Had Enough of Meme Stocks? Stay Sane with Home Depot (NYSE:HD)

Are you tired of meme stocks, roller-coaster rides, and get-rich-quick schemes? Are you ready to build a solid portfolio foundation? I invite you to stick with a tried-and-true blue-chip business, as Home Depot (NYSE:HD) should endure while meme stocks will come and go. I am bullish on HD stock for the long term and feel that it’s appropriate for most portfolio strategies.

Home Depot operates a well-known chain of stores focused on do-it-yourself home-improvement projects. The company is among the ones that have been the most directly impacted by rising interest rates and low housing market turnover (i.e., people aren’t selling and buying homes as much).

Keep in mind that Home Depot has survived difficult market scenarios, including the financial crisis of 2008 to 2009. Home Depot will still be here when the Federal Reserve eventually cuts interest rates, so don’t be surprised if the market turns away from meme stocks and returns to a sturdy stand-by like Home Depot stock.

Home Depot Delivers Mixed Results but Reaffirms Guidance

Some commentators might consider Home Depot’s first-quarter Fiscal Year 2024 results as a gauge of the U.S. housing market’s condition. Overall, there’s uncertainty surrounding Home Depot and the housing market, as the company’s results were imperfect. On the other hand, at least Home Depot maintained its previously published outlook (instead of lowering the outlook) for the full year.

Here’s what you need to know. For Q1 of FY2024, Home Depot generated net revenue of $36.4 billion, down 2.3% year-over-year. Furthermore, this result fell short of the consensus estimate of $36.6 billion. Comparable-store sales, meanwhile, declined 2.8% year-over-year globally and 3.2% in the U.S.

Home Depot CEO Ted Decker cited “a delayed start to spring and continued softness in certain larger discretionary projects,” which I feel is an indirect way of blaming persistent inflation and high interest rates. Taking those factors into consideration, Home Depot’s quarterly sales results weren’t great but they also weren’t terrible.

Turning to the bottom line, Home Depot reported adjusted quarterly earnings of $3.63 per share, down 5% year-over-year compared to earnings of $3.82 in the year-earlier quarter. Again, this isn’t a terrible result; plus, Home Depot beat Wall Street’s consensus earnings estimate of $3.60 per share. This adds another successful quarter to Home Depot’s outstanding track record of quarterly EPS beats.

Looking toward the future, investors might expect Home Depot’s management to be worried about housing-market trends, inflation, and interest-rate policy this year. However, Home Depot provided guidance that should quell anyone’s concerns. In particular, the company reaffirmed its full-year FY2024 revenue outlook, which calls for growth of 1% year-over-year.

Could Cooling Inflation Heat Up Home Depot Stock?

The rate of inflation in 2024 will affect the U.S. housing industry in general and Home Depot specifically. If inflation cools, even just a little bit, this should provide a headwind for Home Depot and the company’s investors.

On that topic, some positive news just came in. The Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) inflation gauge data for April. Last month, the CPI increased 0.3% month-over-month and 3.4% year-over-year.

These results indicate a slight easing of inflation. In March of this year, the CPI grew 0.4% month-over-month and 3.5% year-over-year. These aren’t huge differences, but even a slight deceleration in inflation could provide some housing market relief.

Additionally, if this disinflation trend continues in the coming months, the Federal Reserve might finally decide to lower interest rates. That, in turn, would incentivize people to start more home-improvement projects.

So, even if Home Depot’s quarterly results weren’t amazing, an improving housing industry backdrop could be bullish for the stock in the long run. Thus, Citigroup (NYSE:C) analyst Steven Zaccone assured, “We do not believe this is a thesis-changing print for bulls playing the multiyear recovery in pent-up demand for home improvement spending as rates come down and existing home turnover improves.”

Is Home Depot Stock a Buy, According to Analysts?

On TipRanks, HD comes in as a Moderate Buy based on 20 Buys, six Holds, and two Sell ratings assigned by analysts in the past three months. The average Home Depot stock price target is $383.58, implying 10% upside potential.

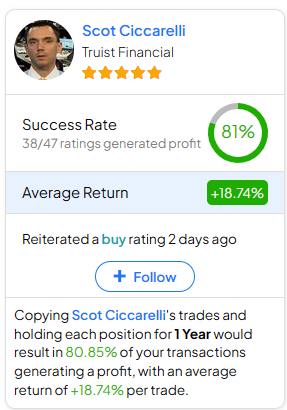

If you’re wondering which analyst you should follow if you want to buy and sell HD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Scot Ciccarelli of Truist Financial, with an average return of 18.74% per rating and an 81% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Home Depot Stock?

Maybe you’ve had enough of fast-moving meme stocks and just want something solid and steady for your portfolio. For that, you can look to Home Depot, which is consistently profitable and pays a decent dividend.

Besides, it’s encouraging to see Home Depot maintaining its full-year revenue guidance, and the April CPI print indicates some relief from rising inflation. Therefore, while some short-term traders might obsess over meme-stock get-rich-quick dreams, I’m focusing my attention on HD stock and would certainly consider it for a long-term position.