Bearish Trendline Threatening Chinese E-Tail Stock

U.S.-listed shares of China-based e-tailer Alibaba Group Holding Ltd (NYSE:BABA) are 0.8% lower at $72.80 at last glance, following news that the company bought back shares worth $4.8 billion — its second largest repurchase ever. BABA is underperforming in 2024, down 6.1% year to date, and a historically bearish signal is flashing that could keep headwinds blowing.

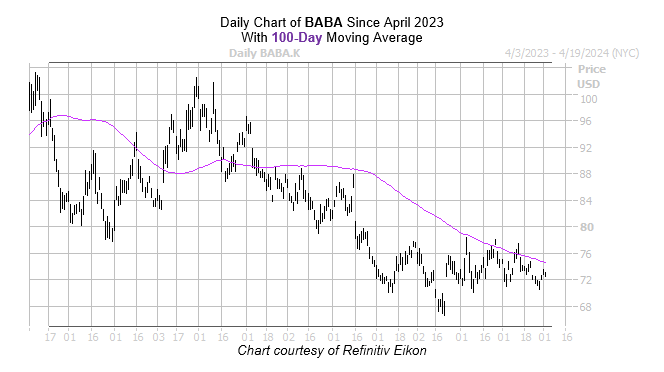

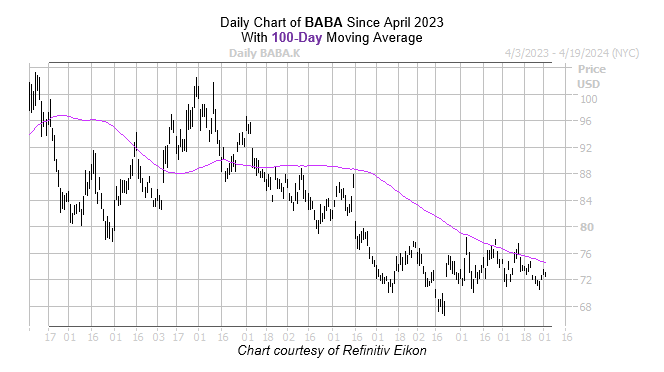

Specifically, Alibaba stock just pulled back within one standard deviation of its 100-day moving average after mostly trading above the trendline since August. According to a study from Schaeffer’s Senior Quantitative Analyst Rocky White, eight other similar instances occurred in the last three years. After 75% of these occurrences, the equity suffered a drop one month later, averaging a 9.8% loss.

A similar move from its current perch would put BABA near the $65.70 level, surpassing its year-to-date lows and moving to its lowest mark since November 2022. What’s more, it would extend the stock’s already steep 26% year-over-year deficit.

Sentiment surrounding Alibaba stock is already quite bullish. Of the 15 covering analysts, 12 rate the shares a “strong buy.” Plus, short interest dropped 7.4% in the last reporting period.

Now might be the perfect time to speculate on BABA’s next move with options. The stock’s Schaeffer’s Volatility Index (SVI) of 29% sits in the low 8th percentile of its annual range. In other words, options players are pricing in lower-than-usual volatility expectations at the moment.