Sam Bankman-Fried sentenced to 25 years for crypto fraud

Sam Bankman-Fried, the founder of collapsed cryptocurrency exchange FTX, has been sentenced to 25 years in prison for masterminding a fraud that cost investors, lenders and customers $11bn (£8.7bn).

At a sentencing hearing in New York, Judge Lewis Kaplan said Bankman-Fried had shown “never a word of remorse for the commission of terrible crimes” and “exceptional flexibility with the truth” during the trial. If he serves his full sentence, the one-time “Crypto King” will be 57 years old by the time he leaves prison.

Judge Kaplan told the 32-year-old, who stood in court wearing beige prison overalls, that his “punishment must fit the seriousness of the crime”.

Bankman-Fried, who had pleaded not guilty, had faced a possible sentence of up to 110 years in prison, while US prosecutors had called for between 40 and 50 years.

On Thursday, Judge Kaplan said Bankman-Fried’s crimes contributed to losses to $8bn in customers losses and around $3bn for investors and lenders. He also declared Bankman-Fried had attempted to tamper with a witness in the run up to the trial and had given false evidence to the court.

He added of Bankman-Fried’s witness testimony: “I’ve been doing this job for close to 30 years. I’ve never seen a performance like that.”

The prison term comes after Bankman-Fried was found guilty of syphoning off billions of dollars in customer funds from FTX to fund high risk investments and luxury purchases. The jury took just four hours to find him guilty on all counts in November

Speaking ahead of the sentencing, Bankman-Fried said he “made a lot of mistakes” and “caused a lot of damage”. He added: “My useful life is probably over.” His lawyers said he plans to appeal the jury verdict.

The rise of FTX, at one point valued at $32bn, made Bankman-Fried a billionaire by the age of 30. The cryptocurrency business, which enjoyed celebrity endorsements from the likes of American football star Tom Brady, was the second biggest cryptocurrency exchange prior to its collapse.

FTX filed for bankruptcy in late 2022 after a multibillion-dollar black hole was uncovered in its accounts, and Bankman-Fried was quickly arrested in the Bahamas before being extradited to the US.

During the trial, the jury heard how FTX executives engineered a secret software back door to divert customer cash for funding high risk deals at a sister hedge fund. Bankman-Fried was also accused of spending millions of pounds on property in the Bahamas and on political donations.

A self-proclaimed “effective altruist”, Bankman-Fried supposedly intended to make as much money as possible to give to good causes.

However, at last year’s trial his former friends and colleagues, including his ex-girlfriend Caroline Ellison, gave evidence against him after pleading guilty to US prosecutors.

Bankman-Fried, however, insisted on his innocence and protested he had simply made mistakes. On Thursday, he admitted customers had suffered and apologised to former colleagues, adding the failure of the business “haunts me every day”.

Bankman-Fried’s lawyers pleaded for a more lenient sentence because of their client’s alleged autism, mental health and philanthropic endeavours. Speaking to the court on Thursday, they raised his veganism during a final plea to the judge, and called the former FTX boss an “awkward math nerd” and a “beautiful puzzle”. They had suggested a penalty of less than six years behind bars.

In a filing earlier this month, they accused US officials of a “medieval view of punishment… a death in prison sentencing recommendation”. On Thursday, his lawyer, Marc Mukasey, insisted Bankman-Fried was “not a ruthless financial serial killer”.

His lawyers had insisted his crimes did not compare to those of financier Bernie Madoff, who was sentenced to 150 years in prison in 2009 for his operation of a decades-long, $65bn Ponzi scheme.

They also protested that many FTX customers would be returned much of the money they had deposited with the exchange prior to its collapse.

Despite filing for bankruptcy, many of FTX’s investments and assets have since soared in value as the price of Bitcoin has spiked. It also holds an investment in fast-growing artificial intelligence start-up Anthropic.

In sentencing remarks, Judge Kaplan dismissed this argument. He said: “The assertion that customers and creditors will be paid in full is misleading.” He added: “A thief who takes his loot to Las Vegas and successfully bets the stolen money is not entitled to a discount on the sentence by using his Las Vegas winnings to pay back what he stole.”

Many customers have had their savings locked up for over a year, disrupting their lives and putting them in financial peril.

While the value of Bitcoin has climbed in recent months to more than $70,000, the bankruptcy estate only expects to pay out customers at the price of their digital coins as of November 2022, with FTX creditors arguing they effectively be short changed.

Among hundreds of victim statements, one testified: “My whole life has been destroyed. I have two young children, one born right before the collapse. I still remember the weeks following where I would stare blankly into their eyes, completely empty inside knowing their futures have been stolen through no fault of our own.”

06:54 PM GMT

That’s all for today

Thanks for joining us and do tune in again next week after the Easter bank holiday.

06:19 PM GMT

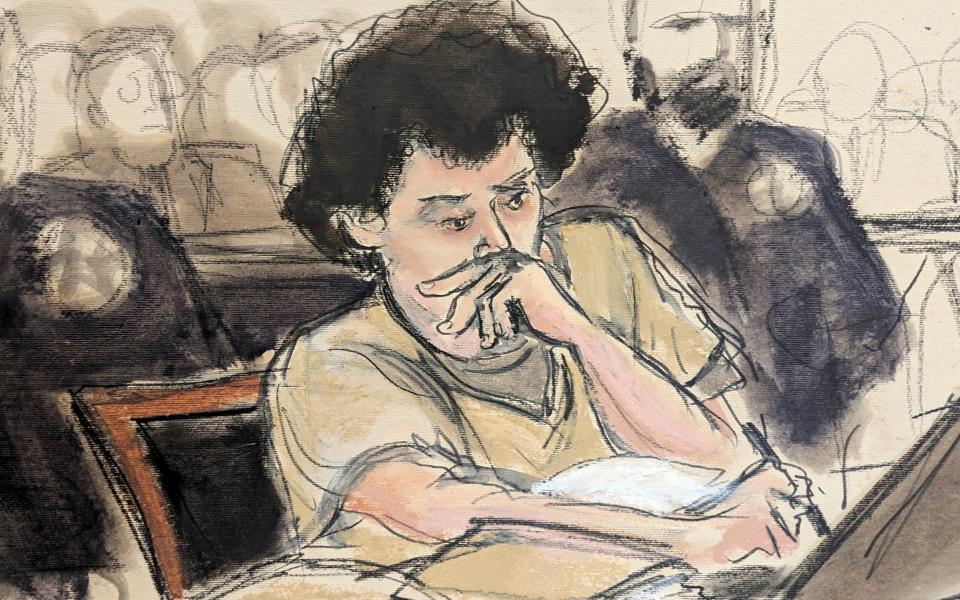

More sketches from inside the Sam Bankman-Fried court case

06:02 PM GMT

Weight-loss service most popular on Boots Online Doctor website, company says

Boots has said weight-loss is the most popular and fastest growing service on its ‘Online Doctor’ website, as people race to try to get their hands on obesity drugs.

