April’s 5 Dividend Growth Stocks With 4.67%+ Yields

PM Images

Written by Nick Ackerman.

For some background on this monthly publication, here is my view on dividend growth stocks:

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines, and they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all returned back into your pocket from that point forward.

All of this being said, it is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors, but earnings payout ratios, debt and free cash flow are among these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support possible dividend growth. For these, the grades will also be A+ through B- ratings.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 384 stocks at this time from the 399 listed last month. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, from highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

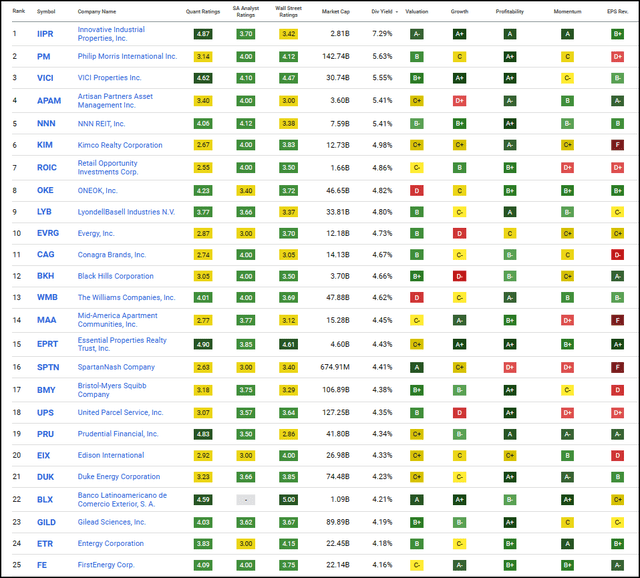

I will share the top 25 that showed up as of 04/03/2024.

Top 25 Screening (Seeking Alpha)

We recently covered Philip Morris (PM), VICI Properties (VICI), NNN REIT (NNN) and ONEOK (OKE), so we will wait to provide our quick updates on those names until at least a quarter goes by.

This month we will be giving a quick look at Innovative Industrial Properties (IIPR), Kimco Realty (KIM), LyondellBasell Industries N.V. (LYB), Evergy (EVRG) and Conagra (CAG).

Innovative Industrial Properties 7.29% Yield

IIPR is a name we are quite familiar with that comes up regularly on this list. This is also a more speculative REIT name that I hold myself, so it is one that I am personally keeping a closer eye on than usual. The last time we took a look at this cannabis-related industrial REIT was January of this year. At that time, its smaller peer, NewLake Capital Partners (NLCP had also shown up on our list for discussion.

During our last update, the REIT declared another dividend and held it steady…

Read More: April’s 5 Dividend Growth Stocks With 4.67%+ Yields