Exploring Sweden’s Top Dividend Stocks In June 2024

Amidst a backdrop of political uncertainty and fluctuating markets across Europe, Sweden’s financial landscape offers a unique avenue for investors seeking stability through dividend stocks. As we explore some of the top dividend stocks in Sweden this June 2024, it’s crucial to consider how these assets can serve as potential bulwarks against volatility while providing consistent returns.

Top 10 Dividend Stocks In Sweden

|

Name |

Dividend Yield |

Dividend Rating |

|

Zinzino (OM:ZZ B) |

4.35% |

★★★★★★ |

|

Betsson (OM:BETS B) |

6.37% |

★★★★★☆ |

|

Loomis (OM:LOOMIS) |

4.42% |

★★★★★☆ |

|

HEXPOL (OM:HPOL B) |

3.36% |

★★★★★☆ |

|

Axfood (OM:AXFO) |

3.09% |

★★★★★☆ |

|

Duni (OM:DUNI) |

4.84% |

★★★★★☆ |

|

Skandinaviska Enskilda Banken (OM:SEB A) |

5.56% |

★★★★★☆ |

|

Avanza Bank Holding (OM:AZA) |

4.37% |

★★★★★☆ |

|

Nordea Bank Abp (OM:NDA SE) |

8.12% |

★★★★★☆ |

|

Afry (OM:AFRY) |

3.00% |

★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland, with a market capitalization of approximately SEK 16.60 billion.

Operations: Bravida Holding AB generates its revenues from providing technical services and installations across Sweden, Norway, Denmark, and Finland.

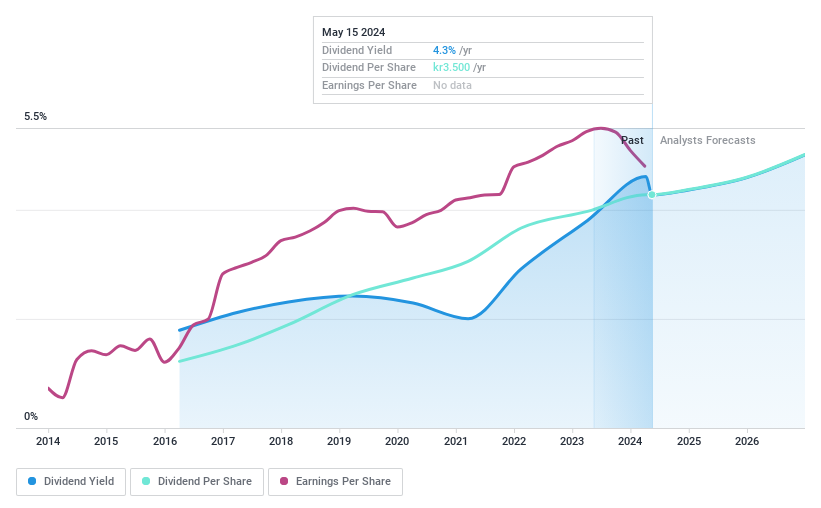

Dividend Yield: 4.3%

Bravida Holding, despite a less than decade-long dividend history, recently announced a SEK 3.50 per share payout totaling SEK 714.29 million for FY 2023, reflecting a stable but young dividend profile. The company’s dividends appear sustainable with earnings and cash flow coverage ratios at 61.7% and 43.5%, respectively. However, Q1 results showed a dip in net income to SEK 200 million from SEK 269 million year-over-year, potentially flagging concerns about consistent profitability amidst operational challenges such as the overbilling scandal involving its Malmö El Service department.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy firm specializing in digital solutions development, with a market capitalization of approximately SEK 4.66 billion.

Operations: Knowit AB generates its revenue primarily through three segments: Solutions (SEK 3.91 billion), Experience (SEK 1.48 billion), and Connectivity (SEK 1.05 billion), along with a notable contribution from Insight (SEK 895.45 million).