The company, which runs virtual consultations via its ‘Online Doctor’ website to prescribe people treatments including contraceptive pills, said weight-loss was its most in-demand service.

Drugs such as Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro are available via the website, although they are prescription only with people going through clinical assessments to see if they need treatments. Boots says it also offers 10-week weight loss programmes and WeightWatchers offers to those with excess weight.

Obesity jabs have, however, been in huge demand over the past year after studies suggest people can lose a fifth of their weight.

Boots said sales were up in its retail stores by 5.9pc in the three months to the end of February.

05:46 PM GMT

UK stocks end March quarter on upbeat note

London stocks ended the March quarter on a buoyant note, boosted by a positive update from sportswear retailer JD Sports.

The FTSE 100 was up by around 0.3pc, while the FTSE 250 gained 0.4pc, coming as data confirmed that Britain’s economy entered shallow recession in 2023.

JD Sports on Thursday hit an almost-three month high, with shares jumping by 16pc on signs the sportswear market was not worsening.

The company said profits would be in line with its guidance from January, when it was forced to slash forecasts following weaker Christmas sales.

Peel Hunt analysts said they expected that “things will get better as the comp eases, shoppers find their feet, and crucially, a more compelling product pipeline emerges”.

05:37 PM GMT

Adnams hires first female CEO in 152-year history

Meanwhile Adnams has hired the first female chief executive in its history, promoting Jenny Hanlon from the CFO post.

The Suffolk beer and spirit company, which was founded in 1872, said Ms Hanlon would be taking over from Andy Wood at its annual general meeting in June.

Ms Hanlon said: “This is a hugely exciting time to be taking the reins from Andy.

“The Adnams brand is cherished and championed by colleagues and customers, in its heartland of the East of England, across the wider UK and throughout dozens of countries around the world.”

It comes weeks after the brewer said it had hired advisors to explore funding options for its future growth plans, pointing to challenges across the hospitality and brewing industries.

05:19 PM GMT

Superdry eyes London exit after founder ends takeover talks

Superdry is looking at options to exit the London market, after it said its founder would not make a takeover offer but could seek to delist the company.

The retailer said Julian Dunkerton, who is also its chief executive, was no longer in talks over a take-private deal, citing the “ongoing work on its turnaround plan and material cost saving options” which meant they had concluded this was not the right move.

However, Superdry said Mr Dunkerton remained in talks over a possible seperate transaction, by which it would look to raise fresh cash from shareholders, including potentially its founder.

This possible fund-raise would be fully underwritten by Mr Dunkerton which would provide extra cash for its turnaround plans. It would be at a “very material discount” to its current share price and be conditional on the company delisting.

04:48 PM GMT

Chinese property giant delays results as housing crisis escalates

Chinese property giant Country Garden has delayed the release of its results as the country’s housing crisis escalates.

Country Garden said it would not be able to publish its results on time, meaning its shares are expected to be suspended from next Tuesday.

It blamed the “continuous volatility of the industry” for the delay, saying: “The operating environment the group is confronting is becoming increasingly complex.”

Country Garden said it needed more time to collect information to make the appropriate account estimates and judgments in its results.

It follows turmoil in the Chinese housing market, which has been rocked by a spate of bankruptcies following a regulatory crackdown in the country on how much developers could borrow.

04:31 PM GMT

Bitcoin up around 2pc

The price of Bitcoin is up around 2pc and trading at north of $70,000, close to record highs achieved earlier this month.

The recovery in the price of digital currencies was a key talking point during the trial as Bankman-Fried’s lawyers argued his victims could likely get much of their money back.

04:12 PM GMT

Sam Bankman-Fried ordered to forfeit $11bn

Having been sentenced, the FTX founder has also been ordered to forfeit $11bn he stole as part of the crime.

Bankman-Fried stood with his hands together before him as the sentence was read out.

The convicted fraud’s lawyers had sought to insist his crime was not akin to that of Bernie Madoff, the financier whose Ponzi scheme cost investors billions.

Madoff was sentenced to 150 years in prison.

03:49 PM GMT

Sam Bankman-Fried sentenced to 25 years

Sam Bankman-Fried has been sentenced to 25 years in prison.

Handing out his sentence, Judge Kaplan said it is the judgment of the court that you are sentenced to 240 months then consecutive 60, for a total of 300 months, equating to 25 years.

03:45 PM GMT

Sam Bankman-Fried rises for sentence

Judge Kaplan said that Sam Bankman-Fried was “evasive” when he told lies and “hair splitting – trying to get prosecutors to rephrase questions for him”.

He said: “I’ve been doing this job for close to 30 years. I’ve never seen a performance like that.”

03:43 PM GMT

Bankman-Fried ‘knew that Alameda was spending customer funds’

Judge Kaplan is speaking again. He said Bankman-Fried is “a high achieving autistic person”.

He added that Bankman-Fried “had been exceptionally ambitious” and “wanted to be a hugely politically influential person in his country”.

Judge Kaplan said that “this was a huge financial crime”.

He added that Bankman-Fried was a “man willing to flip a coin as to the continued existence of life on earth”.

Bankman-Fried was aware that “Alameda [FTX’s sister hedge fund] was spending customer funds on risky investments, political contributions and Bahamas real estate”, the judge said.

“The funds were not his to use.”

He added: “He knew it was wrong… He knew it was criminal. He regrets that he made a very bad bet about the likelihood of getting caught – but he is not going to admit a thing, as is his right.”

03:31 PM GMT

Bankman-Fried would do it again if maths justified it, says attorney

Assistant United States Attorney Nicolas Roos told the Manhattan Court that victims of Bankman-Fried’s fraud “lost their life savings”.

He described the financial instability faced by a man who lives in Portugal whose daughter was born the day before FTX’s bankruptcy.

