Bank of America lays out the exact scenario that could finally pop the stock market’s AI bubble

-

Bank of America says the ongoing “anything but bonds” bull market has led to a very top-heavy stock market.

-

The firm is watching real 10-year yields and credit spreads for signals of when that AI-led rally could end.

-

BofA says higher yields and tighter spreads could sound recession alarms and spur a stock sell-off.

Bank of America has coined a phrase for what’s going on in markets right now, calling it an “anything but bonds” bull run.

The firm notes that in the fourth quarter of 2023, stocks and crypto led the way. In the first three months of 2024, it was commodities and… well, still crypto. And so far in the second quarter it’s been the US dollar’s time to shine.

While this has been lucrative for well-positioned traders across asset classes, BofA warns it’s a byproduct of immense government spending, and could end up unwinding if a few key conditions are met.

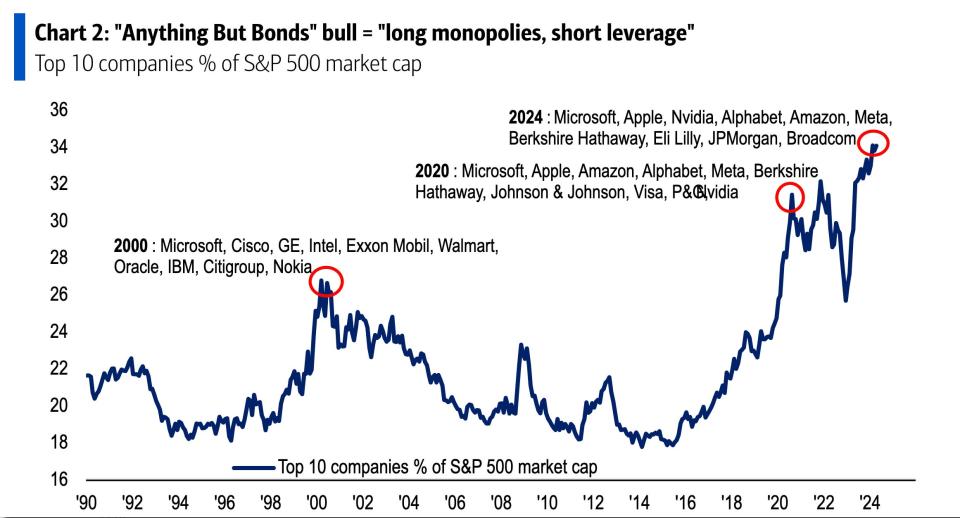

The key piece is the cohort of mega-cap tech companies that have long dominated stock-market performance, largely because of their affiliation with AI. BofA says the “anything but bonds” rally has set a particular fire under the market’s biggest stocks, with the top 10 accounting for a record 34% of S&P 500 market cap, as reflected in the chart below.

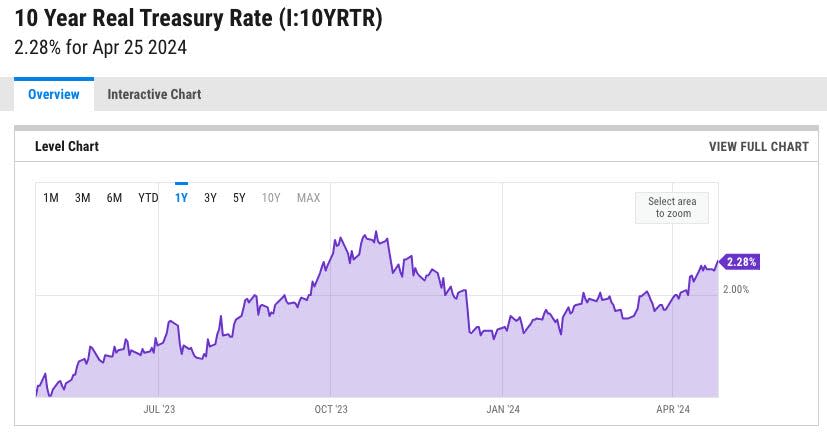

But BofA doesn’t see this high-flying bull run lasting forever. The firm outlines a scenario that could derail the rally and finally dent mega-cap growth-stock leadership: real 10-year yields climb into the 2.5%-to-3% region, and/or higher yields combine with higher credit spreads to stoke fears of recession.

The real 10-year yield is currently at 2.28%, meaning it has further to go before it triggers an eventual sell-off in the types of mega-cap names heavily weighted in major indexes. Per the chart below, it hasn’t exceeded 2.5% since October 2023, and even then, only briefly.

There’s also the consideration that mega-cap tech is no longer moving higher like an ever-unstoppable monolith. There has been bifurcation in the AI-focused Magnificent Seven stocks as Tesla and Apple have gotten off to rocky starts to 2024, while juggernauts like Nvidia and Microsoft have shown no signs of slowing. Then there’s Meta, which was up 40%-plus this year headed into earnings, but took a sizable share-price hit because it’s not growing quite fast enough to please investors.

These divergences have reduced concentration risk in a way that could dampen any eventual sell-off. In the meantime, if you subscribe to BofA’s view, you should be watching the 10-year real yield for a signal of when any such downturn is coming.

Read the original article on Business Insider