Better Artificial Intelligence Stock: Nvidia vs. SoundHound AI

Nvidia (NASDAQ: NVDA) and SoundHound AI (NASDAQ: SOUN) have set the stock market on fire this year with stunning gains so far, though a closer look at the trajectory of the shares of these two companies shows us that their spikes can be attributed to different reasons.

Nvidia’s 90% gains in 2024 are a result of the company’s outstanding top- and bottom-line growth, driven by the hot demand for its graphics processing units (GPUs) and processors for powering artificial intelligence (AI) servers.

SoundHound AI, on the other hand, sprang into the limelight in February this year when it was revealed that Nvidia holds a stake in the company. SoundHound stock subsequently jumped a stunning 347% in February.

SoundHound AI has been delivering healthy growth thanks to the increasing deployment of its AI voice-recognition technology across multiple industries, including automaking and restaurants. But the Nvidia investment brought the stock under greater scrutiny, and a weaker-than-expected earnings report for the fourth quarter of 2023 sent its shares packing in March.

So, even though SoundHound shares are up 158% in 2024, they are down more than 38% from mid-March. But is this pullback an opportunity for investors to buy the stock? Or should they prefer Nvidia to profit from the AI boom? Let’s find out.

The case for SoundHound AI

May has turned out to be a terrific month for SoundHound AI as the stock seems to have regained its mojo.

First-quarter 2024 results, which were released on May 9, have boosted investor confidence once again. The stock shot up thanks to a 73% year-over-year increase in revenue to $11.6 million.

The adjusted net loss was down by a penny to $0.07 per share. SoundHound increased the midpoint of its 2024 revenue guidance to $71 million from the earlier estimate of $70 million.

The updated revenue guidance would translate into a 55% year-over-year increase. For comparison, SoundHound’s top line increased 47% in 2023, which means that the company’s growth is set to accelerate this year. And management expects to exceed $100 million in revenue in 2025, meaning that it aims to deliver 40%-plus revenue growth next year as well.

The reason SoundHound is so confident in the future is because of an improving potential revenue pipeline and partnerships with big players such as Nvidia and the automaker Stellantis. In March this year, the company said that its generative AI voice assistant, SoundHound Chat AI, is on Nvidia’s Drive automotive platform. And Stellantis has already started integrating SoundHound AI’s voice-recognition assistance into its vehicles.

Quick-service restaurants have been adopting this technology as well for taking food orders. In all, SoundHound sees a total addressable market worth $140 billion for voice-recognition AI across multiple end markets, so there is a good chance it could continue to grow at a healthy pace in the long run and remain a top AI stock.

The case for Nvidia

With an estimated 98% share of the market for data center GPUs, Nvidia gives investors a terrific way to capitalize on the booming demand for AI infrastructure. Training large language models and deploying technology that SoundHound and others are offering wouldn’t have been possible without the computational power of Nvidia’s chips.

Nvidia enjoys a technological advantage over rival chipmakers trying to enter the AI chip market, and the company is expected to maintain its dominance with the launch of new chips later this year. That’s why Nvidia is expected to keep growing faster than SoundHound.

Revenue in fiscal 2024 (which ended in January this year) was up 126% year over year to $60.9 billion, well ahead of the growth that SoundHound AI delivered last year.