He talked about a 23-year-old eldest son in Morocco who kept money on FTX “not to loan it out to the defendant”.

He said the defendant took $1.7bn from investors, which taken alone necessitates a long sentence.

He said: “Some get 40 or more years for that alone.”

He added: “You have the defendant’s cost / benefit analysis which would allow him to do it again… if Bankman-Fried thought mathematics justified it, he’d do it again.”

03:23 PM GMT

Bankman-Fried: I was trying to help

Bringing a close to his statement at the hearing, Sam Bankman Fried said customers “will finally get paid” the current value of assets following the collapse of FTX.

He said he understands how prosecutors the court and the media view him adding: “I was trying to help – that’s not how the prosecutors saw it… that’s that.”

He said he customers, lenders and investors would receive the “current value of assets” from FTX and he wished he “had been able to do more to help that”.

He ended: “There is an opportunity to do what I thought I would do for the world, not what I ended up doing.

“If people do what they can for the world, hopefully I can see their success not just my own failures. Thank you.”

03:03 PM GMT

I was responsible at the end of the day, says Bankman-Fried

Sam Bankman-Fried has admitted he was “responsible at the end of the day” for the failure of FTX customers.

He told the court in Manhattan during his sentencing hearing that the trading platform’s users “mostly have been failed, by more people than I can count, not least of all myself”.

He said:

I was the CEO of FTX, I was its leader, that means I was responsible at the end of the day.

It doesn’t matter why things go bad, if you’re the CEO, it’s on you. I’m not the one who matters the most at the end of the day… My useful life is probably over.

I’ve long since given what I had to give. I can’t do it from prison.

02:55 PM GMT

‘I made a lot of mistakes’ says Sam Bankman-Fried

Sam Bankman-Fried admitted he “made a lot of mistakes” as he spoke during his sentencing hearing which could result in him facing decades behind bars.

He admitted that customers “weren’t paid back” and that his FTX cryptocurrency exchange “didn’t survive that”.

He acknowledged his actions had “caused a lot of damage” and admitted customers “could have been paid back”.

He said the liquidity crisis at FTX, which led to its collapse, “was in part my doing”.

02:50 PM GMT

Sam Bankman Fried addresses court

Sam Bankman-Fried is addressing the courtroom for the first time at his sentencing hearing.

The disgraced crypto tycoon said he does not know whether “the most important thing today is my emotion life or hypothetical future kids”.

He said he agreed with most of what victim Sunil Kavuri told the court earlier in the hearing about “what they’ve gone through”.

He said he “threw away” what his colleagues at FTX had built.

“They were let down. I’m sorry about that,” he told the court.

“I’m sorry about what happened at every stage. Things I should have done and said, thing I shouldn’t have. I care about everything too.”

02:47 PM GMT

Bankman-Fried is misunderstood, mother believes

Barbara Fried, the mother of FTX’s former chief executive Sam Bankman-Fried, believes her son is misunderstood, his lawyer has said.

Marc Mukasey told the Manhattan Court that his client “never sought out to be the king of crypto” and just “wanted to have the largest positive impact in the world”.

He added:

His mother says there’s a terrific sadness at his core.

His brother says Sam would be uncomfortable giving me a hug – but I know he would give me a kidney if I needed one…

He has been in the worst prison in the country for the last seven months.

02:41 PM GMT

Bankman-Fried is ‘awkward math nerd,’ says lawyer

Sam Bankman-Fried’s lawyer Marc Mukasey said his client is “an awkward math nerd”.

He told the court: “He’s into veganism. He has an off the chart intellect. He is a beautiful puzzle.

“He can parse words better than a Talmudic scholar. He was a billionaire unconcerned about material possessions.”

02:39 PM GMT

Bankman-Fried ‘was not a ruthless financial serial killer,’ says lawyer

Sam Bankman-Fried’s lawyer Marc Mukasey said Sam Bankman-Fried “did not want to personally inflict pain on anyone in any way” as he carried out his fraud.

He told the Manhattan court that Bankman-Fried “was not a ruthless financial serial killer. He wasn’t predatory”.

He said: “He makes decisions with math in his head, not malice in his heart.”

02:21 PM GMT

FTX fraud victim: I have suffered for two years

Victim Sunil Kavuri is now addressing the Manhattan courtroom, having flown in from London.

He said at least three people have died by suicide as a result of the FTX fraud. He said:

I’d like to address the argument that the loss was zero. They continue to claim that in the media. It is false.

I have suffered for two years. The bankruptcy estate is assuming or mischaracterising us as unsecured creditors. We had property rights. Sullivan & Cromwell has trampled over our property rights.

They have liquidated billions of dollars of crypto assets. There’s a token S&C sold at 11 cents, it’s now trading at two dollars. FTX had $10 billion in Solana tokens – they sold it at a 70pc discount.

Mr Kavuri said the token is being sold to FTX’s own clients – Galaxy – and it is “destroying customer value”.

“This is our property,” he said.

He added: “What I feel, how it relates to Sam, it has hurt me. Other co-conspirators, aiders and abetters, need to be held accountable.”

02:15 PM GMT

Judge indicates sentence will be severe

Judge Kaplan has indicated that the sentencing he hands out will be severe.

He said he finds that the Mr Bankman-Fried “gave perjured testimony at trial” and “falsely testified that until the Fall of 2022 he had no knowledge that Alameda had spent FTX customer funds”.

“He falsely testified that he first learned of the $8bn in October 2022.”

Judge Kaplan said: “Finally he falsely testified that repayment of third party loans by Alameda would require Alameda to borrow more customer funds from FTX.”

He added: “I have limited my findings on obstruction to support the finding – there may be more.

“The total offense level is 60 – once you cross 43, it cannot go higher. The guideline is life in prison. But the maximum is 1,320 months in this case.”

02:10 PM GMT

Sam Bankman-Fried’s texts constituted witness tampering, says judge

Judge Kaplan said that Sam Bankman-Fried’s texts to a former general counsel “did in fact constitute attempted witness tampering”.

Prosecuters said the crypto tycoon reached out to the “current general counsel of FTX US who may be a witness at trial”.

Judge Kaplan said: “On obstruction of justice, I find that Mr. Bankman-Fried’s text to the former general counsel did in fact constitute attempted witness tampering.”

01:59 PM GMT

Judge: Thief who wins in Vegas with loot is not entitled to sentencing reduction

Judge Kaplan has begun speaking in the Manhattan Court, rejecting the defence’s argument that Sam Bankman-Fried’s fraud was in fact a victimless crime.

