Which AI-Flavored Stock Is Best?

The technology-driven market rally will eventually run out of steam. However, until it does, many analysts are optimistic about overlooked companies that could gain just as much as the most obvious high-growth stocks. Though the implied upside varies greatly in the following trio (VRT, DELL, PLD), I would keep tabs on the following stocks as analysts look to reward companies that are able to make money from AI bets sooner rather than in the distant future.

Indeed, getting in on the AI boom entails a great deal of investment. And it’s about time that such bets had a clearer payoff. With rates likely to stay elevated for another year, we’ll need to see some of those “strategic” AI-related investments translate into cash flows. Therefore, in this piece, we’ll check in with TipRanks’ Comparison Tool below to check in with three AI-flavored plays that retain their Strong Buy ratings from the analyst community.

Vertiv (NYSE:VRT)

Shares of data center infrastructure and services provider Vertiv will not be for the faint of heart after skyrocketing more than 670% since its April 2023 lows. Undoubtedly, the stock seems just too hot to handle, but, in many ways, the company’s story seems to “rhyme” with that of the AI chip makers. More demand for AI applications means more AI chips are needed. And more AI chips mean more up-to-speed data center demand.

Given said tailwinds, I’d be bullish had it not been for the hefty multiple—90.3 times trailing price-to-earnings (P/E) at writing—and the profound momentum behind the stock. For now, I’m sitting on the sidelines with a neutral position, but I would be tempted to jump into VRT stock on a steep pullback.

Given booming AI-led infrastructure demand, and the more palatable forward P/E of 40.8 times, VRT shareholders may have enough reason to justify sticking by the name. Add the recently-raised full-year guidance for sales and adjusted operating profit into the equation, and it certainly seems like Vertiv’s a winner poised to continue winning. Citigroup (NYSE:C) analyst Andrew Kaplowitz certainly seems to think so, with his Street-high price target of $110.00, implying over 11% upside from here.

Of course, the stakes remain high, especially if investors call for heavy spenders on AI to pull back ever so slightly. If there’s one thing we learned this quarterly earnings season, it’s that AI innovation costs money, lots of money. And perhaps investors want balance rather than sheer aggression on spending (I’m looking at you, Meta Platforms (NASDAQ:META)).

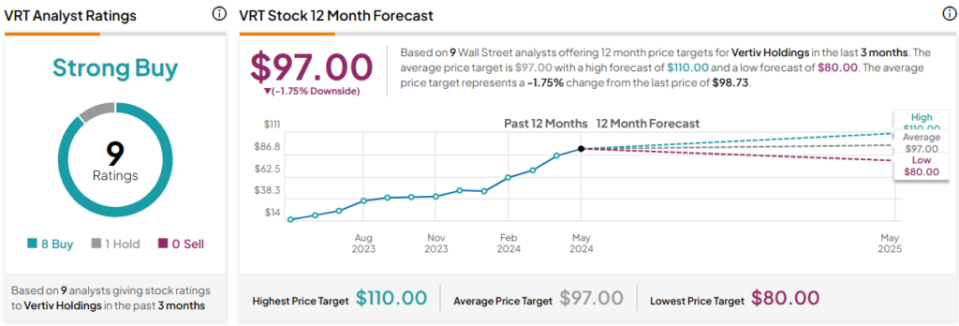

What Is the Price Target for VRT Stock?

Vertiv stock is a Strong Buy, according to analysts, with eight Buys and one Hold assigned in the past three months. The average VRT stock price target of $97.00 implies 1.75% downside potential.

Dell Technologies (NYSE:DELL)

The longtime personal computer (PC) and server firm Dell Technologies has shown us that it can compete in the AI revolution. The stock caught many by shock as it added to last year’s gains with a notable quarterly beat that helped contribute to the massive 73% year-to-date surge in shares. Even after its historic rally, I’m more inclined to stay bullish on the stock, as it’s clearly an AI play that’s been slept on by far too many market participants.

Unfortunately, the biggest upside surprise is already in, with numerous analysts already having re-evaluated the firm to the upside for its AI server prowess. Like Vertiv, Dell is an AI hardware player that’s starting to feel the heat of the AI boom. And the good news is that there may still be many more quarters that could feel the lift of AI server demand. Further, unlike some of the AI software developers, it seems like the hardware players are ready to profit from the boom in a span measured in quarters rather than years.

Dell isn’t just focused on feeding AI server demand with the hottest new GPUs; it also stands out to win as it readies its newest PC slate for a potential on-device AI supercycle. Of course, demand for personal AI hardware could extend for many years.

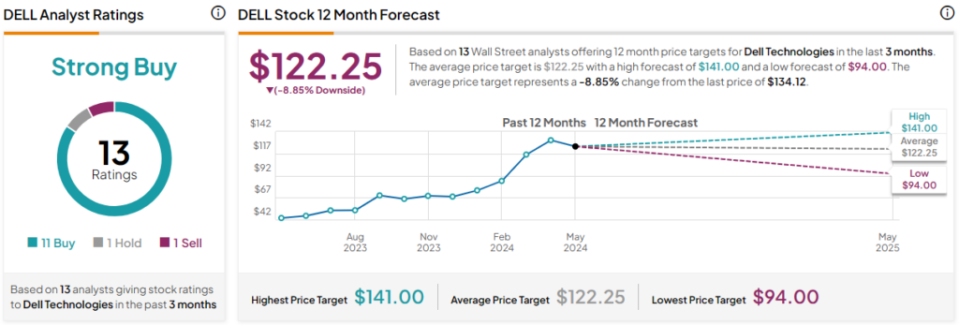

What Is the Price Target of DELL Stock?

Dell stock is a Strong Buy, according to analysts, with 11 Buys, one Hold, and one Sell assigned in the past three months. The average DELL stock price target of $122.25 implies 8.9% downside potential.

Prologis (NYSE:PLD)

Next, we have Prologis, a logistics real estate investment trust (REIT) that has been betting on data centers. PLD stock has been stuck in a multi-year rut since imploding back in 2022. Now down more than 36% from its all-time high, thanks to the headwind of higher interest rates and softening demand for warehouse space, I think now seems like an opportune time to go against the grain.

Shares sport a bountiful 3.6% yield, which is pretty good for a “growthy” REIT that will live to see better days, likely when consumers are in a healthy enough spot to spend more on e-commerce platforms. All things considered, I am bullish despite warehouse headwinds that may stick around for many quarters to come.

Even in the face of industry challenges, Prologis is ready to keep investing in its high-growth future. Earlier this year, the firm announced its intention to bet $25 billion on data centers. That’s a big deal that punches Prologis’ ticket to the AI bandwagon. Warehouses are out, and data centers are in. As warehouse demand continues to drag, the REIT will diversify into a timelier arena that could help reverse its stock trend well before the demand picks up.

In these early stages of the AI boom, the world needs more data centers. Though expensive, I see Prologis’ big bet on the data center as having the potential to pay massive dividends.

What Is the Price Target of PLD Stock?

Prologis stock is a Strong Buy, according to analysts, with 13 Buys and three Holds assigned in the past three months. The average PLD stock price target of $132.07 implies 22% upside potential.

Conclusion

There are some less-obvious companies that stand to profit big from the AI revolution. As investors insist on seeing AI bets turn into dollar bills, I expect the following trio of data center plays could gain more love on Wall Street. Of the trio, investors expect the most from PLD stock.