Got $25? You Could Buy 1 of the Top Artificial Intelligence (AI) Stocks in the Market

Some of the most talked about artificial intelligence (AI) stocks like Nvidia or Super Micro Computer are approaching $1,000, making them unaffordable for many investors who lack access to fractional shares. Fortunately, another top AI stock is less than $25, and investors should consider it if they want to increase their exposure to AI without overweighting their portfolio to a single company.

Palantir Technologies (NYSE: PLTR) is a great AI investment and can be had for under $25. But is now the right time to buy?

Palantir’s new AI product is taking the U.S. by storm

Palantir has been in the AI business for much longer than many of its peers. As a result, it developed years of experience that others can’t replicate.

Originally, Palantir’s AI product line was developed for government use and was deployed to take in massive data streams and give those in charge the best information possible to make real-time strategic decisions. Eventually, this software was expanded beyond government use, massively increasing Palantir’s market opportunity.

Those products deal with AI in the traditional sense, but the AI that most people are talking about today is different from the AI of yesterday. When most people mention AI now, they are discussing generative AI, the technology behind products like ChatGPT. This is a powerful branch of AI with many use cases, but integrating it into internal systems isn’t the easiest.

However, Palantir’s AIP (Artificial Intelligence Platform) helps its clients do just that.

AIP gives developers the tools they need to integrate AI into all levels of a business and use proprietary data without fear of that information leaking into the public domain. With tools to implement AI within a business, it has become an incredibly popular product. Chief Revenue Officer Ryan Taylor stated in Palantir’s fourth-quarter earnings conference call, “I’ve never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in U.S. commercial.”

With AIP booming in the U.S. commercial sector, it’s having a sizable boost to Palantir’s finances.

Palantir’s business is faring well

In Q4, U.S. commercial revenue rose 70% year over year to $131 million. While this is an impressive result, it still doesn’t make up most of Palantir’s revenue. Government revenue is still the largest chunk of Palantir’s business, as it tips the scale at $324 million of the $608 million total.

U.S. commercial isn’t even half its total commercial revenue, as Palantir brought in $284 million worldwide. But, if U.S. commercial can maintain its growth rates (which should be possible due to the high demand of AIP), the tables may flip later in the year.

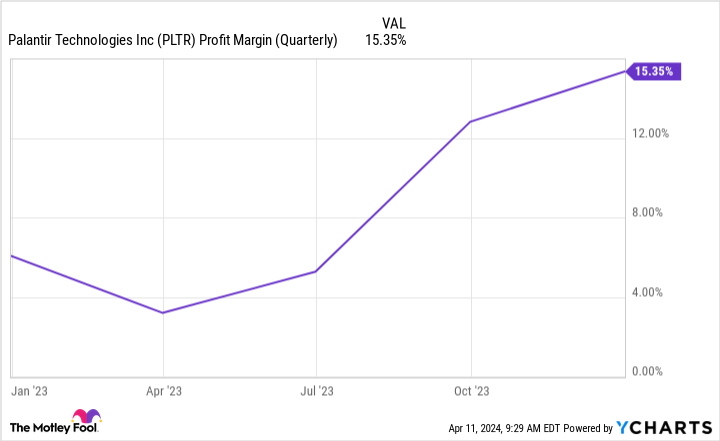

Unlike many software companies, Palantir has emphasized running a profitable business. In every quarter in 2023, Palantir turned a profit, and Q4 was its most profitable period yet.

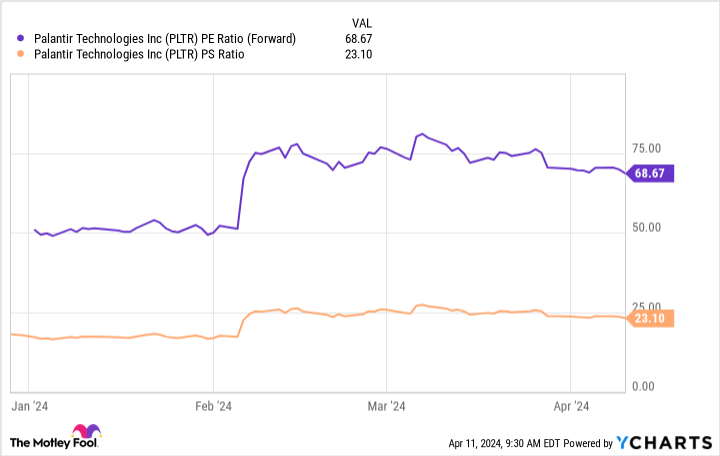

However, this business success and improving profitability come at a price, as Palantir’s stock is far from cheap from a valuation standpoint.

Palantir trades at a hefty forward price-to-earnings (P/E) ratio, which makes sense because it’s unlikely that It will achieve maximum profitability in 2024. Its price-to-sales ratio of 23 is also very expensive, especially considering Palantir’s overall revenue growth rate was 20% in Q4.

For Palantir to maintain that premium valuation, it must grow its government revenue and maintain the U.S. commercial growth levels. If it can do that, then the premium will be worth it.

But if you’re looking for a little exposure to the AI space at a low stock price, there are few better stocks than Palantir. While the stock is expensive, that’s because there are many expectations that Palantir will succeed. If it can keep up these fantastic results over the next three or five years, then the premium you pay today could be worth it years later due to growth.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Got $25? You Could Buy 1 of the Top Artificial Intelligence (AI) Stocks in the Market was originally published by The Motley Fool