He said the assertion that customers and creditors will be paid in full “is misleading,” adding that the defendants equate loss with dollar volume in the bankruptcy case.

He said investors and lenders were also injured parties. He said: “The crimes here included taking FTX customer money to which defendant had no right and using it no speculative investments by Alameda and a variety of other things.”

He added that a “fortuitous run-up in the value of some cryptocurrencies bears no relation to the gravity of the crimes that were committed”.

He said: “A thief who takes his loot to Las Vegas and successfully bets is not entitled to a sentencing reduction.” That is the case even if it is paid back.

Judge Kaplan said that the suggestion “that people will be paid back is speculative”.

He finds that the loss amount readily exceeds $550m, which is the top tier. He found investors lost $1.7bn, lenders lost $1.3bn, and customers lost $8bn.

01:51 PM GMT

Bankman-Fried lives ‘life of delusion’ says FTX boss

John Ray, FTX’s current chief executive, told the US court last week that Bankman-Fried’s claims that the failure of FTX was effectively victimless are “categorically, callously, and demonstrably false”.

In a witness statement ahead of sentencing, Mr Ray, a restructuring expert who handled the failure of Enron, wrote: “Customers still will never be in the same position they would have been had they not crossed paths with Mr Bankman-Fried and his so-called brand of ‘altruism.’”

He added:

Mr Bankman-Fried continues to live a life of delusion.

The “business” he left on November 11, 2022 was neither solvent nor safe.

Vast sums of money were stolen by Mr Bankman-Fried, and he was rightly convicted by a jury of his peers.

01:42 PM GMT

Sam Bankman-Fried arrives in court

Sam Bankman-Fried has arrived in Manhattan District Court wearing light brown jail uniform.

The courtroom is full.

His parents arrived earlier this afternoon.

01:41 PM GMT

FTX fraud victims: My whole life has been destroyed

Victims of the FTX fraud have provided hundreds of witness statements to the Manhattan Court ahead of the sentencing hearing, detailing the impact its failure and their frozen funds have had on their lives.

Many are furious their funds have been out of reach even as cryptocurrency prices have surged.

“I experienced a significant loss due to the crimes that caused the FTX collapse. They were not victimless,” writes one.

“They significantly impacted my and my family’s financial stability.”

Another says: “Our faith in FTX, bolstered by SBF’s celebrity and political endorsements, has been shattered, leaving us to suffer the consequences of his actions. The ordeal has underscored the reality of our misplaced trust and the ongoing struggle to recover from this financial setback.”

A third writes:

My whole life has been destroyed. I have two young children, one born right before the collapse.

I still remember the weeks following where I would stare blankly into their eyes, completely empty inside knowing their futures have been stolen through no fault of our own.

I did not gamble on crypto. I did not make any crypto gains. I had my [Bitcoin] which I had collected over years deposited on FTX as a custodian. I did not agree to the risk that SBF took with my funds.

01:36 PM GMT

Pictured: Sam Bankman-Fried’s mother arrives at court

Barbara Fried, the mother of FTX’s former chief executive Sam Bankman-Fried has arrived at Manhattan District Court for his sentencing.

01:29 PM GMT

Bankman-Fried’s lawyers push back against calls for 100-year sentence

Ahead of today’s hearing, Sam Bankman-Fried’s lawyers have been arguing for a lenient jail term of as little as six years, writes Matthew Field.

In legal filings, Mr Bankman-Fried’s lawyers have urged the judge to implement a more lenient sentence because of his client’s autism, mental health and philanthropic endeavours.

His lawyers described calls by prosecutors for a 100-year sentence as “barbaric” and “grotesque”.

“Sam suffers from anhedonia, a severe condition characterised by a near-complete absence of enjoyment, motivation, and interest,” the filing said.

“He has been that way since childhood.”

01:19 PM GMT

Gove: Thames Water’s leadership must ‘carry the can’ for failings

Thames Water’s leadership must “carry the can” for the company’s shortcomings and not pass higher bills onto consumers after successive management teams failed to invest enough, Michael Gove has said.

Asked about the water company by broadcasters, the Communities Secretary said:

I think the leadership of Thames Water has been a disgrace. I think for years now we have seen customers of Thames Water taken advantage of by successive management teams that have been taking out profits and not investing as they should have been.

When I was environment secretary I called this out. They haven’t changed their ways. I have zero sympathy for the leadership of Thames Water. In my own constituency I have seen how they have behaved in a high-handed and arrogant way towards the consumers who pay their bills.

So the answer is not to hit the consumers, the answer is for the management team to look to their own approach and ask themselves why they are in this difficult situation, and of course the answer is because of serial mismanagement for which they must carry the can.

01:14 PM GMT

SBF masterminded syphoning off of FTX customer cash

Today’s sentencing comes after Bankman-Fried was found guilty of seven charges of fraud and conspiracy by a Manhattan jury in November, after deliberating for just four hours.

Our senior technology reporter Matthew Field has a recap of of the legal proceedings:

The guilty verdict followed a month-long trial where former FTX executives pleaded guilty to fraud charges and testified against him.

Former executives, including his ex girlfriend Caroline Ellison, took to the witness stand to give evidence against their friend.

The jury was told how Bankman-Fried, known in the crypto industry as SBF, masterminded efforts to syphon off billions of dollars in FTX customers’ funds to use it for high risk investments and luxury purchases.

Prosecutor Danielle Sassoon told the jury at the time: “He didn’t bargain for his three loyal deputies taking that stand and telling you the truth: that he was the one with the plan, the motive and the greed to raid FTX customer deposits – billions and billions of dollars – to give himself money, power, influence.

“He thought the rules did not apply to him. He thought that he could get away with it.”

01:00 PM GMT

Sam Bankman-Fried to be sentenced for multi-billion dollar crypto fraud

Sam Bankman-Fried, the former billionaire cryptocurrency wunderkind, is awaiting his sentencing today over his conviction for stealing $8bn from customers of the now-bankrupt FTX exchange he founded.

The 32-year-old faces the prospect of decades behind bars after a jury found him guilty in November on seven fraud and conspiracy counts.

His sentencing before US District Judge Lewis Kaplan in Manhattan will mark the culmination of Bankman-Fried’s downfall from an ultra-wealthy cryptocurrency entrepreneur and major political donor to US authorities’ biggest trophy to date in a crackdown on wrongdoing in digital asset markets.