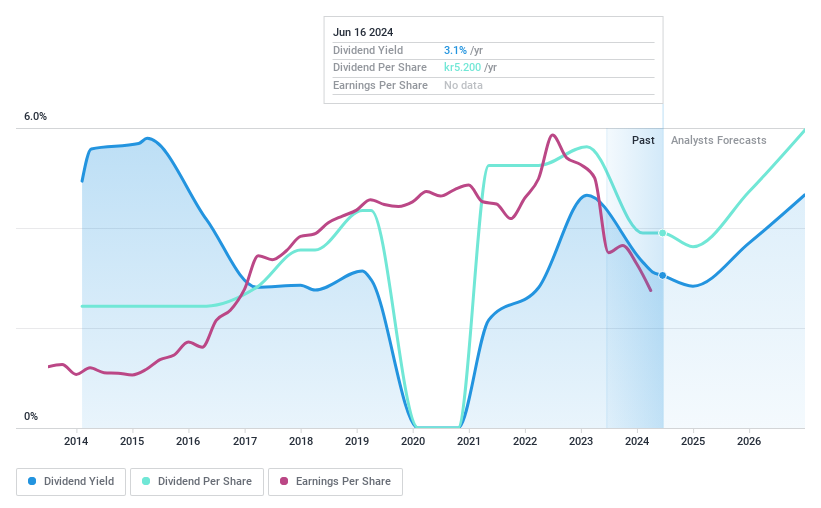

Dividend Yield: 3.1%

Knowit AB’s recent dividend declaration of SEK 5.20 per share, split into two payments, aligns with its historical pattern but reflects a cautious approach amid fluctuating earnings. With Q1 2024 revenue dropping to SEK 1.77 billion from SEK 1.97 billion year-over-year and net income decreasing to SEK 61 million from SEK 99.8 million, financial performance raises concerns about sustained profitability and dividend stability. Despite these challenges, the dividends are supported by a reasonable payout ratio of 70.9% and a cash payout ratio of 39%, suggesting that current dividends are manageable within existing financial constraints.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB Traction is a private equity firm that focuses on various investment strategies including distressed assets and buyouts, with a market capitalization of approximately SEK 3.89 billion.

Operations: AB Traction’s revenue is primarily generated from its Financial Investments segment, totaling SEK 237.90 million.

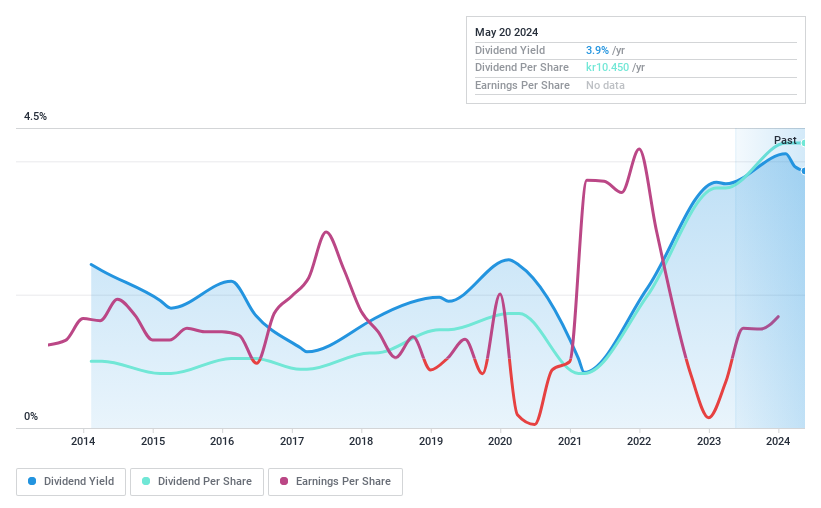

Dividend Yield: 4%

AB Traction’s dividend yield stands at 3.97%, below the top Swedish dividend payers. Despite a 10-year history of increasing dividends, payments have been unstable, with significant annual fluctuations exceeding 20%. The company’s dividends are well-covered by both earnings and cash flows, with payout ratios near 82.9%. Recent financials show a decline in net income to SEK 128.2 million from SEK 211 million year-over-year, potentially impacting future dividend reliability and growth.

Key Takeaways

-

Click this link to deep-dive into the 24 companies within our Top Dividend Stocks screener.

-

Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

-

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our…

Read More: Exploring Sweden’s Top Dividend Stocks In June 2024