Better AI Stock: Alphabet vs. Meta Platforms

Technology giants Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Meta Platforms (NASDAQ: META) are pretty similar at their core. Both companies dominate their respective fields by offering superior products for free. Both companies make tons of money by selling advertising that users see as they browse the two companies’ platforms.

For Alphabet, the primary revenue drivers are Google Search and YouTube. For Meta, it’s social media apps like Facebook, Instagram, and WhatsApp.

Both companies are investing heavily in artificial intelligence (AI) to help extend their leadership. AI appears to be the next great technological frontier for the taking.

But which is the better AI stock to buy? Here is what you need to know.

AI: Opportunity or threat?

From the outside looking in, AI seems like a shiny new topic to the average bystander. But “big tech” has been warring over AI for years already. Billions of eyeballs scan Meta (social media) and Alphabet’s (Google and YouTube) core products daily. AI has long played a big part in matching advertisers with the right combination of eyes to maximize ad performance.

Both companies are also investing billions in AI ambitions today. Meta is spending a fortune to develop several AI capabilities, ranging from large language models to the metaverse. Meanwhile, Alphabet’s ambitions are in the cloud, where its Google Cloud business can grow as it teams with corporations to manage their computing and AI needs.

The reality is that AI chatbots like OpenAI’s ChatGPT are only the latest saga in this ongoing AI war. However, these chatbots are the most immediate consumer-facing AI applications today. Users can ask these chatbots virtually anything, and the chatbots will quickly spit out answers.

For Alphabet, this presents a potential problem. A search engine generates revenue by getting users to click on multiple search results (preferably those tied to advertised results). If a chatbot is going to provide the information users are looking for without a search through multiple potential answers, will that reduce revenue? Alphabet, of course, is adapting to AI and integrating its large language model into Google products. However, competition is doing the same, which could potentially suck search engine traffic from Alphabet over time.

Meanwhile, Meta’s use of AI doesn’t necessarily conflict with its existing social media model. It enhances advertising by adding innovative tools for customers. Meta has also integrated its AI chatbot capabilities into its main apps, letting users easily perform queries from their homepage.

When it comes to chatbots, there appears to be less conflict of interest between AI and Meta, which gives it an advantage over Alphabet.

Financial fist-a-cuffs

Both companies are at similar life stages; both initiated dividends for the first time this year and carry similarly massive market caps that exceed a trillion dollars.

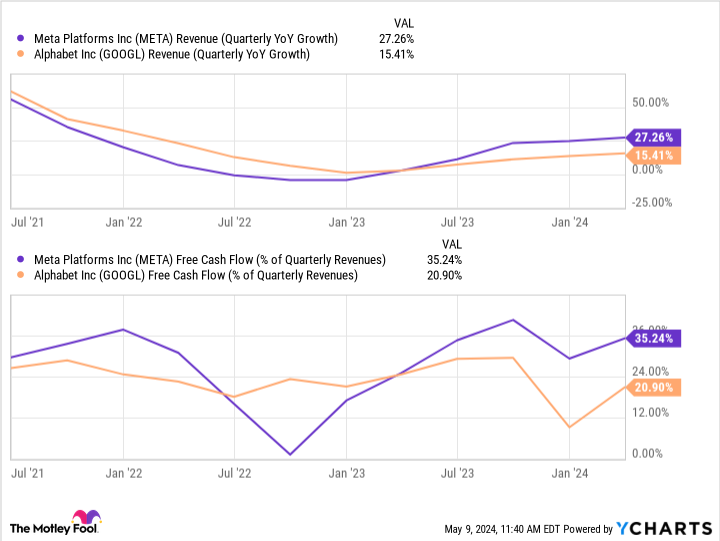

When you compare them head-to-head, Meta seems to have some advantages over Alphabet. For example, Meta’s revenue growth rate has accelerated in recent quarters to surpass Alphabet’s. The company is also converting a notably higher percentage of its revenue to free cash flow. To be clear, both companies have extremely deep pockets. Trailing-12-month cash flow for Meta and Alphabet is $49 billion and $69 billion, respectively.

Free cash flow factors in capital expenditures, so that’s after accounting for each company’s massive AI spending, primarily to build out data center capacity to support long-term AI ambitions. While Meta is growing faster and more efficiently, Alphabet is still generating a notably higher absolute cash flow, which can’t be ignored. So much cash generation is a competitive advantage in its own right, allowing Alphabet to outspend or even acquire the competition.

Which is the better deal?

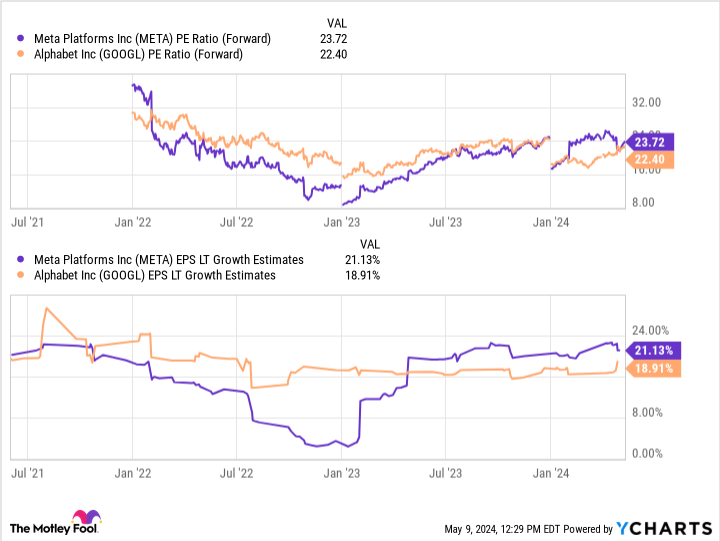

Perhaps investors shouldn’t be surprised that Wall Street values both stocks similarly. After all, they have similar business models, sizes, and financial performances. Meta squeaks out a slight premium to Alphabet, partially because analysts expect just a bit more growth over the long term than Alphabet.

Meta and Alphabet’s respective price/earnings-to-growth (PEG) ratios hover just over 1, signaling that both stocks are attractive today for their expected growth. Meta is slightly cheaper for its expected growth, but it’s hard to call a winner here. Earnings growth swinging a few points one way or another makes this a different story, so investors could easily call this a draw.

The winner is:

There is no wrong decision when comparing two high-quality companies like this. The truth is that both big technology companies, members of the “Magnificent Seven” stocks, are top-flight compounders that dominate their respective industries.

However, AI could be a differentiator over time, and it seems today that Meta is better positioned for AI tailwinds than Alphabet, which must grapple with potentially increased search engine competition from competitors’ chatbots.

Meta also scores slightly higher financially than Alphabet, ultimately sealing the deal.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Meta Platforms. The Motley Fool has a disclosure policy.

Better AI Stock: Alphabet vs. Meta Platforms was originally published by The Motley Fool