This Stock Has Billionaire Buy-in. Time to Add It to Your Portfolio?

Running a hedge fund isn’t easy, and most eventually close within their first five years. At the same time, it is a profession that can turn people into billionaires. Billionaire hedge fund managers generally become billionaires because they are great stock pickers.

As such, it can be a good idea to track some of the ideas of what these billionaire hedge fund managers are investing in and possibly follow suit.

The Motley Fool recently analyzed 16 top hedge funds to see which tech stocks these billionaire fund managers were putting their money into. While not the most common stock on the list, one name that caught my eye was Pinterest (NYSE: PINS).

Billionaire investor Paul Singer of Elliott Management made the stock his top tech holding and third-largest stock position at over 10% of his equity portfolio. Elliott Management, known as an activist firm, will often get involved to help companies improve their operations.

Pinterest’s big opportunity

Pinterest is known for its namesake online vision board, which users visit to find inspiration for things such as shopping, home design, travel, and other interests. The company’s site attracts nearly 500 million monthly active users from across the globe, the majority of whom are women.

The biggest opportunity for the company is better monetizing its large user base, which simply means finding ways to generate more revenue from its users. Like other social media companies, Pinterest derives much of its revenue from advertising. Given that its users are often actively looking for ideas related to certain styles or activities, much of the company’s ad revenue is performance-based, meaning its ads directly lead to clicks or a purchase, as opposed to brand advertising, which is meant to spread the awareness of a brand and its products.

Over the past few years, the company invested in innovation to help drive additional revenue from its user base. This includes introducing such features as in-app checkout, augmented reality, and a Shop the Look feature, which uses AI and computer vision to recommend similar buyable items within its merchant catalog. Pinterest has really focused on making its site a personalized, shoppable experience.

Ultimately, this is all being done to help improve the company’s average revenue per user (ARPU). In the fourth quater, Pinterest saw its global ARPU rise just 2% to $2.00. However, that does not tell the whole story, as ARPU varies greatly from different regions. ARPU in the U.S. and Canada climbed 6% to $8.07, while European ARPU jumped 23% to $1.23. Rest of World ARPU was only 15 cents, but that was up 7% from 14 cents.

Pinterest has a lot of room to still grow its ARPU numbers. For example, Meta Platform‘s global Q4 ARPU was $13.12, and its U.S. and Canada ARPU was $68.44. Partially closing this ARPU gap would lead to a lot of growth for Pinterest.

Amazon and Google partnerships

In addition to innovation, Pinterest is looking to drive ARPU through partnerships with Amazon and Google, which is owned by Alphabet.

Amazon, the e-commerce giant, is helping bring shoppable content to the Pinterest platform, with its own products that it sells as well as with third parties that use the Amazon platform.

With Google, meanwhile, Pinterest is looking for the search giant to help it better monetize international markets where Google has a better reach. About 80% of Pinterest users are outside the U.S., but only about 20% of its revenue comes from international markets. This is a big disconnect and another big opportunity for Pinterest. Other large social media platforms often see a 50/50 revenue split between the U.S. and international.

A great opportunity over the long term

With 500 million monthly active monthly users that are comparatively undermonetized compared to other social media sites, especially in international markets, the opportunity in front of Pinterest is clear. If the company can close some of the ARPU gap in the years to come, it is going to make a lot more money, and the stock is going to be much more valuable than it is today.

Pinterest has been making strides, as evidenced by its European ARPU growth in Q4. The involvement of Elliott Management, which has members on Pinterest’s board, shows that the company is in good hands.

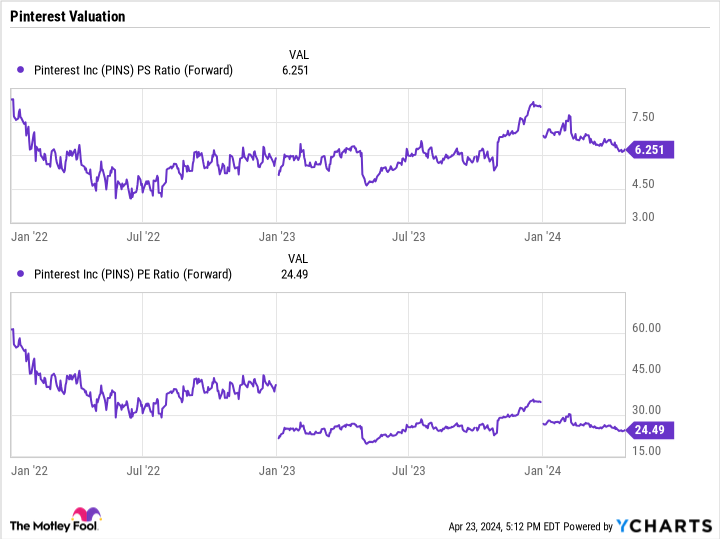

Trading at just over 6 times sales and a forward price-to-earnings (P/E) multiple of under 25, the stock looks attractively valued given the opportunity in front of it.

Pinterest looks like an attractive investment over the long term. As such, it is not too late to follow billionaire Paul Singer and buy this tech stock.

Should you invest $1,000 in Pinterest right now?

Before you buy stock in Pinterest, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pinterest wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $488,186!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet and Pinterest. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Pinterest. The Motley Fool has a disclosure policy.

This Stock Has Billionaire Buy-in. Time to Add It to Your Portfolio? was originally published by The Motley Fool