3 Types of REITs That Have Outperformed the S&P 500

Congress created real estate investment trusts (REITs) in 1960 to level the playing field. REITs empower anyone to invest in wealth-creating, income-producing real estate.

They’ve certainly done that over the years. Over the long term, our research found that REITs have outperformed stocks. Since 1994, three REIT subgroups stood out for their ability to beat the S&P 500. Here’s a closer look at these market-beating REIT types.

Storing up wealth

According to data from Nareit, self-storage REITs have delivered a 17.3% average annual total return since 1994. That has obliterated the S&P 500’s 10.1% average annual total return during that period.

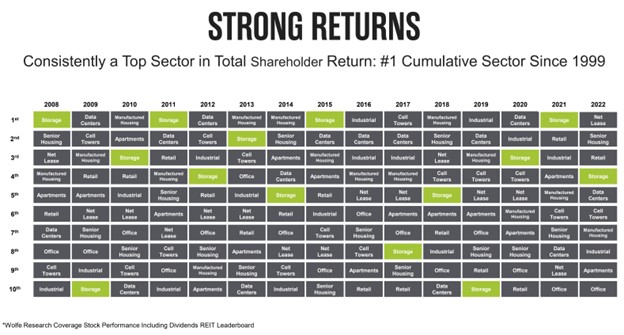

Self-storage REITs have routinely delivered strong returns compared to other REITs:

As that slide highlights, the group has delivered the No. 1 cumulative-sector return since 1999. The space has delivered strong returns over the past decade:

Extra Space Storage (NYSE: EXR) has led the way. As of the final day of 2023, it was the second-best performing REIT over the past decade, with a 443% total return.

A few factors have driven the sector’s strong returns. Self-storage properties are very profitable, requiring an occupancy level of 40% to 45% to break even (compared to 60% for most multifamily properties). Meanwhile, demand is steadily rising and relatively economically resilient. On top of that, self-storage leases are short term, which enables operators to increase rents to market rates reasonably quickly. These catalysts have enabled the top-three remaining publicly traded self-storage REITs to grow their core funds from operations (FFO) per share by more than 200% apiece since 2011, with Extra Space growing by nearly 690%. That has enabled all three to deliver robust dividend growth. The rapidly rising dividend income and earnings have enabled these REITs to handily beat the S&P 500.

Dual catalysts

Industrial REITs have delivered the second-best performance in the sector since 1994, with an average annual total return of 14.4%. They have also delivered strong performance over the past decade, with Rexford Industrial and Prologis (NYSE: PLD) delivering two of the five highest returns among REITs at 440.8% and 379%, respectively, as of the end of last year.

Two factors have helped drive the performance of industrial REITs: The accelerating adoption of e-commerce and changing supply chain practices. They’ve enabled industrial REITs focused on logistics properties to deliver strong core FFO and dividend growth. Over the last five years, logistics REITs have grown their core FFO per share by 9% annually (with 12% from industry-leader Prologis) while delivering 10% compound annual dividend growth (and 12% from Prologis).

The sector expects to continue growing rapidly. Rents on existing warehouse properties are skyrocketing due to high demand and low vacancy levels. That’s enabling REITs to develop additional properties. These catalysts drive Prologis’ view that it can grow its core FFO per share by 9% to 11% annually through 2026. That should also enable the company to continue increasing its dividend at a strong rate. Those two drivers could enable the leading industrial REIT to maintain its market-beating performance.

Capitalizing on the housing shortage

Residential REITs have delivered the third-highest performance among REIT subgroups since 1994 at 12.7% annually. A few factors have helped drive the sector’s strong performance. They include relatively economically resilient demand for rental homes (people need a place to live), enabling landlords to steadily increase rents. Housing market imbalances, especially since the Financial Crisis, have also helped drive demand for rental housing.

As an investment, manufactured home communities have stood out. Equity LifeStyle (NYSE: ELS) was the fourth-best performing REIT over the past decade, delivering a nearly 400% total return as of the end of last year. A big driver is the economic resiliency of manufactured-home communities. These landlords can continue raising rents during a recession because the costs of moving a manufactured home to another community are often too prohibitive.

That driver has enabled Equity LifeStyle to grow its same-store net-operating income at a 4.3% annual rate since 1998, faster than the REIT sector average and apartments (both at 3.3%). Add in an ever-expanding portfolio (which also includes RV parks and marinas), and the company has grown its normalized FFO per share at an 8.6% compound annual rate since 2006. That has allowed it to deliver 21% compound annual dividend growth during that period.

REITs can make great investments

REITs have outperformed the S&P 500 over the long term. A big driver has been the robust returns from self-storage, industrial, and residential REITs. The factors that have enabled those REIT subgroups to deliver strong returns remain in place. That’s why investors should consider adding one or more of those REIT classes to their portfolio.

Should you invest $1,000 in Prologis right now?

Before you buy stock in Prologis, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Prologis wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Matt DiLallo has positions in Prologis and Rexford Industrial Realty. The Motley Fool has positions in and recommends Prologis and Rexford Industrial Realty. The Motley Fool recommends Extra Space Storage and recommends the following options: long January 2026 $90 calls on Prologis. The Motley Fool has a disclosure policy.

3 Types of REITs That Have Outperformed the S&P 500 was originally published by The Motley Fool