He faces a statutory maximum of 110 years, but will likely receive less. Prosecutors are seeking a prison sentence of 40 to 50 years for what they say was one of the biggest financial frauds in US history.

12:51 PM GMT

Pound slips as UK recession confirmed

On the currency markets, the pound fell slightly after official figures confirmed Britain entered a recession in the second half of last year.

Sterling was last down 0.1pc, but was still on course for a gain this week against the dollar, ahead of key US inflation data on Friday. The pound was up 0.2pc against the euro, which traded at 85p.

Action in the currency market has been dominated this week by the prospect of the Bank of Japan intervening to buy the yen, which has hit its weakest since 1990 against the dollar.

The pound also fell against the yen, dropping 0.1pc to 190.92, having hit its highest against the Japanese currency since August 2015 this week.

It came as UK GDP shrank by 0.1pc in the third quarter and by 0.3pc in the fourth quarter, unchanged from preliminary estimates, the Office for National Statistics said.

Two-year gilts, the most sensitive to changes in rate expectations, have fallen 25 basis points in March, heading for their first monthly drop since November.

Futures markets show traders see a roughly 20pc chance of the Bank of England cutting rates at its next meeting in May, although June’s meeting is still the most likely point, with a 55pc chance.

12:37 PM GMT

AO World shares jump as it upgrades profit outlook

In more positive corporate news, electronics retailer AO World has increased its profit guidance after “clear progress” over the past year.

Shares in the London-listed company rose by more than 13pc after its latest upgrade, having already improved its earnings outlook in November last year as its cost-cutting actions bear fruit.

The retailer, which counts Mike Ashley’s Frasers Group as a major shareholder, has cut a number of jobs and closed its German business as part of its turnaround plan.

Today AO told shareholders it expects adjusted pre-tax profits “at least” at the top of its previous guidance, of between £28m and £33m for the year to March 31.

It added that it expects to report revenues of around £1.04bn for the year, after its core business returned to growth in the final quarter.

12:14 PM GMT

Customers, not shareholders, will pay for Thames Water, warns peer

Thames Water customers will fund a bailout for the struggling utility company and get nothing in return, a peer has warned.

Lord Sikka said “shareholders will get dividends, customers big bills” as the company’s chief executive Chris Weston refused to rule out raising bills by 40pc.

The Professor of Accounting at the University of Sheffield tweeted:

Chief executive of Thames Water has refused to rule out 40% bill increases for customers.

This is a con.

Customers, not shareholders, will provide capital and own absolutely nothing in return.

Current shareholders will get dividends, customers big billshttps://t.co/QnsaRx0Ky4

— Prem Sikka (@premnsikka) March 28, 2024

12:02 PM GMT

Green MP calls for Thames Water nationalisation

Caroline Lucas, the only Green MP, has said the latest developments at Thames Water show it must be nationalised:

Investors can see the writing on the wall for #ThamesWater. Endless sewage, supply outages and no money to sort it out. It’s clear Thames Water cannot run this vital public service – none of these companies can. We need to bring them all into public ownership. @We_OwnIt

— Caroline Lucas (@CarolineLucas) March 28, 2024

11:43 AM GMT

Thames Water among industry’s worst polluters

Thames Water is the worst performing supplier in England and Wales, recording the highest number of serious sewage pollution incidents in a decade in 2022.

The utility company, which collects and treats sewage for 15m people, had 17 serious incidents in 2022, worse than the 12 recorded in 2021 and 13 in 2020. Its worst year previously was 2013, when 22 were recorded.

In October, it was named among the industry’s worst performers in watchdog Ofwat’s annual review for a third year.

It came just weeks after Thames Water was hit with a £101m fine for “lagging” in its efforts to clean up pollution, plug leaks and improve customer service. The penalty was later reduced to £73.8m.

An Environment Agency report last year called water companies’ performance “simply unacceptable”.

To fix the issues, Thames Water has proposed to raise customer bills by 40pc starting 2025 and is seeking £2.5bn in equity over the five years from 2025.

11:26 AM GMT

Thames Water is ‘blackmailing’ regulator, say union bosses

The GMB union accused Thames Water of “blackmailing” the regulator Ofwat and customers and said it was meeting with bosses at the troubled water supplier.

Thames Water has been battling to secure its financial future since last summer, with a funding crisis leaving the company on the brink of emergency nationalisation.

It is understood that investors pulled a £500m funding plan that was agreed last summer after Ofwat refused to bow to the water giant’s demands for a 40pc bill hike for customers, an easing of capital spending requirements, as well as leniency on penalties for failing to meet targets.

Gary Carter, GMB national officer, said:

Thames Water investors are essentially blackmailing customers and Ofwat.

Assets and infrastructure are falling apart – instead of putting the money in to fix it, shareholders are refusing to pay a penny unless bills are allowed to rocket.

Holding bill payers to ransom for costs after years of underinvestment is completely unacceptable.

Shareholders need to think again and invest in Thames and the 8,000 strong workforce who keep the company afloat.

11:13 AM GMT

Pictured: Protesters storm Department of Business and Trade

Some images just in from our picture desk showing pro-Palestine protesters at the Department of Business and Trade.

The demonstrators entered the Old Admiralty Building as they called for a ceasefire in the conflict between Israel and Hamas.

10:58 AM GMT

Thames Water bonds drop into distressed territory

Investors who previously backed Thames Water would receive just 17p in the pound if they tried to redeem their corporate bonds in the troubled supplier.

Thames Water Kemble bonds have dropped well into distressed territory after it emerged that shareholders will not provide a £500m cash injection for the utility company by the end of this months, as had been expected.

Last year the bonds were priced at about 88p in the pound but slumped to as low as 55p in June as the scale of its debts emerged.

They were trading at about 30p earlier this week.

10:44 AM GMT

Could Thames Water collapse and what will it mean for customers?

Thames Water is at risk of renationalisation after it failed to secure hundreds of millions of pounds in survival funding.

Our senior money reporter Charlotte Gifford examines what it means for customers:

The water giant is in a race to find extra cash after shareholders refused to pay £500m by the end of the month, saying regulatory requirements make its business plan “uninvestable”.

The announcement has raised new fears the Government could step in to rescue the heavily indebted firm from collapse.

Read how customers would be affected if Thames Water is forced into special administration.

