ANSYS (NASDAQ:ANSS) Reports Sales Below Analyst Estimates In Q1 Earnings

Engineering simulation software provider Ansys (NASDAQ:ANSS) missed analysts’ expectations in Q1 CY2024, with revenue down 8.4% year on year to $466.6 million. It made a non-GAAP profit of $1.39 per share, down from its profit of $1.85 per share in the same quarter last year.

Is now the time to buy ANSYS? Find out in our full research report.

ANSYS (ANSS) Q1 CY2024 Highlights:

-

Revenue: $466.6 million vs analyst estimates of $555 million (15.9% miss)

-

EPS (non-GAAP): $1.39 vs analyst expectations of $1.98 (29.8% miss)

-

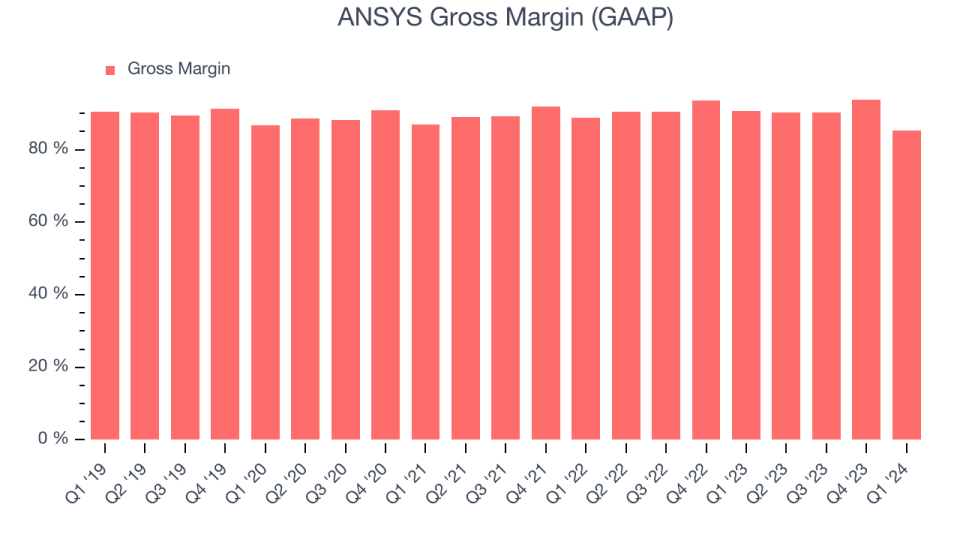

Gross Margin (GAAP): 85.3%, down from 90.6% in the same quarter last year

-

Market Capitalization: $28.36 billion

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

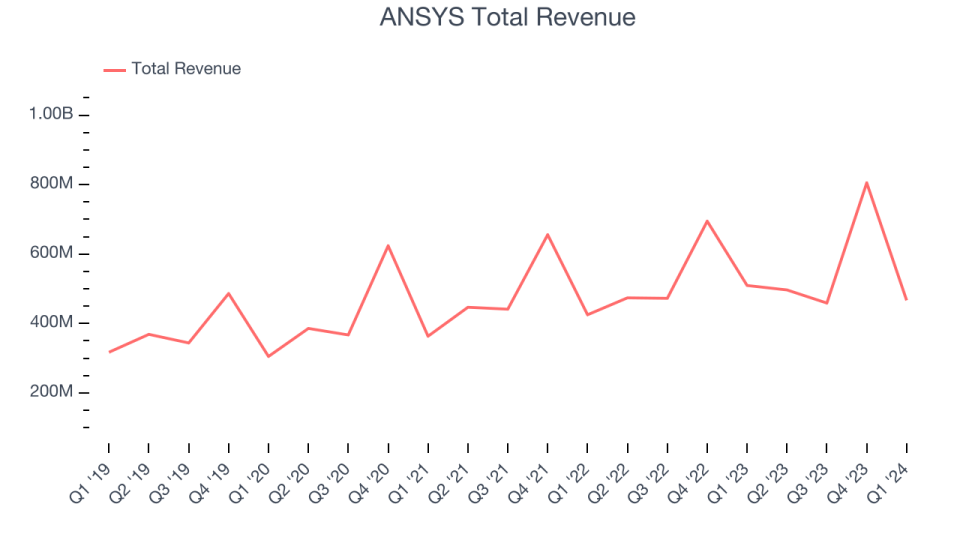

As you can see below, ANSYS’s revenue growth has been unremarkable over the last three years, growing from $363.2 million in Q1 2021 to $466.6 million this quarter.

This quarter, ANSYS’s revenue was down 8.4% year on year, which might disappointment some shareholders.

Looking ahead, analysts covering the company were expecting sales to grow 13.1% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn’t cost much to provide it as an ongoing service to customers. ANSYS’s gross profit margin, an important metric measuring how much money there’s left after paying for servers, licenses, technical support, and other necessary running expenses, was 85.3% in Q1.

That means that for every $1 in revenue the company had $0.85 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite its decline over the last year, ANSYS’s excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Key Takeaways from ANSYS’s Q1 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts’ expectations and its gross margin shrunk. This underperformance was driven by a worse-than-expected average contract value of $407 million (compared to estimates of $433). Overall, this was a mediocre quarter for ANSYS. The company is down 3.2% on the results and currently trades at $311 per share.

ANSYS may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.