J-LeaseLtd Leads Three Premier Dividend Stocks In Japan

Amidst a backdrop of mixed performances in global markets, Japan’s stock market has shown resilience with the Nikkei 225 Index registering a slight gain. This stability makes it an opportune time to consider the merits of dividend stocks, which can offer investors potential income in addition to capital appreciation opportunities.

Top 10 Dividend Stocks In Japan

|

Name |

Dividend Yield |

Dividend Rating |

|

Yamato Kogyo (TSE:5444) |

3.93% |

★★★★★★ |

|

Business Brain Showa-Ota (TSE:9658) |

3.71% |

★★★★★★ |

|

Koei Tecmo Holdings (TSE:3635) |

3.70% |

★★★★★★ |

|

Globeride (TSE:7990) |

3.65% |

★★★★★★ |

|

HITO-Communications HoldingsInc (TSE:4433) |

3.65% |

★★★★★★ |

|

Ryoyu Systems (TSE:4685) |

3.46% |

★★★★★★ |

|

FALCO HOLDINGS (TSE:4671) |

6.74% |

★★★★★★ |

|

KurimotoLtd (TSE:5602) |

5.18% |

★★★★★★ |

|

GakkyushaLtd (TSE:9769) |

4.18% |

★★★★★★ |

|

Innotech (TSE:9880) |

4.08% |

★★★★★★ |

Click here to see the full list of 387 stocks from our Top Dividend Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

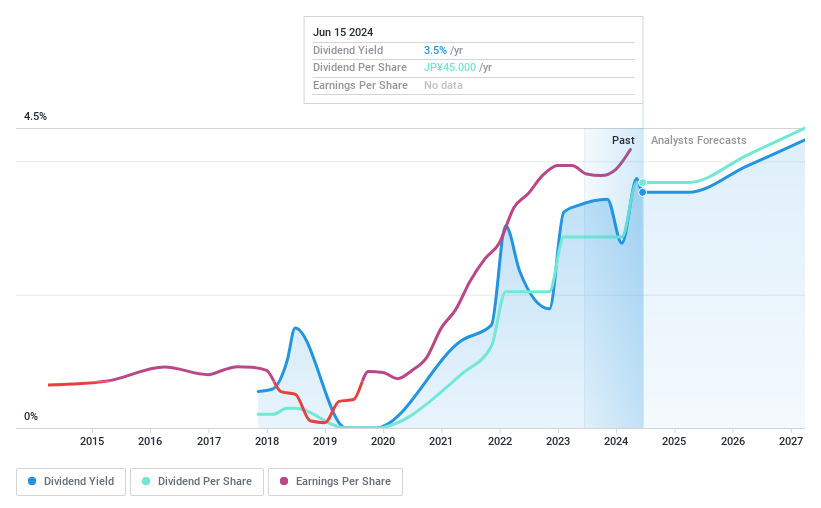

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J-Lease Co., Ltd. operates primarily in the guarantor-related business and has a market capitalization of approximately ¥22.63 billion.

Operations: J-Lease Co., Ltd. primarily generates its revenue from guarantor-related activities.

Dividend Yield: 3.5%

J-Lease Co., Ltd. recently reduced its annual dividend from JPY 35.00 to JPY 22.50 per share, maintaining this level for the upcoming quarter despite a challenging history of unstable and volatile dividend payments over the past seven years. Despite these fluctuations, dividends are currently supported by a payout ratio of 57.1% and a cash payout ratio of 69.3%, indicating coverage by both earnings and cash flows. The company forecasts modest growth with expected net sales reaching ¥16.21 billion and profits attributable to owners at ¥1.89 billion for FY ending March 2025, suggesting potential stability ahead.

