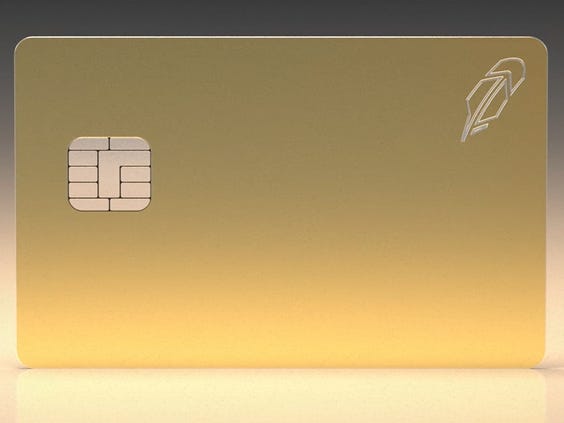

Robinhood stock surges after the company launches a solid gold credit card with 3% cashback rewards

-

Robinhood stock surged 8% on Wednesday after the company unveiled a solid gold credit card.

-

The credit card will offer 3% cashback rewards and 5% cashback on travel booked through Robinhood’s travel portal.

-

Robinhood is offering solid gold credit cards to the first 5,000 users who refer 10 people to the company’s monthly service plan.

Robinhood stock surged as much as 7% on Wednesday after the company launched a solid gold credit card that offers its users 3% cashback rewards.

This marks Robinhood’s first foray into the lucrative credit card market, expanding its offerings from investing and saving to also spending. Robinhood had previously launched a cash debit card.

The new credit card offers a rather generous 3% cashback reward on all purchases, as well as 5% cashback rewards on travel purchases made through Robinhood’s online travel portal. Additionally, the Robinhood credit card has no annual fee and no foreign transaction fee.

The Robinhood Gold Card is made of stainless steel and weighs 17 grams, but there is a solid gold version of the credit card that weighs 36 grams and is worth more than $1,000 of 10 karat gold.

Robinhood is giving this solid gold card to the first 5,000 users that refer 10 people to Robinhood’s Gold subscription plan.

Robinhood CEO Vlad Tenev is bullish on the card bringing in new customers to the company’s stock trading platform.

“What I predict we’ll see is a significant number of customers that join for the credit card and then become investors,” Tenev told Axios on Tuesday.

While the Robinhood credit card comes with no annual fee, it’s only available to Robinhood Gold subscribers, which costs $5 per month.

Robinhood Gold offers other benefits to its members besides access to the credit card, including a 3% match on IRA deposits, 5.25% interest on cash, and access to lower margin rates.

Robinhood stock has been on a tear so far this year, rising 59%, though the stock is still 76% below its record high of $85 per share.

Read the original article on Business Insider