Is UPS the Best Dividend Stock?

UPS‘ (NYSE: UPS) current forward dividend yield of around 4.4% is highly attractive for income-seeking investors, but is the payout sustainable? The company’s earnings have disappointed recently, and the dividend cover looks pretty thin in 2024. Is UPS a stock for dividend hunters to buy? Here’s what you need to know before buying the stock.

UPS’ dividend

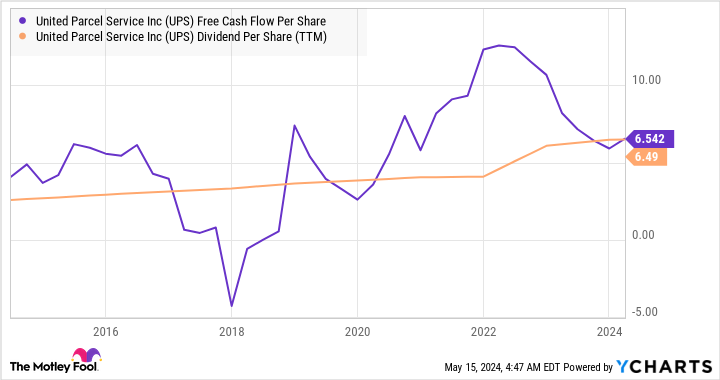

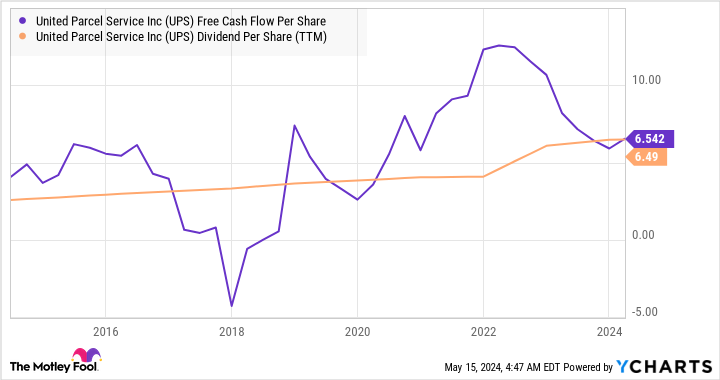

The company’s trailing-12-month dividend cost it about $5.4 billion, and as you can see below, following a disappointing 2023, its free cash flow (FCF) per share didn’t cover its dividend last year. Clearly, that’s not a sustainable situation, and investors should buy UPS stock more for where the company is going than where it just came from.

Though, in fairness, last year was a uniquely bad one for UPS. Its delivery volumes fell much more than management expected due to a slowing economy and a natural retraction from the boom of previous years caused by stay-at-home measures. In addition, a protracted labor dispute over a contract renewal caused customers to divert volumes in fear of strike action.

Where UPS is heading

That said, management’s plans involve significantly improving profit margins and delivery volumes and growing revenue per piece in excess of cost per piece by using technologies such as automation to consolidate facilities and smart facilities to improve productivity. In addition, UPS continues to grow its higher-margin small and medium-sized business (SMB) and healthcare-based revenue.

Management aims to hit FCF of $5.9 billion to $6.7 billion in 2024, and ultimately $17 billion to $18 billion from 2024 to 2026. The low end of that figure would produce an average of $5.6 billion per year, which would cover the dividend. Moreover, the guidance looks conservative given the target of $5.9 billion to $6.7 billion (before pension contributions) in 2024 and the aim of hitting roughly $7 billion in FCF in 2026. Wall Street analysts have UPS hitting $18.3 billion in FCF from 2024 through 2026.

Still, whichever way you look at it, UPS’ FCF to dividend cover isn’t looking great. However, that didn’t stop CEO Carol Tome saying on the recent earnings call:

We have a targeted dividend payout ratio of 50%. We are higher than that. It’s our intent to earn back into a 50% payout ratio over time.

She went on to outline that she had “no intent” to cut the dividend, with outgoing CFO Brian Newman noting, “We’re committed to a stable and growing dividend.”

It’s a confident narrative from management. Still, it’s hard to see a significant increase in the dividend, given the kind of FCF generation management outlined for the next few years.

Is UPS a dividend stock to buy?

The company is in recovery mode in 2024, with management expecting to pass an inflection point in volumes through the year as it laps easier comparisons with 2023. In addition, margins should expand as they come up against the cost increases associated with the new labor contract in 2023.

Meanwhile, the technology investments are logical, and UPS is hitting all its internal targets for growth in healthcare and SMB revenue. On the downside, any economic deterioration, mainly when there’s overcapacity in the delivery package industry, would hit UPS hard and lead to serious questions over its capital allocation strategy, starting with the dividend.

On the other hand, recent earnings saw management confirm that it expects a “slight uptick” in delivery volumes in its domestic business in the second quarter, leading into a low-single-digit increase in the second half. That’s a key number to watch because if it comes through, then UPS is on the way to muddling through the next few years while keeping its dividend growing, albeit slowly.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

Is UPS the Best Dividend Stock? was originally published by The Motley Fool