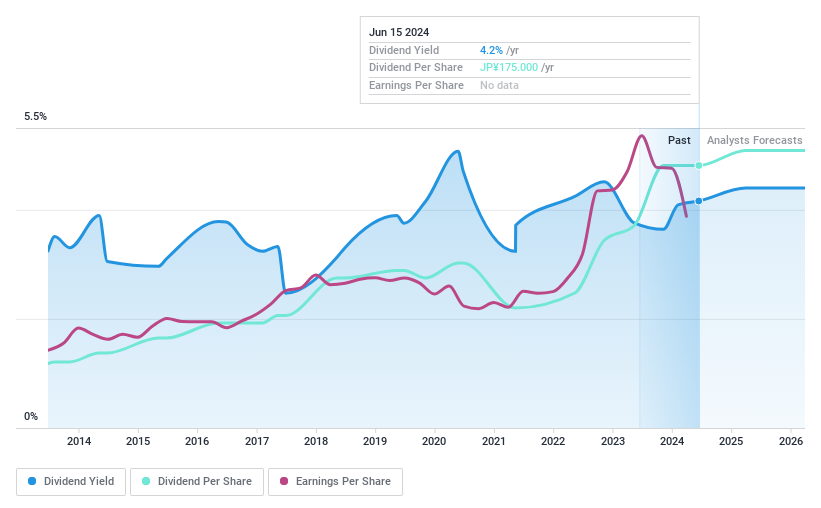

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hagiwara Electric Holdings Co., Ltd. operates in the sale of electronic devices and equipment across Japan, North America, Europe, and Asia, with a market capitalization of approximately ¥41.89 billion.

Operations: Hagiwara Electric Holdings Co., Ltd. generates its revenues from the sale of electronic devices and equipment across various regions including Japan, North America, Europe, and Asia.

Dividend Yield: 4.2%

Hagiwara Electric Holdings has shown a commitment to increasing dividends over the last decade, with a current yield of 4.16%, ranking in the top quartile of Japanese dividend stocks. However, its dividend history is marked by volatility and shareholder dilution within the past year. Despite this, dividends are well-supported by a payout ratio of 33.8% and a cash payout ratio of 37.7%. The company’s earnings are projected to grow by 16.36% annually, indicating potential for sustained dividend payments amidst its challenges with reliability and recent market valuation at 76.3% below estimated fair value as discussed in their May earnings call.

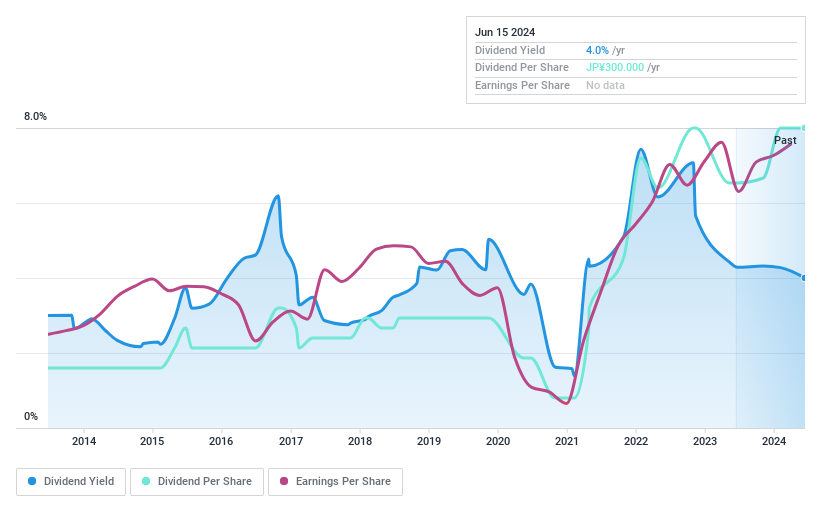

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinsho Corporation, operating globally, engages in the import, export, and trade of iron and steel products, ferrous raw materials, nonferrous metals, machinery, information industry products, and welding items with a market capitalization of approximately ¥66.00 billion.

Operations: Shinsho Corporation’s business includes the global trade of a diverse range of products, such as iron and steel, ferrous raw materials, nonferrous metals, various machinery, technology-related items, and welding equipment.

Dividend Yield: 4%

Shinsho Corporation recently increased its year-end dividend for FY 2024 to ¥190 per share but projected a decrease to ¥150 for FY 2025, reflecting a pattern of inconsistent dividends over the past decade. Despite trading at 51.2% below its estimated fair value, suggesting potential undervaluation, concerns about dividend reliability persist due to volatile historical payments and insufficient coverage by operating cash flow. However, both earnings and cash flows currently cover the dividends well, with payout ratios of 44.5% and 32.2%, respectively.

Summing It All Up

-

Investigate our full lineup of 387 Top Dividend Stocks right here.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating…

Read More: J-LeaseLtd Leads Three Premier Dividend Stocks In Japan