ExxonMobil and Chevron Stock Have 22%-30% Upside, According to 1 Wall Street Analyst

An analyst at Piper Sandler recently raised price targets for both ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) and maintained an “overweight” rating on them. The new price targets imply a 22% upside for ExxonMobil (price target adjusted to $145 from $130) and 30% for Chevron (to $240 from $180), as the analyst takes a positive view of the outlook for oil majors.

The oil price outlook

The price of oil is above $80 a barrel. Amid a period of economic uncertainty, ongoing coordinated production cuts by OPEC and OPEC+ countries,, and a need for the U.S. government to replenish the strategic petroleum reserve after running it down to levels not seen since the 1980s, there are plenty of reasons to feel optimistic about energy prices.

An element of uncertainty

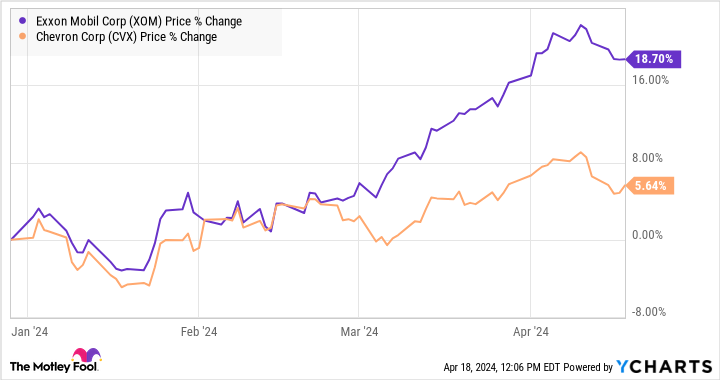

The most significant variable in both companies’ near-term prospects probably relates to ExxonMobil’s arbitration case against Chevron. As you can see from the chart below, it appears that the market seems to think ExxonMobil will win out as their stock price performances have diverged significantly since the issue came to the fore in late February.

Chevron has agreed to buy Hess (NYSE: HES), whose assets include a 30% stake in the highly valued Stabroek block in Guyana. However, ExxonMobil holds a 45% stake in Stabroek, and China’s CNOOC International holds 25%. ExxonMobil and CNOOC have launched arbitration claims, arguing that they have the first right of refusal over Hess’s stake in Stabroek.

It’s an interesting situation, but one in which retail investors might walk away in favor of buying other oil stocks. It’s not usually a good idea to trade against people who might be better informed over a one-off significant event that could move both stocks’ prices.

Instead, someone seeking energy exposure might take a more diversified approach by investing in the Vanguard Energy ETF (NYSEMKT: VDE), which has over 100 individual stock positions.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

ExxonMobil and Chevron Stock Have 22%-30% Upside, According to 1 Wall Street Analyst was originally published by The Motley Fool