BARK) In The Context Of Other Toys and Electronics Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the toys and electronics stocks, including Bark (NYSE:BARK) and its peers.

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

The 6 toys and electronics stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 0.8%. while next quarter’s revenue guidance was 3.3% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and toys and electronics stocks have held roughly steady amidst all this, with share prices up 0.8% on average since the previous earnings results.

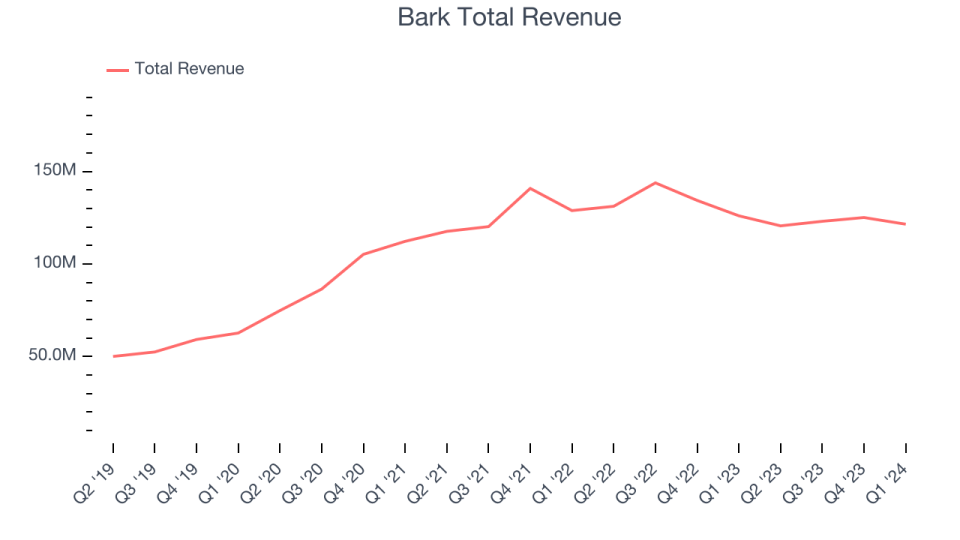

Weakest Q1: Bark (NYSE:BARK)

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

Bark reported revenues of $121.5 million, down 3.6% year on year, falling short of analysts’ expectations by 0.8%. It was a weak quarter for the company, with a miss of analysts’ operating margin estimates and revenue guidance for next quarter missing analysts’ expectations.

“Fiscal 2024 was a significant year for BARK in that we capped it off with another strong quarter, and we’re building momentum entering fiscal 2025,” said Matt Meeker, Chief Executive Officer of BARK.

Bark delivered the weakest full-year guidance update of the whole group. The stock is down 0% since the results and currently trades at $1.42.

Read our full report on Bark here, it’s free.

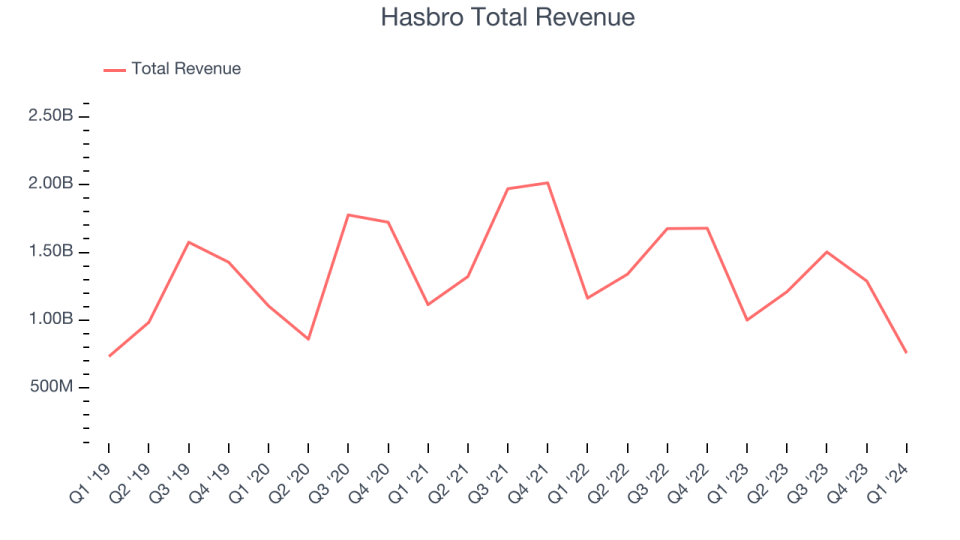

Best Q1: Hasbro (NASDAQ:HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Hasbro reported revenues of $757.3 million, down 24.3% year on year, outperforming analysts’ expectations by 2.2%. It was an exceptional quarter for the company, with an impressive beat of analysts’ earnings and operating margin estimates.

Hasbro had the slowest revenue growth among its peers. The stock is up 4.5% since the results and currently trades at $60.75.

Is now the time to buy Hasbro? Access our full analysis of the earnings results here, it’s free.

Sonos (NASDAQ:SONO)

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Sonos reported revenues of $252.7 million, down 16.9% year on year, exceeding analysts’ expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts’ operating margin and earnings estimates.

The stock is down 14.7% since the results and currently trades at $15.

Read our full analysis of Sonos’s results here.

GoPro (NASDAQ:GPRO)

Known for sponsoring extreme athletes, GoPro (NASDAQ:GPRO) is a camera company known for its POV videos and editing software.

GoPro reported revenues of $155.5 million, down 11% year on year, surpassing analysts’ expectations by 6.1%. It was a slower quarter for the company, with a miss of analysts’ earnings estimates and a miss of analysts’ cameras sold estimates.

GoPro pulled off the biggest analyst estimates beat among its peers. The stock is down 27.5% since the results and currently trades at $1.33.

Read our full, actionable report on GoPro here, it’s free.

Funko (NASDAQ:FNKO)

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko reported revenues of $215.7 million, down 14.4% year on year, falling short of analysts’ expectations by 2.1%. It was a solid quarter for the company, with an impressive beat of analysts’ earnings and operating margin estimates.

Funko achieved the highest full-year guidance raise among its peers. The stock is up 52% since the results and currently trades at $10.4.

Read our full, actionable report on Funko here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.