Medtronic vs. Walgreens Boots Alliance

If you’re an everyday investor looking for stocks that can deliver steadily rising dividend payouts over long periods, the healthcare sector is the right place to begin your search. People get sick during economic downturns just as often as they do when businesses are booming.

Medtronic (NYSE: MDT) and Walgreens Boots Alliance (NASDAQ: WBA) are two dividend-paying giants of the healthcare sector. Both offer yields that are far more attractive than the paltry 1.4% yield you can receive from the average stock in the benchmark S&P 500 index.

Here’s a closer look at their recent performances to see which is most likely to deliver steadily growing payouts in the years ahead.

The case for Medtronic

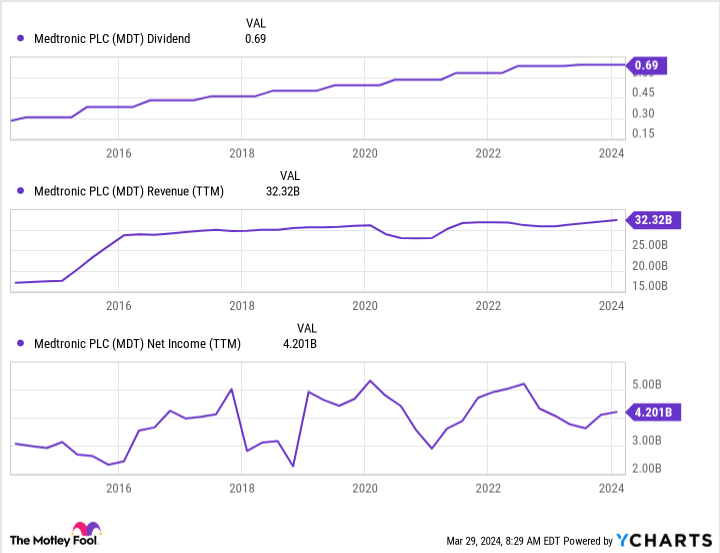

Medtronic’s focus on developing new medical technology has served its shareholders well. The company has been able to raise its quarterly dividend payout for 46 consecutive years. The stock offers a 3.2% yield at recent prices.

Medtronic’s dividend payout has grown 146% over the past 10 years but that pace slowed down. The payout has grown just 9.5% over the past three years.

Many of the devices Medtronic sells, such as pacemakers and spinal stimulators, aren’t implanted into patients until after they jump through a lot of medical hoops. The COVID-19 pandemic threw a wrench in the company’s gearbox, but investors will be glad to learn that total sales are up 7% over the past three years.

Medtronic sales and earnings have a strong chance to continue moving in the right direction. The company’s product lineup has expanded significantly in recent months. During its fiscal third quarter that ended Jan. 26, the Food and Drug Administration (FDA) approved the company’s new pulsed field ablation system and a new neurostimulator. More recently, the FDA approved the company’s new aortic valve replacement system.

The case for Walgreens Boots Alliance

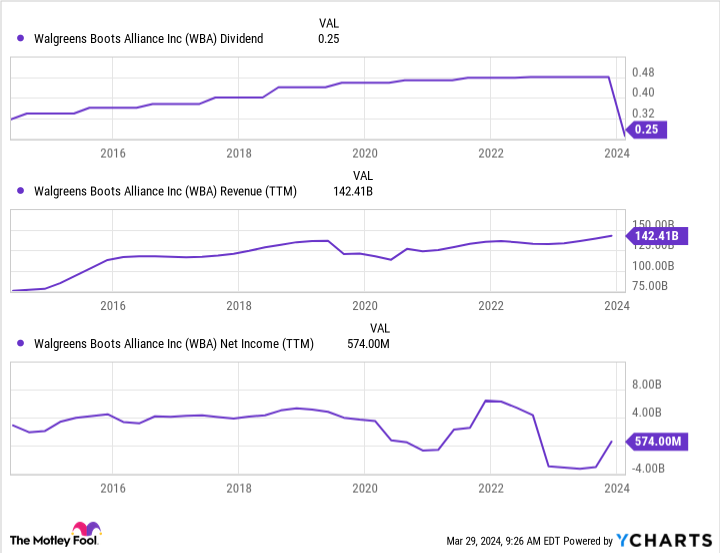

The past several years have been difficult ones for Walgreens Boots Alliance shareholders. In a nutshell, the company’s attempt to become more than a chain of retail pharmacies isn’t working out. As a result, it reduced its dividend by 48% this year. At recent prices, the stock offers a 4.6% yield.

Investors who follow Walgreens closely will remember it had planned to launch 1,000 primary care practices in partnership with VillageMD, a joint venture partly owned by Cigna. Walgreens plowed billions into VillageMD but has nothing but losses to show for it. During Walgreens’ fiscal second quarter that ended Feb. 29, the partners wrote down the value of VillageMD by $12.4 billion.

Walgreens’ portion of the latest VillageMD impairment charge worked out to $5.8 billion and led to a reported net loss of $5.9 billion in its fiscal second quarter. Even after adjusting for non-cash impairment charges, the company reported second-quarter operating income that sank 26.5% year over year to just $900 million.

Retail pharmacies are increasingly at the whim of pharmacy benefits managers, or PBMs, that essentially determine how much they receive for dispensing prescription drugs. Without a PBM of its own, it’s hard to see how Walgreens will grow its bottom line in the years ahead.

The better dividend stock to buy now

Walgreens offers a higher yield, but shrinking profit margin in the retail pharmacy space could make growing its bottom line, and dividend payout, next to impossible over the long run.

Medtronic’s not growing as quickly as it used to, but developing new medical technology is a more lucrative endeavor than the troubled retail pharmacy business. With its dividend-raising streak still intact, and plenty of newly approved products to market, Medtronic looks like a much better dividend stock to buy.

Should you invest $1,000 in Medtronic right now?

Before you buy stock in Medtronic, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medtronic wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool recommends Medtronic. The Motley Fool has a disclosure policy.

Better Dividend Stock to Buy Now: Medtronic vs. Walgreens Boots Alliance was originally published by The Motley Fool