Archer Aviation Still Hasn’t Been Cleared for Takeoff

Archer Aviation (NYSE: ACHR) has proved out the concept of short-haul vertical-lift air transportation. It has a functioning prototype of what looks like a plane/helicopter hybrid. While not exactly a futuristic design, it’s still pretty cool, and the idea of flying around a city, avoiding ground traffic, is likely to be compelling to many people. The only problem is that Archer Aviation is still a long way away from being able to mass-produce and sell its aircraft. Here’s what you need to understand before you buy into this story stock.

Archer Aviation’s big idea

If you’ve ever been stuck in the traffic gridlock that can occur in a city, you know just how desirable it would be to fly above it all and get to where you’re going without any delays. That’s the underlying story that Archer Aviation is playing up. With a prototype proving it can make good on that dream, it wouldn’t be shocking to see investors interested in the company’s shares.

There’s just one small problem. Archer Aviation is nowhere near ready to offer its product to the world. That’s a problem that only money, time, and strong execution can solve. In the company’s 10-K, it admits that it’s still just “in the process of developing the infrastructure necessary to manufacture Midnight,” the name of its aircraft, “reliably, at scale, and in a cost-effective manner.” It continues: “That involves two main aspects: developing the necessary component supply chain and building out our manufacturing operations.” In plain English, the company isn’t capable of building anything more than a prototype right now.

Further, moremanagement noted that it continues “to focus our efforts on obtaining certification from the FAA of our aircraft in the U.S. and engaging with key decision makers in the U.S. cities in which we plan to initially operate our aircraft.” The plain English here is that it can’t legally sell its aircraft until the U.S. government approves it as airworthy, and the company doesn’t yet have a place to test the aircraft. In addition, given that the company wants to both sell its aircraft and operate its own fleet of so-called air taxis, it will also need to get government approval as an airline. It will probably need to get the aircraft approved before that can happen.

Archer Aviation has a long way to go

Investors looking at this story stock have to recognize that buying now would be putting money into a company that’s only at the start of its journey. There’s no way to know, at this point, whether Archer Aviation can build a sustainable business. The only thing certain is that it has a lot of work, and a lot of spending, ahead of it before it might get to that point. Only aggressive growth investors should be considering the shares.

If you do consider investing, the big question you should probably ask is, “What could go wrong?” The answer is a lot.

Fairly simplistically, the company could fail to get the government approvals it needs. It could also have trouble building the necessary infrastructure to manufacture the vehicles. But from a bigger picture, it isn’t clear if there’s really a market for the product that’s big enough to justify the company’s efforts. Archer Aviation offers up some compelling background:

In 2023, 56% of the world’s population lived in urban areas according to the World Bank, and their projection is that the urban population will double its current size by 2050, where nearly 7 of 10 people will live in cities. This migration has led to unprecedented traffic congestion, with a noticeable struggle to scale ground infrastructure.

The company goes on to quote a Morgan Stanley study that suggests there’s will be a $1 trillion market opportunity by 2040 and a $9 trillion opportunity just a decade after that. Or this could be the next Segway, a much-hyped product that ended up being a huge bust. There’s no way to know.

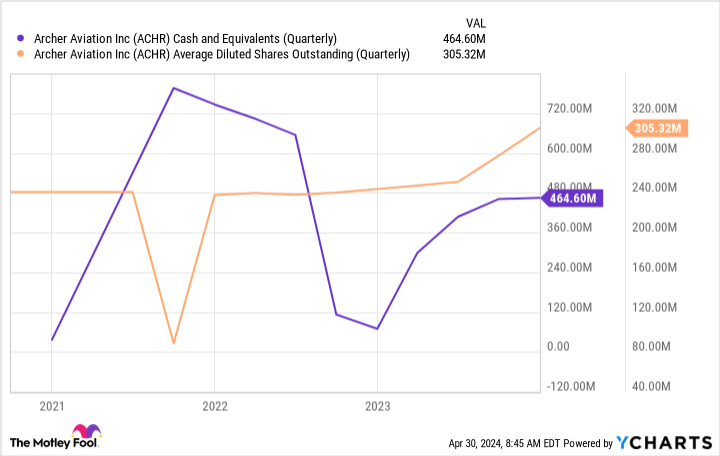

But what is pretty clear is that Archer Aviation is, as the company itself explains, “an early stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the foreseeable future.” That hints at the need for more capital, which will probably mean issuing stock and diluting early investors. Thus, buying shares now might actually not be so good, even if the company does manage to create a real business someday.

Most investors should wait on Archer Aviation

A good idea is not enough to make a company. To do so requires a real and approved product and the ability to produce that product at scale, and Archer Aviation has a long way to go before it hits that point. But here’s the part that should really highlight the risks: Archer Aviation spent $446.9 million on operating expenses in 2024 while producing no revenue and ended the year with just $464.6 million in cash. Simple math suggests that things are already pretty tight here. Most investors should probably watch from the tarmac until this company’s business has actually lifted off.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Watch Out, Growth Stock Investors: Archer Aviation Still Hasn’t Been Cleared for Takeoff was originally published by The Motley Fool