10:28 AM GMT

Who owns Thames Water?

Thames Water’s parent company is Kemble Water Holdings, whose shareholders last year promised to pump £750m into the supplier by March 2025.

This forms part of a group of companies, known as the Kemble Water Group, and is owned by a consortium of institutional shareholders – mostly pension funds and sovereign wealth funds.

These include Canadian pension fund Omers and the Universities Superannuation Scheme – the trustee of one of the largest pension schemes in the UK.

Other shareholders are Infinity Investment, British Columbia Investment Management and Hermes GPE, the manager of the BT pension scheme.

The shareholders’ £500m cash injection, which had been expected by the end of the month, was contingent on several criteria being met, including Ofwat approving its £18.7bn turnaround plan which stretches to 2030 and would require a sharp increase in bills.

Kemble, which was set up to raise finance for Thames, is solely reliant on dividends from the utility company to service its debts, which stood at £14bn in its most recent figures.

10:12 AM GMT

Interest rate cuts ‘a long way off’, says Bank of England official

Interest rate cuts by the Bank of England “are a long way off,” one of its rate setters has warned, despite inflation falling to 3.4pc.

Jonathan Haskel was one of two members of the Monetary Policy Committee to switch their vote from increasing interest rates to holding them steady at 5.25pc at its last meeting.

The Bank voted by a majority of 8-1 to keep rates steady, with the switch by Mr Haskel and his colleague Catherine Mann taken by markets as a sign that interest rate cuts are incoming.

However, Mr Haskel has warned he is not preparing to vote for a cut.

He told the Financial Times:

Although the fall in headline inflation is very good news, it is not informative about what we really care about: what we really care about is the persistent and the underlying inflation.

I think cuts are a long way off.

10:00 AM GMT

Thames Water faces sink or swim moment as debt crisis deepens

Investors have been dumping Thames Water’s debts while the supplier has been busy dumping sewage.

Our reporter Michael Bow analyses the utility company’s perilous financial state:

An early sign of the crisis about to engulf Thames Water came when part of its £14bn debt pile crashed to a record new low.

Fund managers who own Thames debt began dumping some of its riskiest IOUs at the start of the year over fears the company could fail to repay the debts.

A bond linked to an entity in Thames’ byzantine debt structure has crashed by 20pc in value over the last two weeks of January. The bond, which is linked to a company called Thames Water (Kemble) Finance, plunged to 40p in the pound, down from a price of 50p. They were worth as much as 87p six months earlier.

While having no immediate impact on the group, or consumers, the bond market tremors were a sign investors believe that Thames Water could be heading for a further financial squeeze.

09:44 AM GMT

Government must stabilise Thames Water, says Labour

Labour urged the Government and regulators to “do everything in their power to stabilise” Thames Water after its shareholders pulled their investment plan.

Steve Reed, the shadow environment secretary, said:

The Conservatives weakened regulation, allowing water companies to get massively in debt while the sewage system crumbled and illegal sewage dumping hit record levels.

The Conservatives’ negligence is why the country’s largest water company is now in this worrying position.

The Government and regulators must do everything in their power to stabilise the company and ensure new investment comes through to fix the broken sewage system without taxpayers being left to foot the bill.

Labour will strengthen the regulator’s powers and make financial stability a priority to prevent this situation from happening again.

09:32 AM GMT

JD Sports boosts profits as it resists sales

JD Sports has warned trading remains “challenging” as retailers increase promotional sales, but shares jumped after it pushed up its profit guidance.

The sportswear retailer said that it expects profits to be in line with its previous guidance of between £915m and £935m before tax and adjusted items in the year to early February.

It had downgraded its outlook for profits in January when the business said it had to cope with “elevated promotional activity” – industry jargon for products being on sale.

Shares were up 6.2pc to leads the FTSE 100 as the company “chose not to participate fully” in these sales in the UK and Ireland, which were mainly online. As a result like-for-like sales fell by 3.2pc in the region in the fourth quarter.

The business said that profit could be both lower or higher in the current financial year than it was last year. It expects pre-tax profit to be between £900m to £980m. Chief executive Regis Schultz said:

Looking ahead, the current trading environment remains challenging due to less product innovation and elevated promotional activity, especially online.

We anticipate trading conditions will improve as we move through the year, helped by a busy sporting summer and softer comparatives with last year.

The company opened 215 new JD shops in the year to early February, and said that the launch of a new UK loyalty programme had been “encouraging” and attracted 800,000 downloads so far.

09:23 AM GMT

Hunt defends economic growth pledge as recession confirmed

Jeremy Hunt insisted the economy had grown last year “albeit at a very slow rate” when asked if the latest GDP figures meant Rishi Sunak had failed in his pledge to grow the economy.

The Office for National Statistics confirmed its preliminary figures showing Britain entered recession at the end of last year with GDP contracting by 0.1pc in the third quarter and by 0.3pc in the fourth quarter.

Asked by broadcasters about the Prime Minister’s growth promise, the Chancellor said:

The Prime Minister’s pledge last year was to halve inflation and he delivered on that. In fact inflation has fallen from over 11pc to 3.4pc.

Having done that he then said we would grow the economy. I don’t think any of us were expecting the economy to actually grow last year, the Bank of England wasn’t, the Office for Budget Responsibility wasn’t, in fact it did, albeit at a very slow rate.

That is a testament to the resilience of the economy but also the fact the Government took some very difficult decisions early on to make sure we got the economy back on track.

09:19 AM GMT

Hunt monitoring Thames Water ‘very carefully’

The Treasury will monitor Thames Water’s situation “very carefully”, Jeremy Hunt said.

Asked by broadcasters if the Government was ready to step in to support Thames Water customers if necessary, the Chancellor said:

The Treasury will continue to monitor very carefully what is happening at Thames Water.

Our understanding is that the company is still solvent and today’s news should not have an impact on the services received by customers.

Obviously there are parts of the country where the service has not been up to scratch, including in my own constituency, and local MPs will continue to hold Thames Water to account in those situations, but overall we will continue to watch the situation very carefully.

09:13 AM GMT

FTSE 100 lifted by rising oil prices

The FTSE 100 rose in early trading as it was bolstered by commodity-linked stocks in the last trading day of the week.

The commodity-heavy index was up 0.3pc, while the domestically-focused FTSE 250 was down 0.1pc as official figures confirmed Britain was in recession at the end of last year.

