MAR) Vs The Rest Of The Hotels, Resorts and Cruise Lines Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at hotels, resorts and cruise lines stocks, starting with Marriott (NASDAQ:MAR).

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying “things” (wasteful) to buying “experiences” (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 15 hotels, resorts and cruise lines stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 1.4%. while next quarter’s revenue guidance was 0.8% below consensus. Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the hotels, resorts and cruise lines stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.2% on average since the previous earnings results.

Marriott (NASDAQ:MAR)

Founded by J. Willard Marriott in 1927, Marriott International (NASDAQ:MAR) is a global hospitality company with a portfolio of over 7,000 properties and 30 brands, spanning 130+ countries and territories.

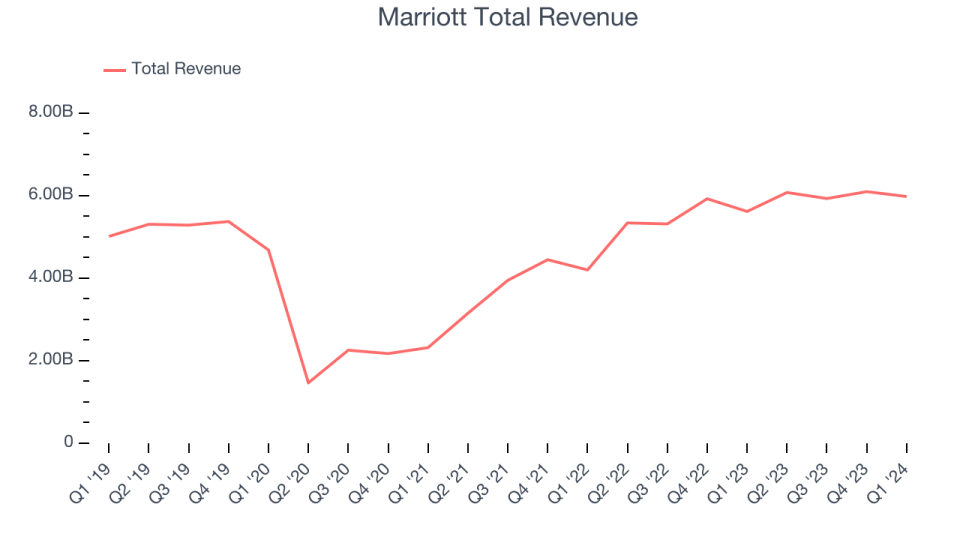

Marriott reported revenues of $5.98 billion, up 6.4% year on year, in line with analysts’ expectations. It was a slower quarter for the company: Marriott’s operating margin missed and its EPS fell short of Wall Street’s estimates. Next quarter’s EPS guidance missed expectations as well, although one positive is that full year gross fee revenue was raised from previous and full year EPS guidance slightly exceeded Wall Street’s estimates.

Anthony Capuano, President and Chief Executive Officer, said, “We were pleased with our results in the quarter, which included both excellent net rooms growth and cash generation. Worldwide RevPAR1 grew over 4 percent, with gains in both occupancy and ADR. Our international markets were particularly strong, posting RevPAR gains of 11 percent, led by nearly 17 percent year-over-year growth in Asia Pacific excluding China.

The stock is down 0% since the results and currently trades at $236.

Read our full report on Marriott here, it’s free.

Best Q1: Playa Hotels & Resorts (NASDAQ:PLYA)

Sporting a roster of beachfront properties, Playa Hotels & Resorts (NASDAQ:PLYA) is an owner, operator, and developer of all-inclusive resorts in prime vacation destinations.

Playa Hotels & Resorts reported revenues of $300.6 million, up 9.8% year on year, outperforming analysts’ expectations by 6.3%. It was a stunning quarter for the company, with an impressive beat of analysts’ earnings estimates.

Playa Hotels & Resorts pulled off the biggest analyst estimates beat among its peers. The stock is down 9.8% since the results and currently trades at $8.52.

Is now the time to buy Playa Hotels & Resorts? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Choice Hotels (NYSE:CHH)

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE:CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Choice Hotels reported revenues of $331.9 million, down 0.3% year on year, falling short of analysts’ expectations by 3.2%. It was a weak quarter for the company, with a miss of analysts’ operating margin estimates and underwhelming earnings guidance for the full year.

Choice Hotels had the weakest performance against analyst estimates in the group. The stock is down 4.1% since the results and currently trades at $117.13.

Read our full analysis of Choice Hotels’s results here.

Sabre (NASDAQ:SABR)

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $782.9 million, up 5.4% year on year, surpassing analysts’ expectations by 3.9%. It was a mixed quarter for the company, with a miss of analysts’ earnings estimates.

The stock is up 1.4% since the results and currently trades at $2.94.

Read our full, actionable report on Sabre here, it’s free.

Hilton (NYSE:HLT)

Founded in 1919, Hilton Worldwide (NYSE:HLT) is a global hospitality company with a portfolio of hotel brands.

Hilton reported revenues of $2.57 billion, up 12.2% year on year, surpassing analysts’ expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts’ earnings and operating margin estimates.

The stock is up 6.9% since the results and currently trades at $210.71.

Read our full, actionable report on Hilton here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.