocks. Chevron (NYSE: CVX), ExxonMobil (NYSE: XOM), and Western Midstream (NYSE: WES) stand out to a few Fool.com contributors because billionaires are buying their stock. Here’s a look at whether they think others should follow them and buy these energy stocks.

Why Buffett mainstay Chevron should be in your portfolio

Reuben Gregg Brewer (Chevron): Warren Buffett added to his position in Chevron in 2023. While we can’t know for sure what he was thinking when he decided to buy more of the stock, there are some clear reasons why you should like the energy giant.

As an integrated energy major, Chevron provides broad exposure to the sector, with operations in the upstream (drilling), midstream (pipelines), and downstream (chemicals and refining) segments. This provides balance through the often volatile energy cycle. It also has a globally diversified portfolio, which allows management to direct investment to where it will likely have the most benefit.

These facts alone, however, don’t separate Chevron from its integrated energy peers. A 38-year history of annual dividend increases is an important point of difference. European peers simply don’t match up on the dividend front.

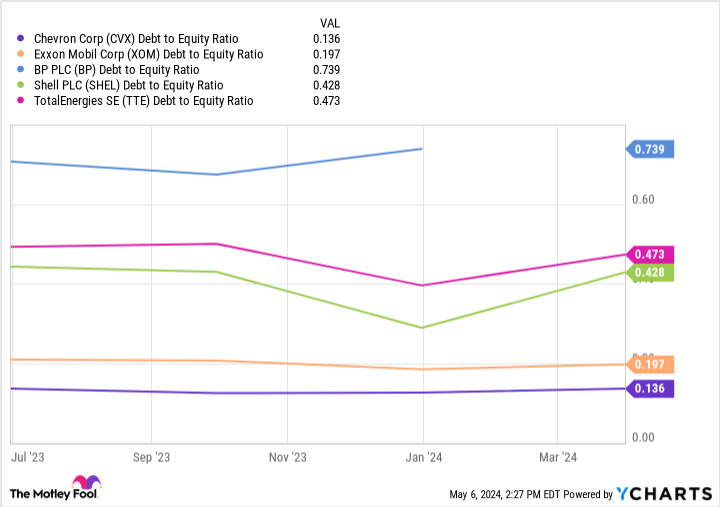

Exxon has a longer dividend streak, however, which is where Chevron’s balance sheet comes into play. Chevron’s debt-to-equity ratio is roughly 0.14 times, lower than any of its peers, including Exxon, which has a ratio of roughly 0.20 times.

If you are a conservative dividend investor, this is important because it means that Chevron has the most leeway on its balance sheet to take on debt during the energy industry’s inevitable downturns. That means it can more easily support its business and dividend when times are tough, a tactic it has used many times before.

Now add in the 4% dividend yield, which is well above Exxon’s 3.3%. All in, if you are looking for energy exposure, an attractive yield, and as much safety as you can get in an oil stock, Buffett’s Chevron pick looks like a long-term winner.

Buying Exxon is a smart move

Neha Chamaria (ExxonMobil): Billionaire Ray Dalio is one of the world’s most revered investors. Rightfully so — Dalio is the founder of the world’s largest hedge fund, Bridgewater Associates, with more than $120 billion of assets under management. Dalio is a strong advocate of diversification, but there’s one particular stock he recently bought hand over fist — oil and gas giant ExxonMobil.

According to Bridgewater Associates’ last filed quarterly report, it added shares to more than 200 holdings in its portfolio in the fourth quarter of 2023. ExxonMobil was its largest buy — the fund added nearly 214,000 shares of the oil and gas producer during the period.

Here’s the real deal: Bridgewater Associates barely held 3,500 shares in ExxonMobil in the previous quarter, which means it upped its share count in the oil and gas stock by a whopping 5,986% in Q4.

Dalio perhaps saw value in ExxonMobil after the stock lost nearly 15% of its value in just the last quarter of 2023. With oil prices rebounding this year, the oil and gas stock has bounced back too, gaining nearly a little over 15% so far this year, as of this writing. As one of the largest oil and gas companies in the world, ExxonMobil is among the top oil stocks to bet on when oil prices are rising.

There’s a lot to like about ExxonMobil. It has a solid balance sheet, has increased its dividend every year for 41 consecutive years now, and has just acquired Pioneer Natural Resources to double its footprint in the Permian Basin.

ExxonMobil believes its upstream earnings could more than double by 2027 versus 2019 and boost its cash flows significantly over the next four years. That should also mean bigger dividends for investors. So while no investor should follow a billionaire investor’s stock moves blindly, you’d want to join Dalio when it comes to ExxonMobil.

A monster yield

Matt DiLallo (Western Midstream): Bill Gross has been pounding the table for pipeline master limited partnerships (MLPs) over the past few months. While he owns several, Western Midstream is his favorite. The billionaire bond investor recently called it the “best of the bunch” in a post on X. He loves its high distribution yield, which is nearly 10%. Gross also highlighted that the yield is tax-deferred, making it an even more attractive investment.

Western Midstream has ramped up its distribution payments this year following a recent portfolio reshuffling. Last year, the company expanded its Powder River Basin footprint by acquiring Meritage Midstream in an $885 million deal. The highly accretive transaction enabled the company to boost its payout by $0.05 per unit. This year, the company sold $790 million of noncore assets. It intends to recycle those proceeds back into its core position and repay debt.

With its leverage ratio approaching its long-term goal of 3 times, Western Midstream has more financial flexibility. That’s empowering it to increase its distribution even more this year. It’s targeting to pay at least $3.20 per unit, though its most recent payout level implies a $3.50 per unit payout. That’s a 52% increase from its prior annual rate of $2.30 per unit.

Western Midstream offers a nearly 10% distribution yield at that level, making it a highly attractive option for those seeking passive income. Further, as Gross noted, the income is largely tax-deferred, which is one of the benefits of investing in MLPs.

However, MLPs have their drawbacks. They send investors a Schedule K-1 to file their taxes each year, which can complicate things. Because of that, investors need to fully understand the tax implications of investing in MLPs before joining Bill Gross and buying Western Midstream.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Matt DiLallo has positions in Chevron. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in TotalEnergies. The Motley Fool has positions in and recommends BP and Chevron. The Motley Fool has a disclosure policy.

Billionaires Can’t Stop Buying These 3 Energy Stocks. Should You Join Them? was originally published by The Motley Fool