Analysts Throw Weight Behind These 2 Top-Scoring Stocks

It’s the most basic question investors face: What stocks to buy? The markets are tossing up a huge volume of data from millions upon millions of daily transactions, involving thousands of traders, dealers, and brokers, and thousands of public stocks. The data makes an imposing edifice – and is tailor made for data sorting tools like the Smart Score.

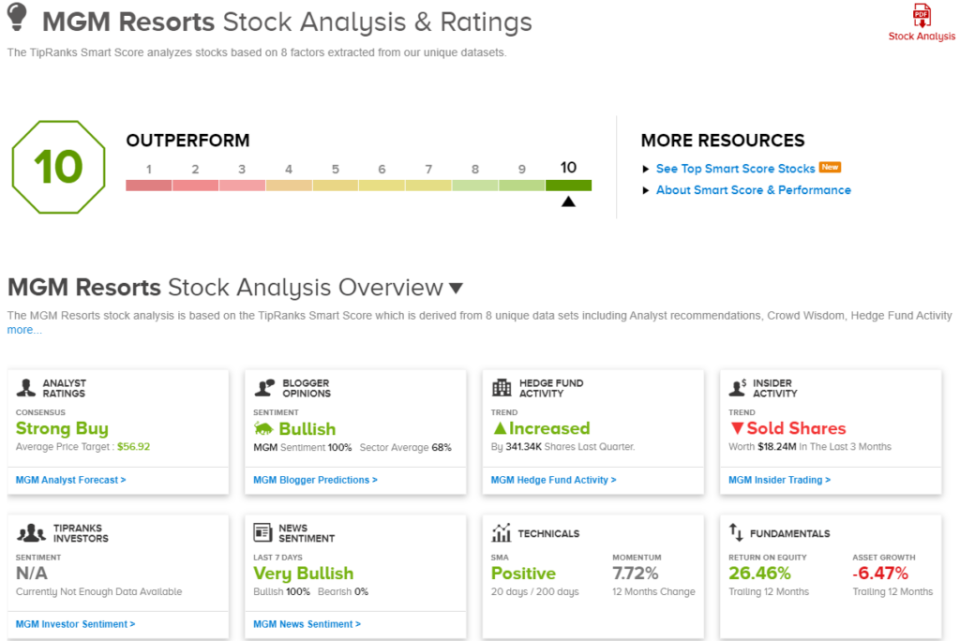

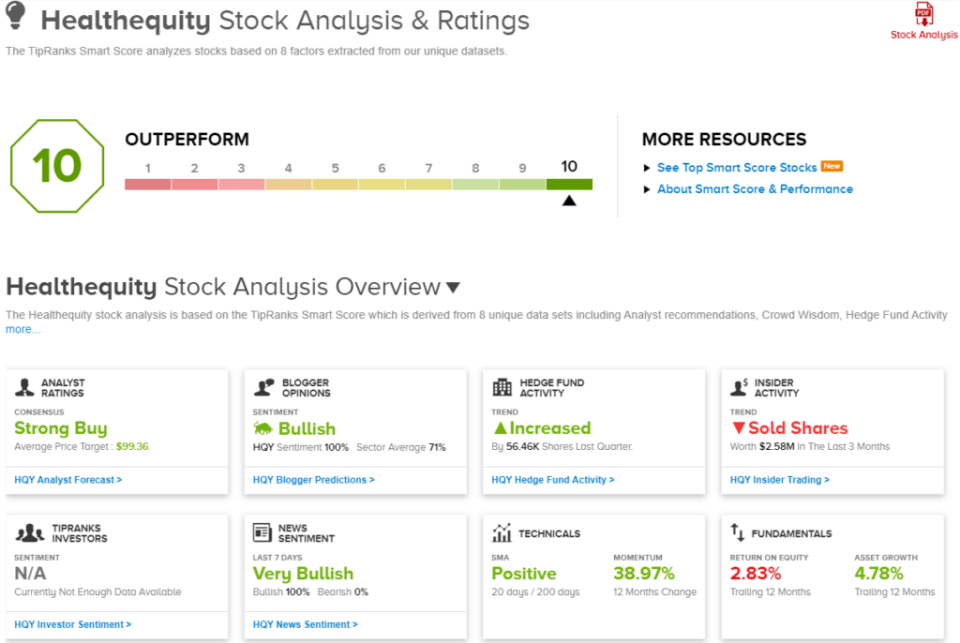

The Smart Score is an AI-powered natural language algorithm, sophisticated enough to scan, collect, collate, and analyze all those reams of data – and then to compare every stock’s latest stats to a set of factors known to match up with future share outperformance. The result is distilled down to a simple, easily readable score, a single number on a scale of 1 to 10, showing investors at a glance the likely main track for any stock. The ‘Perfect 10’ stocks are the shares that clearly deserve a closer look.

And when the Street’s analysts start throwing their own weight behind the Perfect 10s, that’s a double sign that investors should not ignore.

With this as backdrop, we’ve used the TipRanks database to pick up the details on a couple of stocks that have earned the Smart Score’s Perfect 10. Here’s the lowdown.

