Why Fiverr Stock Was Flying High Today

Shares of freelance marketplace Fiverr International (NYSE: FVRR) were flying higher on Thursday after the company reported financial results for the first quarter of 2024. Results were just OK but expectations were low, which explains why investors are so enthusiastic today. As of 1 p.m. ET, Fiverr stock was up 9%, but it had been up almost 16% earlier in the day.

Fiverr pleasantly surprised investors who didn’t expect much

In Q1, Fiverr generated revenue of $93.5 million, which was up 6% year over year. That was the high point of management’s previous guidance, but it was within guidance nonetheless. Active buyers spent more money on the platform on average, and the company increased its take rate — the amount of money it keeps relative to its sales volume.

However, Fiverr’s active buyers dropped from 4.1 million in the fourth quarter to just four million in Q1. As a marketplace business, investors would ideally see both buyers and sellers increasing. The drop in active buyers is discouraging considering the platform first surpassed 4 million buyers back in 2021.

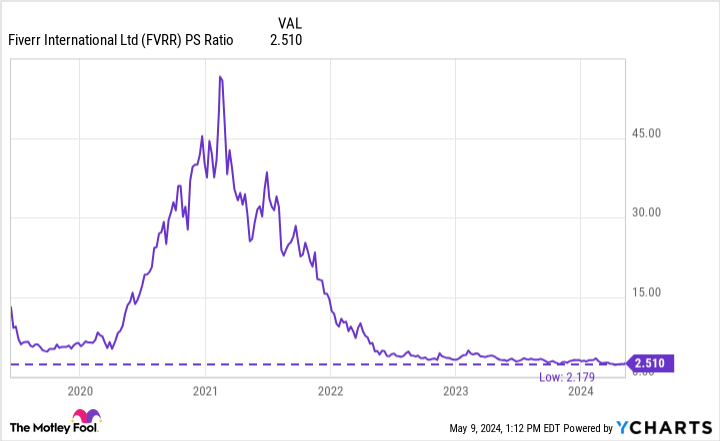

That’s not good. But Fiverr investors seem to be looking past the shortcoming because expectations were so low to begin with. Prior to today’s jump, Fiverr stock traded at an all-time low valuation of 2.2 times trailing sales, which is fairly cheap, and that’s why investors are encouraged relative to those low expectations.

When will the company return to growth?

Fiverr does have its virtues, including a strong balance sheet and a $100 million share repurchase plan, which is huge relative to its current market valuation. And shares are fairly cheap. That said, many cheap stocks fail to beat the market without growth, and growth is what Fiverr doesn’t have right now.

Management says that Fiverr lost some users because it’s focusing on larger, high-value customers. That may be. But this focus isn’t resulting in meaningful growth in those higher-value customers, either. Given that the platform’s user base has plateaued for three years, I believe it’s fair for investors to question the long-term growth opportunity here.

Should you invest $1,000 in Fiverr International right now?

Before you buy stock in Fiverr International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fiverr International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $553,959!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Jon Quast has positions in Fiverr International. The Motley Fool has positions in and recommends Fiverr International. The Motley Fool has a disclosure policy.

Why Fiverr Stock Was Flying High Today was originally published by The Motley Fool