Short Sellers Remain Addicted To Cannabis Stocks

tampatra/iStock via Getty Images

Cannabis stocks remain a target for short sellers as stock prices continue to reflect the difficulties that the industry faces.

Marijuana stocks have the potential to be the next multi-billion-dollar industry as countries around the world start to decriminalize and legalize the drug for both recreational and medicinal purposes. Canada legalized the substance in 2018 and several US states have since followed suit in the ensuing months and years. Despite remaining illegal at a federal level, the substance is legal for recreational use in 23 US states and for medical use in 37 US states.

In August 2023, the U.S. Department of Health and Human Services recommended easing restrictions on marijuana. “Pot stocks” jumped as a result, but following the slower-than-forecast progress in legalizing the substance, uncertainty continues to hang over the potential profits that can be generated by the industry.

Canopy Growth Corp (WEED Canadian line and CGC US line) was once Canada’s most valuable marijuana company, with a market capitalization of $25B at its peak. This has now shrunk to $557M. The company recently announced a follow-on equity offering of $250M, to spend on acquisitions, working capital and general corporate purposes. This news sent the company’s share price lower by 7.6%. Short Interest continues to climb in the stock, recently reaching its highest level since 2023, as a lack of profits, due to the high costs associated with the level of regulatory compliance needed to produce the product, continues to weigh on both the company and the broader sector. To the end of May 2024, lenders of the stock have received $57M in securities lending fees.

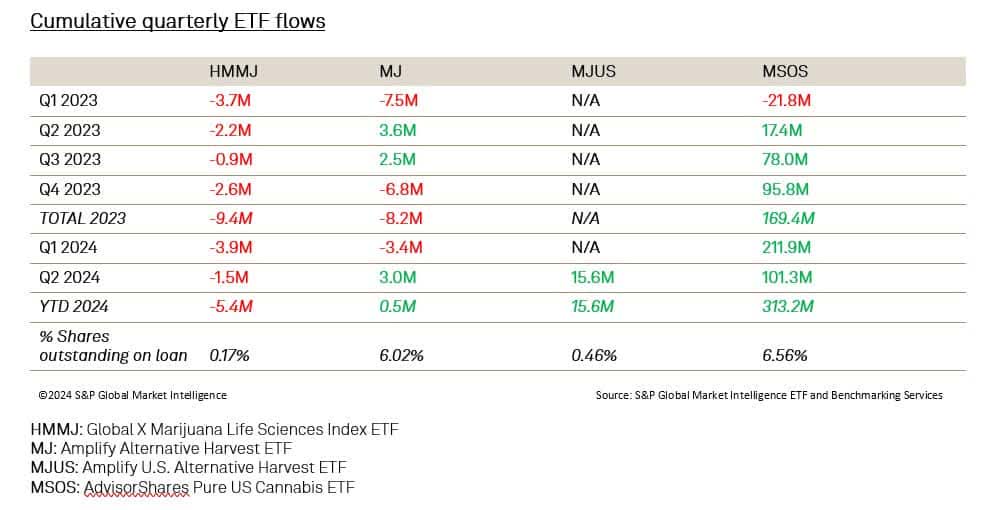

When looking at ETF flow data for some of the largest Marijuana ETFs (by assets under management), a dichotomy can be seen across the investment flows. Those ETFs focusing on the US market appear to be experiencing sustained positive quarterly inflows, whilst those investing across the global marijuana market appear to be less attractive to investors. Any concentration in US “pot stocks” could offer investors greater potential for growth following the recent easing of restrictions at the state level. Any ETF heavily weighted towards Canadian cannabis companies is expected to suffer from the impact of US federal cannabis laws. This prevents foreign companies from entering the US cannabis market whilst retaining their listing on a US exchange as long as marijuana is illegal at the federal level.

Despite the cannabis industry growing and its use becoming more accepted, the industry still faces major challenges. Cannabis producing companies continue to face competition from illegal operators who do not have the same regulatory costs and do not pay taxes. They also face the ongoing challenge of keeping prices low in a heavily regulated environment to ensure that they remain competitive. This creates difficulties in scaling operations and controlling costs. Until these trends change significantly, it is likely that cannabis stocks will remain on the radar of short sellers.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.