1 Stock Down 11% to Buy Before Artificial Intelligence (AI) Could Supercharge Its Growth and Send It Soaring

Technology stocks have been in fine form in the past year, which is evident from the 50% gains clocked by the Nasdaq-100 Technology Sector index during this period. But not all tech stocks have benefited from the broader market’s surge. Fortinet (NASDAQ: FTNT) is one of them.

Shares of the cybersecurity company are down 11% in the past year, and the latest quarterly results (for the first quarter of 2024) haven’t helped matters, either. Let’s see why that was so, before taking a closer look at the catalysts that could help Fortinet regain its mojo.

Fortinet investors are worried about its tepid growth

First-quarter revenue increased just 7% year over year to $1.35 billion, while its adjusted net income was up 26% to $0.43 per share. The numbers exceeded Wall Street’s outlook as analysts were expecting Fortinet to deliver $0.38 per share in earnings on revenue of $1.34 billion. The problem, however, was with Fortinet’s billings during the quarter.

Billings fell just over 6% from the year-ago period to $1.41 billion last quarter, missing the $1.43 billion consensus estimate. Management pointed out that “billings drive current and future revenue” and that the metric is “an important indicator of the health and viability of our business.” So, the contraction in the company’s billings doesn’t bode well, and this explains why Fortinet stock fell after the results were released.

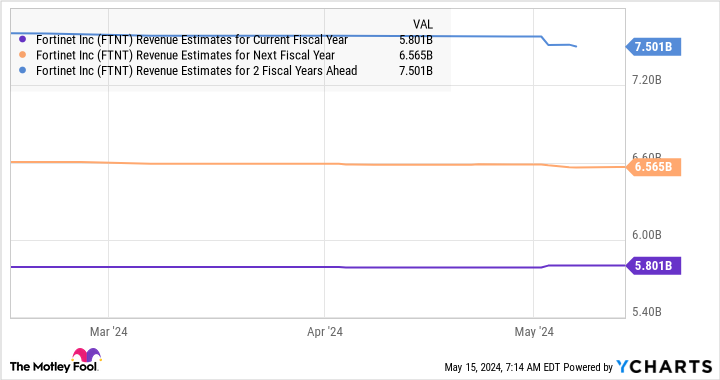

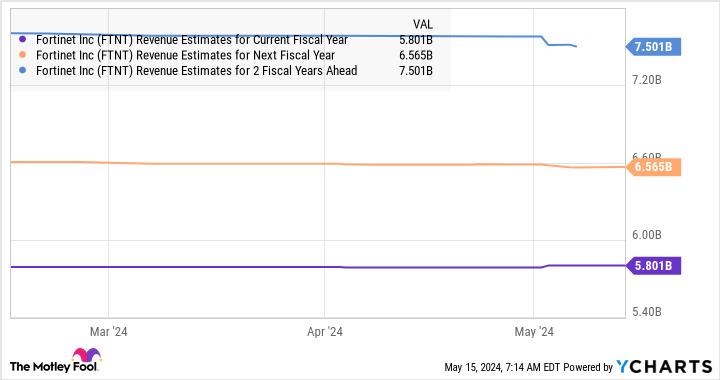

Moreover, Fortinet’s guidance for flat billings in 2024 versus the 14% growth it registered last year has further added to the negative investor sentiment. This explains why the company’s top-line growth is expected to slow down remarkably this year. Fortinet’s revenue guidance of $5.8 billion for this year points toward an increase of just 9% from last year. For comparison, the company’s top line jumped 20% in 2023 to $5.3 billion.

In all, it is easy to see why investors have pressed the panic button and the stock has been underperforming. However, there were a few positive takeaways last quarter that could help accelerate growth once again. Let’s take a closer look at them.

A focus on generative AI could give the company’s growth a boost

The advent of generative artificial intelligence (AI) is going to have a massive impact on the cybersecurity industry in the long run. According to Bloomberg Intelligence, generative AI cybersecurity spending is expected to grow from just $9 million in 2022 to $3.2 billion in 2027. By 2032, the size of that market could jump to almost $14 billion.

Companies that are already offering generative AI-based cybersecurity have been growing at a terrific pace. The market is currently in its early phases of growth, and it is expected to clock an annual growth rate of 109% through 2032. So, it is not too late for Fortinet to jump into this market.

The company launched its FortiAI generative AI cybersecurity assistant last year, and recently added several updates to the platform to help security analysts bolster the cyber defenses of their organizations and accelerate threat detection and analysis.

Management says that FortiAI is “being deployed across both networking and security products,” and the company’s partners and customers have expressed their interest in its generative AI.

As Fortinet continues to roll out these tools across its platform and more customers start adopting them, the company could witness an acceleration in growth. This probably explains why analysts are expecting revenue growth to improve over the next couple of years following this year’s flat performance.

The stock is currently trading at 8.6 times sales, which is a discount to its five-year average sales multiple of 10.5. Assuming its growth accelerates, it won’t be surprising to see the stock approaching its five-year average sales multiple in the future. So if Fortinet’s top line indeed hits $7.5 billion in 2026 and its sales multiple hits 10, the company’s market cap could jump to $75 billion.

That would be a 63% increase from current levels, indicating that this cybersecurity stock could deliver healthy gains over the next three years thanks to catalysts such as AI. Considering that it is trading at a relatively cheaper level right now than where it was before, investors would do well to buy Fortinet while it is beaten down since it seems capable of flying higher in the long run.

Should you invest $1,000 in Fortinet right now?

Before you buy stock in Fortinet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fortinet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Fortinet. The Motley Fool has a disclosure policy.

1 Stock Down 11% to Buy Before Artificial Intelligence (AI) Could Supercharge Its Growth and Send It Soaring was originally published by The Motley Fool