Altria Stock: Buy, Sell, or Hold?

Altria (NYSE: MO) is the type of company that can bring emotion into the investment process. A so-called “sin” stock, investors need to consider if they want to support a company that produces cigarettes. If you can get beyond that fact, though, you still aren’t done with the buy, sell, or hold decision on this stock.

Altria’s business has a complex story to tell and there’s both good and bad involved for investors.

Why you might want to sell Altria

From a business perspective, Altria has a big problem. Cigarettes are generally seen by the public as a bad product, and fewer and fewer people in the United States are smoking them. Notably, after separating from Philip Morris International (NYSE: PM), Altria only sells cigarettes in the United States. While it has the most popular brand in the U.S. market (Marlboro), it doesn’t benefit from the diversification benefits of selling into multiple geographic regions that may have different demand profiles. The company is simply facing an ongoing decline in demand.

To put a number on that, Altria’s production volume fell 9.9% in 2023, 9.7% in 2022, and 7.7% in 2021. Pandemic-impacted 2020 was a relatively good year for the company, with volume only dropping by 0.4%. In 2019, volume slumped 7.3%. That’s just five years, but the negative volume trend here goes further back, and there’s no sign that it is anywhere near close to changing direction. The most notable reason to consider selling Altria — or never even buying it — is that its business is in secular decline.

There’s another negative to consider, but it comes to light by looking at a move made by competitor British American Tobacco (NYSE: BTI). In 2023, British American Tobacco stated that it took a “[23 billion pound] impairment of the carrying value of some of the Group’s U.S. acquired brands, with the combustible brands to be reclassified as definite-lived intangible assets from 1 January 2024.” This is a complex accounting issue, but a layman’s way of thinking about this is that British American Tobacco decided that its U.S. brands would eventually stop having any value in the future because of the ongoing volume declines in the country. Previously, the company had assumed that its U.S. brands would exist in perpetuity.

Think about that for a second as it relates to Altria. If one of the company’s biggest competitors is saying that the U.S. cigarette market is going to zero, wouldn’t Altria’s business be heading for the same fate? If that’s the case, then Altria’s tobacco segment may be vastly less valuable than many investors think. This is not a “set it and forget it” type of investment, and most investors will probably be better off focusing on businesses that have been growing over time.

Why you might want to buy Altria

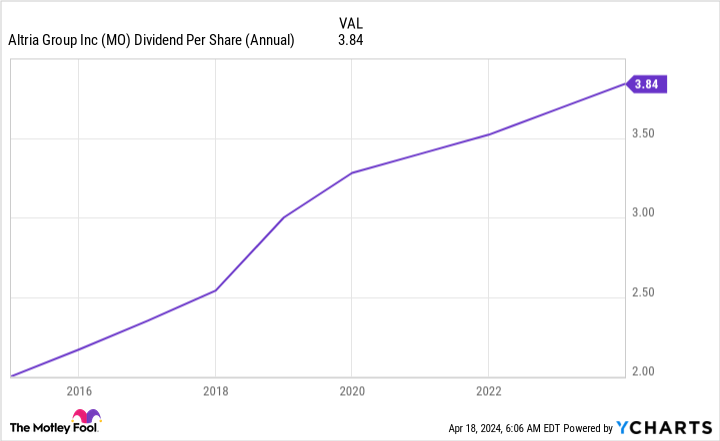

There are two reasons that you might want to buy Altria despite the negative trends in its cigarette business. The first is the most obvious: The stock has a huge 9.5% dividend yield. The second is that Altria has a long history of increasing its dividend annually. The big question, however, is how does a company with a declining business manage these feats?

The answer is that Altria has been steadily increasing prices to offset the impact of volume declines. Although management has been warning about the negative impact of “illicit” vape products, cigarette smokers are pretty loyal customers thanks to the addictive nature of nicotine. It seems highly likely that Altria can continue to follow this same business model for the foreseeable future. Eventually, price increases will exacerbate the volume declines, but not right away. Thus, it should be able to support that huge yield for a little longer. If you decide to buy it, though, make sure you watch the company’s performance very closely.

Why you might want to hold Altria

The reasons for buying Altria and holding the stock are fairly similar. However, if you have owned it for a long enough period of time, you have also seen the major strategic missteps that management has made in the vape and marijuana sectors. Without getting into the details, failed investments in those two areas have led to billions of dollars in write-offs. This is a big problem because it means that the company recognized the need to find a growth platform, but hasn’t been able to do it.

That said, Altria recently bought NJOY, another vape maker. NJOY is further along in its development than the last vape company Altria invested in, Juul. So there’s a reason to believe that NJOY could lead to a more successful outcome, which gets to the heart of the issue: If you plan to stick around here, you need to believe that Altria’s execution as it looks to expand beyond cigarettes will markedly improve. If you don’t believe that, you might want to consider ditching the stock and taking your lumps given that the shares have lost nearly 50% of their value since 2017. Perhaps you can harvest any losses you have to offset gains elsewhere in your portfolio.

Altria is a high-risk investment

Altria is a consumer staples stock, which is a sector generally known for offering slow-and-steady growth over time. But that’s not really the story here given the ongoing volume declines in cigarettes. Yes, the yield is attractive and there’s no reason to think that the streak of annual dividend increases is set to end in the near term. But the long-term risk is huge because Altria’s slowly dying cigarette business will eventually have to be dealt with rather than effectively remaining on life support.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Altria Stock: Buy, Sell, or Hold? was originally published by The Motley Fool