(TCBX) On The My Stocks Page

Longer Term Trading Plans for TCBX

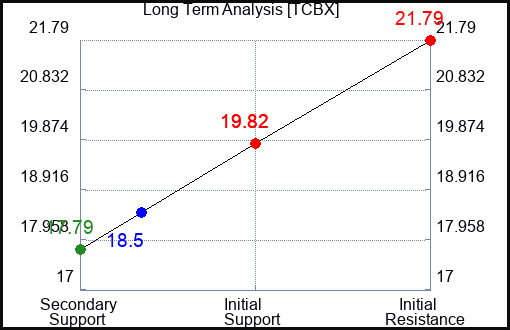

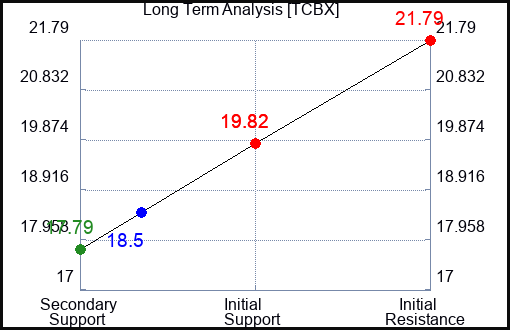

- Buy TCBX slightly over 17.79 target 19.82 stop loss @ 17.74

- Short TCBX slightly under 19.82, target 17.79, stop loss @ 19.88

Swing Trading Plans for TCBX

- Buy TCBX slightly over 18.85, target 19.82, Stop Loss @ 18.8

- Short TCBX slightly near 18.85, target 18.15, Stop Loss @ 18.9.

Day Trading Plans for TCBX

- Buy TCBX slightly over 18.52, target 18.85, Stop Loss @ 18.48

- Short TCBX slightly near 18.52, target 18.15, Stop Loss @ 18.56.

Real Time Updates are available on our Third Coast Bancshares Inc. (TCBX) Page here: TCBX.

TCBX Ratings for April 15:

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Weak | Weak | Strong |

| P1 | 0 | 0 | 17.79 |

| P2 | 18.09 | 18.15 | 19.82 |

| P3 | 18.52 | 18.85 | 21.79 |

Support and Resistance Plot Chart for TCBX

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

Instructions:

-

Click the Get Real Time Updates button below.

-

In the login prompt, select forgot username

-

Type the email you use for Factset

-

Use the user/pass you receive to login

-

You will have 24/7 access to real time updates.

From then on you can just click to get the real time update whenever you want.

Our Market Crash Leading Indicator isEvitar Corte.

-

Evitar Corte warned of market crash risk four times since 2000.

-

It identified the Internet Debacle before it happened.

-

It identified the Credit Crisis before it happened.

-

It identified the Corona Crash too.

-

See what Evitar Corte is Saying…

Read More: (TCBX) On The My Stocks Page