MGM Resorts (MGM)

The first stock on our list, MGM Resorts, is best known as one of the Vegas Strip’s venerable names. Today, the company is a member of the S&P 500 index and operates 31 hotel and gaming destinations around the world, including in Vegas but also in Maryland, Massachusetts, Michigan, Mississippi, and New Jersey, and internationally in China and Japan. The company’s leading brand, MGM Grand, is an icon of the Vegas Strip, but also forms the core of the Detroit casinos in the Motor City’s revitalized downtown.

MGM has its hands in multiple segments of the leisure industry, from resort hotels to casinos, and frequently wraps them up into multi-faceted packages. The company’s entertainment venues are mainly located in prime destinations, and vacationers can find fine dining, shows, spas, pools, gaming – pretty much anything they want, to make a memorable time.

Going forward, MGM has several paths for expansion. Legalized casino gaming is growing more common in the US, and online gaming, particularly sports betting, is also expanding. Both offer natural avenues for MGM.

Turning to the financial side, MGM’s last quarterly report – for 4Q23 – showed a quarterly topline of $4.4 billion, up 22% year-over-year and some $240 million over the estimates. The company’s non-GAAP earnings, of $1.06 per share, were far stronger than the prior-year period’s $1.54 loss – and were 35 cents per share better than the forecast. MGM Las Vegas Strip resorts are the strongest single part of the company’s business and accounted for $2.4 billion of the total quarterly revenue. For 2023 as a whole, MGM generated $16.2 billion at the top line, compared to $13.1 billion in 2022, and had a free cash flow of $1.8 billion.

This stock has caught the attention of Mizuho analyst Benjamin Chaiken, who notes that investors can find multiple shots on goal with this stock. Chaiken writes of MGM, “Our Buy thesis is supported by three pillars: (1) we believe MGM is fundamentally mis-valued, whereby the US land based operations alone (ex Macau and ex-sports betting) trade for only ~4.7x EBITDA, when M&A comps trade for well above that level. (2) MGM has a number of growth opportunities in the near/medium term (e.g., Marriott hotel partnership, potential Vegas Baccarat recovery, potential downstate NY Casino expansion, sports betting profitability inflection, and Macau upside driven by market share growth), as well as long term (Japan Casino development and hotel in Dubai). (3) We see a compelling FCF and stock buyback value creation path, whereby MGM could theoretically buy ~ $4.5-5.0bn of stock over the next five years.”

The analyst’s Buy rating is complemented by a $61 price target that points toward a 32% potential gain for the year ahead. (To watch Chaiken’s track record, click here)

The Mizuho view is one of several bullish takes here; the stock has 14 recent analyst reviews that include 12 Buys to 2 Holds, all for a Strong Buy consensus rating. The shares are trading for $46.30 and the $56.46 average price target implies a potential one-year upside of 22%. (See MGM stock forecast)

HealthEquity (HQY)

The second stock on our list operates in the world of business services and financial tech, where it holds a leading position as a health savings account and flexible spending account administrator. HealthEquity is an IRS-designated non-bank health savings trustee, giving the company across-the-board eligibility for managing such accounts no matter which institutions actually hold the funds. This gives the company a solid foundation to expand its role in a growing piece of the healthcare industry funding pie. HealthEquity works with a variety of interested parties – including employers, benefit advisors, and health plan providers – to create a large set of savings programs for customers to choose from.

The healthcare industry is a growing field – it has been one of the consistently strongest job creators over the past year – and that has created plenty of business for HealthEquity.

The company’s financial results bear witness to that with revenues and earnings mostly showing an upward trend for the past couple of years. In the last reported quarter, fiscal 4Q24 (January quarter), revenue hit $262.4 million, up 12% year-over-year and beating the forecast by $3.4 million. At the bottom line, HealthEquity’s non-GAAP earnings came to 63 cents per diluted share; this was 3 cents per share better than the estimates and a significant increase from the 37 cents reported in the prior-year quarter.

This healthcare sector financial company has caught the attention of JMP analyst Constantine Davides, who is impressed by the company’s ability to leverage high demand into concrete results over an extended period. The analyst writes, “We expect demand for HSAs to remain strong, as we believe high deductible health plans (HDHPs) will remain a popular choice for employers seeking affordable insurance options for their employees. We are constructive on HQY’s opportunity to extend its HSA share gains based on its innovative, purpose-built technology platform, expanding network of strategic partnerships, breadth of solutions, and potential acquisition opportunities. Moreover, we are projecting HQY to meaningfully expand its margins and sustain its double-digit revenue growth over the next several years, driven by our expectation for improved HSA cash yields, underpinning HQY’s ability to potentially double its adjusted net income per share by FY27.”

Quantifying his stance on HQY, the analyst puts a Market Outperform (Buy) rating on the stock, along with a $101 price target that implies a one-year upside potential of 27.5%. (To watch Davides’ track record, click here)

This bullish outlook is no outlier, as demonstrated by the 11 unanimously positive analyst reviews here – which give the stock its Strong Buy consensus rating. These shares have a current selling price of $79.20 and their $99.36 average price target is almost as bullish as the JMP view, suggesting a 25.5% upside on the one-year horizon. (See HQY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.