Energy stocks added 0.7pc as oil prices edged up after two days of declines. Global benchmark Brent crude was last up 0.5pc to more than $86 a barrel.

Mining stocks were up as much as 1.3pc as most base metals prices rose, boosted by signs of stabilisation in China’s broader economy.

The Office for National Statistics confirmed Britain entered a shallow recession last year, with gross domestic product shrinking by 0.1pc in the third quarter and by 0.3pc in the fourth quarter, unchanged from preliminary estimates.

JD Sports climbed 6.3pc to the top of the FTSE 100 after the sportswear retailer said its pretax profit for the year to February 4 would be between £915m to £935m, meeting guidance which it had downgraded in January.

Spirent Communications jumped 11.1pc to the top of the FTSE 250 after it agreed to Keysight Technologies’s offer valuing the firm at £1.2bn.

M&G, Smith & Nephew and Taylor Wimpey were down between 1pc and 6pc as they traded without the right to their next dividend.

09:04 AM GMT

Put ‘broken’ Thames Water into special administration, say Lib Dems

The Liberal Democrats urged the Government to put Thames Water into special administration after the company said its shareholders will not be injecting the first £500m of funding that was agreed last summer.

The party’s Treasury spokeswoman Sarah Olney said:

Thames Water is a broken firm. It is teetering on the brink of collapse and it is clear that things cannot go on as they are.

Drastic action is needed to keep the taps running for millions of customers. Execs have pocketed sky-high bonuses, given billions to overseas investors whilst watching their infrastructure crumble. The board should hang their heads in shame.

No longer should this firm be allowed to mistreat customers and destroy our environment with their filthy sewage.

That is why ministers must use their powers to put Thames Water into special administration immediately, to then be reformed into a public benefit company. Only that way can we ensure this polluting giant will begin working for its customers again.

08:59 AM GMT

Thames Water admits there is ‘possibility’ of government bailout

Thames Water’s boss said it was “premature” to consider what would happen to the company if it does not receive a fresh cash injection before May next year.

He said the company would remain in negotiations with Ofwat until the end of this year which would yield a business plan “that shareholders and anyone who might provide equity can look at and then determine whether they are going to inject equity into Thames”.

He told BBC Radio 4’s Today programme:

If, at the end of the day, probably well into the end of next year, we were in a situation where we had no equity, then we have the prospect of special administration but we are a long way from that at the moment.

There is a possibility but the key message today is one of reassurance. I really want to make it clear that the business continues to operate as normal providing service to our 15m customers, as it does every day.

08:45 AM GMT

We have enough cash to last until May 2025, says Thames Water boss

Thames Water chief executive Chris Weston said the company has enough money to keep going until May next year, even if it does not receive a cash injection until then.

He told BBC Radio 4’s Today programme:

Conversations with Ofwat regarding our business plan for 2025 to 2030 continue.

This is the normal course of business and part of the PR24 process as it’s called. We had hoped to be in a position to confirm equity today but we are not there yet.

We remain in a solid financial position. We have about £2.4bn of liquidity at the moment in cash and undrawn facilities.

That is enough to last us until about May 2025. That will allow us to complete the discussions with Ofwat around our draft and final determinations and off the back of that business plan we will be able to talk to shareholders, whether they be existing shareholders or new shareholders about the prospect of equity being injected into Thames Water.

08:37 AM GMT

Thames Water shareholders blame Ofwat for lack of ‘regulatory support’

Thames Water shareholders said they were in effect forced to withhold the £500m cash injection for the water supplier after Ofwat “has not been prepared to provide the necessary regulatory support”.

In a joint statement, they said:

Shareholders and Thames Water have been working with the regulator Ofwat for over a year on how to address the complex challenges facing the business.

These include both meeting current funding demands and the urgent need for substantial investment to improve performance.

These discussions led to the submission of a business plan which included the largest ever investment programme by any UK water company – over £18 billion – to improve customer service and environmental standards.

To support such unprecedented investment, shareholders committed to supporting a further £3.25bn of investment on top of the £500m provided last year, and pledged to take no cash out of the business until a turnaround was delivered.

This was a solution which addresses the root cause of Thames Water’s challenges without the need for any taxpayer funding.

However, after more than a year of negotiations with the regulator, Ofwat has not been prepared to provide the necessary regulatory support for a business plan which ultimately addresses the issues that Thames Water faces.

As a result, shareholders are not in a position to provide further funding to Thames Water.

Shareholders will work constructively with Thames Water, Ofwat and Government on how to address the consequences of Ofwat’s decision.

08:30 AM GMT

Thames Water owner unable to pay £190m loan in April

Thames Water’s owner Kemble Water said it would not pay interest payments on its debts and would not be able to repay a £190m loan that matures on April 30 unless an extension is granted.

It said:

Absent an investible proposition for the shareholders to provide new equity, Kemble Water Finance Limited (KWF) considers at the current time that it will not be possible to pay further interest payments and, unless an extension to the maturity of the facility is granted by lenders, it will not be able to refinance or repay a £190m facility which matures on 30 April 2024.

In light of the above, KWF and Thames Water (Kemble) Finance Plc intend to approach their lenders and noteholders and request continued support in order to provide a stable platform while they engage with all key stakeholders.

08:09 AM GMT

Ofwat insists it must be ‘fair to bill payers’ as Thames withholds lifeline

Ofwat defended its efforts to be “fair to bill payers” as Thames Water said regulatory requirements had made it “uninvestible” for shareholders.

Thames announced last year that investors were willing to inject £3.25bn into the business so long as it met several conditions, including Ofwat allowing a significant increase to household water bills.

Ofwat will set out its plans for bills in June and said its latest price review needed to “put customer and environmental priorities at the heart of the water sector”. It said:

In order to drive this change, we need to ensure that the sector attracts investment and is fair to bill payers.

Since 2020 nearly £4.6bn new equity has been injected into the sector. We will set out our draft determinations in June this year.

We also need to see companies deliver the performance that customers expect and that they are run in a way that meets customers’ expectations.

07:56 AM GMT

Thames Water must pursue all funding options, says Ofwat

Regulator Ofwat said Thames Water must now seek further funding for its turnaround plan, but sought to assure that “safeguards” were in place to protect services to households.

An Ofwat spokesman said:

Safeguards are in place to ensure that services to customers are protected regardless of issues faced by shareholders of Thames Water.