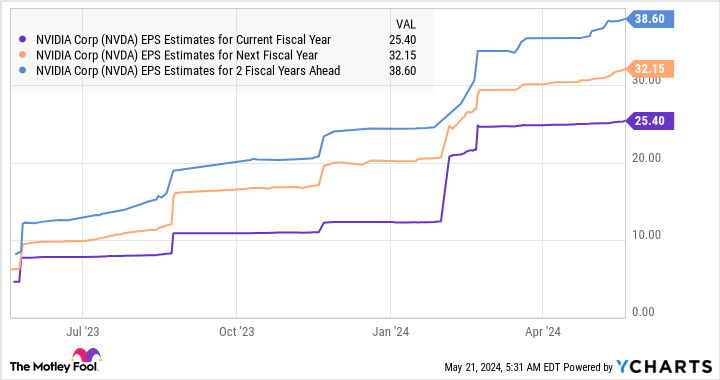

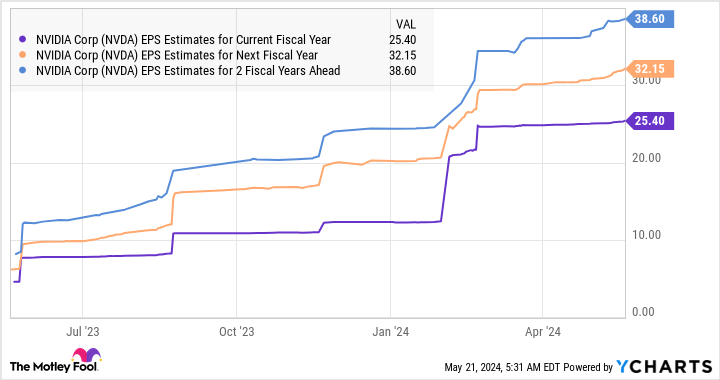

Nvidia’s adjusted earnings jumped 288% year over year to $12.96 per share. SoundHound reported a loss of $0.40 per share for 2023 and isn’t expected to turn profitable any time soon. Nvidia’s earnings are expected to keep heading higher over the next couple of years.

Nvidia’s stronger earnings power, its impressive market share, and the AI chip market — which is expected to grow 38% annually through 2032 and generate $372 billion in annual revenue — indicate that it can sustain its healthy growth for a long time. Meanwhile, SoundHound AI is expected to run into competition from well-heeled tech giants as well as the likes of OpenAI.

Potential SoundHound investors should note that it is a very small company right now, while Nvidia is an established corporation with a wide moat in AI chips. That’s why the latter looks like the safer AI play right now, especially considering the valuation of the two stocks.

The verdict

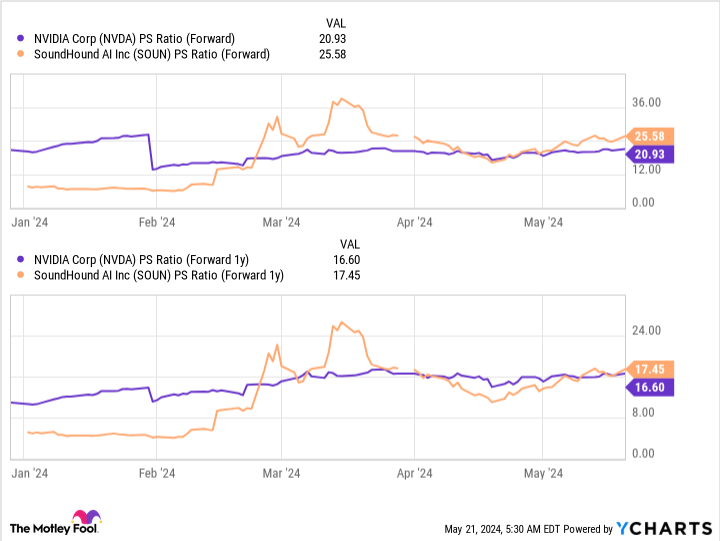

Nvidia’s price-to-sales (P/S) ratio of 39 makes the stock more expensive than SoundHound’s shares, which trade at 27 times sales. The chipmaker’s richer valuation is justified considering its faster growth, fast-improving bottom line, and near-monopoly in AI chips, so it’s the cheaper of the two if we take a look at their forward sales multiples.

All this indicates that Nvidia is the better AI stock to buy, and investors should have an easy choice considering the points discussed above. Nvidia’s higher price-to-sales ratio is justified by its faster growth and strong market position in AI chips. Thus, despite its higher valuation, Nvidia appears to be the safer and more promising AI investment.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Better Artificial Intelligence Stock: Nvidia vs. SoundHound AI was originally published by The Motley Fool