Is Bristol Myers Squibb Stock a Buy?

Stocks are on a roll. We have been in a bull market for over a year. Major indexes haven’t lost their momentum since 2024 started. However, some stocks aren’t keeping pace.

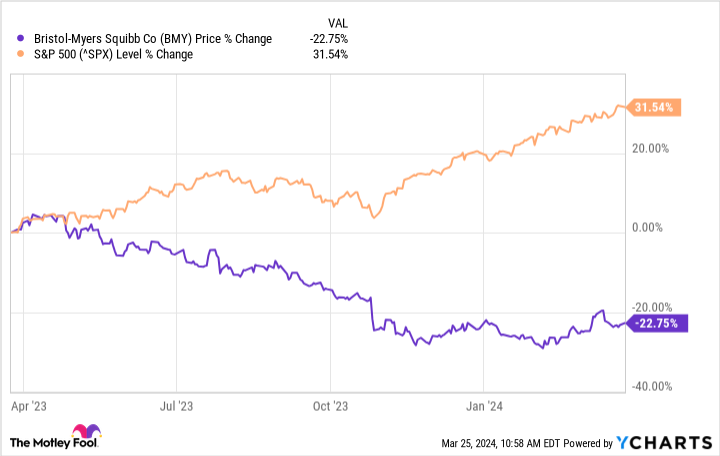

That’s the case with biotech giant Bristol Myers Squibb (NYSE: BMY). The drugmaker has seen its shares drop by 22% over the past year. Some might view this situation as an opportunity to buy Bristol Myers’ stock on the dip, but it’s not worth the trouble unless the company can bounce back.

Let’s find out whether there are better days ahead for the business.

The dreaded patent cliffs

Last year, Bristol Myers’ revenue declined by 2% year over year to $45 billion. Its adjusted earnings per share also dropped 2%, landing at $7.51. The drugmaker is still dealing with the loss of exclusivity for cancer treatment Revlimid, but the problem runs even deeper. Bristol Myers will face other significant patent cliffs by the end of the decade.

The company’s anticoagulant, Eliquis, co-marketed with Pfizer, will run out of patent protection by 2027. Meanwhile, cancer drug Opdivo will lose exclusivity in 2028. In 2023, Eliquis’ revenue of $12.2 billion increased by 4% year over year, making it Bristol Myers’ best-selling medicine. Opdivo came in second, with sales of $9 billion, 9% higher than the year-ago period.

These two medicines accounted for about 47% of Bristol Myers’ top line last year. With these patent losses on the horizon, it is understandable why some investors are skeptical of Bristol Myers.

Innovation is key

The best solution to patent cliffs is to develop new drugs. That’s what Bristol Myers has done in recent years. The company’s portfolio of newer medicines approved since 2019 contains 10 products. The latest to earn the green light is Augtyro, a cancer drug Bristol Myers launched late last year in the U.S. Right now, the best-selling of the bunch is Reblozyl, a treatment for anemia in patients with beta-thalassemia (a rare blood disease).

In 2023, Reblozyl’s sales were about $1 billion, 41% higher than the previous fiscal year. Bristol Myers isn’t stopping. The company expects a couple of brand-new product approvals in the next two years and many more through the end of the decade. The loss of exclusivity of Eliquis and Opdivo will be a major blow, but the drugmaker is preparing for that eventuality.

Bristol Myers expects more than $10 billion in sales from its new product portfolio in 2026. By then, the loss of exclusivity of Revlimid will have a far smaller impact on its financial results. The period from 2027 to 2030 should be rough, but the drugmaker expects $25 billion in sales from various new drugs by 2030.

Here’s the critical point: Patent cliffs are par for the course for drugmakers. Bristol Myers’ innovative potential should allow it to deal with this headwind just as it has before.

Dividends matter

Bristol Myers boasts a solid dividend program that likely isn’t in danger despite the company’s recent subpar financial results. The drugmaker has increased its payouts by a robust 46% in the past five years despite company-specific headwinds and the economic troubles and disruptions most of the world has faced in that time. Still, Bristol Myers has plenty of room to boost its dividend; its cash payout ratio sits at a conservative 37%.

Bristol Myers’ dividend yield of 4.62% also looks highly competitive given that the S&P 500‘s average currently stands at 1.47%. In short, Bristol Myers is a great option for long-term investors in the market for a steady, blue chip dividend stock. However, the company will probably not appeal to growth-oriented investors.

Should you invest $1,000 in Bristol Myers Squibb right now?

Before you buy stock in Bristol Myers Squibb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bristol Myers Squibb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb and Pfizer. The Motley Fool has a disclosure policy.

Is Bristol Myers Squibb Stock a Buy? was originally published by The Motley Fool