Today’s update from Thames Water means the company must now pursue all options to seek further equity for the business to turn around the performance of the company for customers.

Thames Water is a business with a regulatory capital value of £19bn, with £2.4bn of cash/liquidity available, and an annual regulated revenue of £2bn and new leadership team.

07:47 AM GMT

Thames Water in ongoing talks with Ofwat

So to recap, Thames Water has said its shareholders will not be injecting the first £500m of funding that was agreed last summer into the group as industry regulations make its business plan “uninvestible”.

Thames Water said the funding plan drawn up last July was subject to conditions, including a business plan that is supported by “appropriate regulatory arrangements”.

It said the regulations being imposed by industry watchdog Ofwat “make the PR24 plan “uninvestible”, and as a result the shareholder support letter from last July “has not been satisfied”.

“The first £500m of the new equity that had been anticipated will not be provided by Thames Water’s shareholders by 31 March 2024,” it revealed.

Thames Water said it was in ongoing talks with industry regulator Ofwat to secure regulations that are “affordable for customers, deliverable and financeable for Thames Water, as well as investible for equity investors”.

It said once the new regulatory plan is agreed with Ofwat, it “intends to pursue all options to secure the required equity investment from new or existing shareholders”.

07:34 AM GMT

Thames Water says it has £2.4bn in cash

Thames Water said it had £2.4bn in cash and available committed facilities at the end of February as it tried to reassure customers.

However, the supplier has borrowings of nearly £19bn.

If the company is put into special administration, it is estimated that as much as £5bn of financial support would be needed to keep customers connected.

Thames said last October that shareholders were prepared to provide £750m “subject to satisfaction of certain conditions, including the preparation of a business plan that underpins a more focused turnaround that delivers targeted performance improvements for customers, the environment and other stakeholders over the next three years and is supported by appropriate regulatory arrangements”.

Today, the company revealed that those shareholders felt the requirements placed on it by would make its three-year turnaround plan “uninvestible”.

07:26 AM GMT

Hunt insists ‘plan is working’ as recession confirmed

After the Office for National Statistics confirmed the UK was in a recession at the end of last year, Chancellor Jeremy Hunt said:

Last year was tough as interest rates had to rise to bring down inflation, but we can see our plan is working.

Inflation has fallen decisively from over 11pc to 3.4pc, the economy grew in January and real wages have increased for eight months in a row.

Our cuts to National Insurance will boost growth by rewarding work and putting over £900 a year back into the average earner’s pocket.

07:24 AM GMT

Recession marginally shallower than feared after GDP revised

The recession that the UK entered last year was fractionally shallower than first thought, revised new figures from the Office for National Statistics (ONS) have shown.

The ONS said confirmed that the economy shrank by 0.1pc in the third quarter and 0.3pc in the fourth as it left its preliminary estimates of the economy’s performance unrevised.

However small revisions not visible in the headline figures, which are rounded to one decimal place, meant that the cumulative decline in the two quarters was 0.4pc, rather than a previously estimated 0.5pc.

07:21 AM GMT

Thames Water at risk of being nationalised as £500m lifeline withheld

Thames Water took a further step towards nationalisation after shareholders said they would not provide it with a £500m lifeline.

The troubled utility company was told it had not satisfied the conditions to receive the first tranche of support outlined as part of its three-year turnaround plan.

It had been expecting the half a billion pound payment by March 31, but shareholders said they would not provide the cash as the regulatory requirements on the company make it “uninvestible”.

Directors of the troubled supplier had been racing to finalise a £750m lifeline from investors at a board meeting on Wednesday, with the threat of special administration looming as Thames reels from vast debts and poor performance.

Without the extra money from investors, who include Canadian pension fund Omers and the Universities Superannuation Scheme, Thames would be at risk of relying on a taxpayer-backed bailout. The business needs billions of pounds to survive.

The company is putting up its bills by an average 12.4pc at the start of next month, following a 9.4pc increase last year. It will take the average bill to £471.

Thames was owned for a decade by Macquarie, the Australian investment bank, which took out £1.2bn of dividends while driving the company’s debt up from £1.6bn to £10bn.

Macquarie sold to current shareholders in 2017, with the new owners since attempting to reduce the business’s borrowing pile.

Thames announced last year that investors were willing to inject £3.25bn into the business, with £750m expected in 2024.

Chief executive Chris Weston said: “I’d like to reassure our customers that, despite this announcement, it is business as usual for Thames Water.

“Our 8,000 staff remain committed to working with our partners in the supply chain to provide our services for the benefit of our customers, communities and the environment.”

07:14 AM GMT

Good morning

Thanks for joining me. Thames Water has been told it will not be given a £500m lifeline by the end of the month, putting the supplier a step closer towards nationalisation.

Without the extra money from investors, who include Canadian pension fund Omers and the Universities Superannuation Scheme, Thames would be at risk of relying on a taxpayer-backed bailout. The business needs billions of pounds to survive.

Thames announced last year that investors were willing to inject £3.25bn into the business, with £750m expected in 2024.

5 things to start your day

1) National Living Wage should start at 18 instead of 21, says pay-setting group | Business chiefs warn change would be unaffordable

2) Crunch meeting at Thames Water amid scramble for £750m | Directors race to finalise lifeline from shareholders and avoid special administration

3) BT to convert 2,000 old payphones into advertising screens | Telecoms giant plans to triple its number of digital screens despite local backlash

4) Morrisons’ losses mount amid debt finance pressures | Higher interest rates hammer supermarket as it attempts ambitious turnaround plan

5) Insurers face record $3bn bill from Baltimore bridge collapse | Payout will be up to double the claim for Costa Concordia wreck, say analysts

What happened overnight

Asian investors trod carefully on Thursday after a Federal Reserve official floated the idea of delaying or reducing interest rate cuts.

Hong Kong, Shanghai, Sydney and Wellington rising, while Singapore, Seoul, Taipei and Jakarta fell.

Tokyo’s benchmark Nikkei 225 closed down 1.5pc, or 594.66 points, at 40,168.07, while the broader Topix index lost 1.7pc, or 48.47 points, to 2,750.81.

Chinese markets recouped losses from the day before. Hong Kong’s Hang Seng index gained 1.1pc to 16,579.99, while the Shanghai Composite advanced 1.2pc to 3,029.01.

Australia’s S&P/ASX 200 jumped 0.9pc to 7,887.00. Taiwan’s Taiex was little changed.