3 Dividend Stocks That Are Too Successful for Their Own Good

The S&P 500 now yields just 1.4% as companies that don’t pay dividends or have low yields make up a larger share of the broader market. Investors looking for passive income may be turning to stocks with higher yields and track records of dividend raises.

Walmart (NYSE: WMT), WM (NYSE: WM) (formerly known as Waste Management), and Sherwin-Williams (NYSE: SHW) consistently buy back shares and raise their dividends. But they now yield less than the S&P 500.

Here’s why these three dividend stocks are too successful for their own good, and why great companies can become poor sources of income over time.

Walmart is in growth mode

Walmart is hovering around an all-time high. After a successful 3-for-1 stock split, Walmart raised its dividend by 9%, marking the largest raise in over a decade and the 51st consecutive dividend raise. Still, Walmart only pays an $0.83-per-share quarterly dividend, which is a mere 1.3% yield.

Prior to this, Walmart had made close to bare minimum annual raises. But that’s mostly because it has been reinvesting in its stores and improving the underlying business. The strategy has mostly worked.

Walmart’s revenue is up over 25% in the last five years — a fairly big move for a company its size. Its operating margin is back over 4%, which makes a big difference for its profitability.

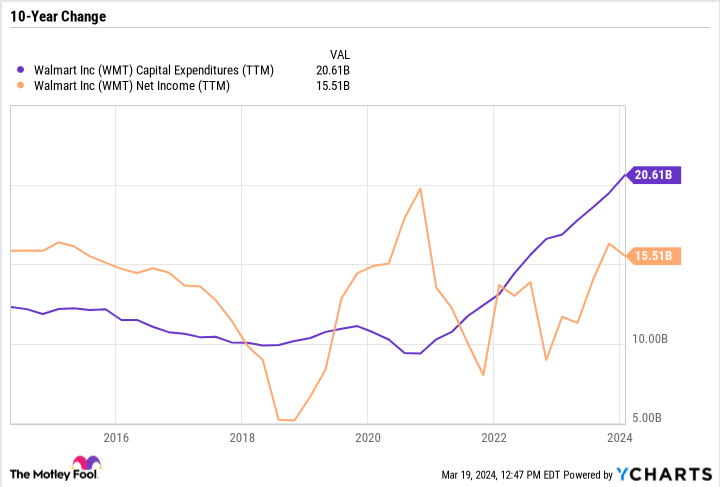

However, Walmart’s trailing-12-month net income is surprisingly lower today than it was a decade ago because Walmart has increased its capital expenditures (capex). In fact, capex has nearly doubled in just three years!

If Walmart wasn’t spending so much on capex, it would be generating record profits. But long-term investors care more about where a company’s profits are years from now than what they are today.

Aside from store expansions, Walmart has invested heavily in store pickup and delivery through its Walmart+ program. In fiscal 2024, Walmart passed $100 billion in global e-commerce sales for the first time, meaning e-commerce made up over 15% of total sales.

Walmart is investing in supply chain automation and remodeling 928 stores and Sam’s Clubs over the next year. These improvements have come at a steep cost, which makes Walmart look expensive. But if they work out, they could set the stage for plenty of growth and dividend raises in the future.

WM is unlocking a new revenue stream

WM handles the entire waste management value chain, from collection to transportation, separation, treatment, and reuse. The business is pretty self-explanatory, until recently when the reuse side of the equation has expanded far beyond recycling.

Similar to Walmart, WM’s capex has exploded in recent years, doubling over the last three years. The company’s capex growth rate has far exceeded its net income growth rate, which makes sense given WM won’t see a return on some of these investments for years.

The big driver of WM’s investments is sustainability through recycling projects and renewable natural gas (RNG).

Landfill gas (LFG) is produced when bacteria break down organic waste. According to the Environmental Protection Agency, LFG contains about 50% methane and 50% carbon dioxide — not a good combination when released directly into the atmosphere. WM is working on trapping and processing that LFG into pipeline quality gas that can be reused. The sustainable process is why the finished product is called “renewable” natural gas.

RNG production is far more expensive than fossil-based gas. But there are credits to make RNG a good investment. On its Q4 2023 earnings call, WM discussed the stability of the credit program and why credits can be stacked together to make the program more profitable. WM is a leader in the LFG to RNG industry, which has decades of potential especially as the pace of the energy transition accelerates.

WM is putting up excellent numbers despite these long-term investments. Profits are near an all-time high and margins have recovered from the pandemic-induced slowdown. WM stock has rather quietly surged over 108% in the last five years, outperforming the S&P 500. The company has made meaningful raises to its dividend, and returned $2.44 billion to shareholders in 2023, but the yield is low because the stock has done so well and WM is investing in long-term growth, not just the dividend.

Sherwin-Williams is so much more than just its paint stores

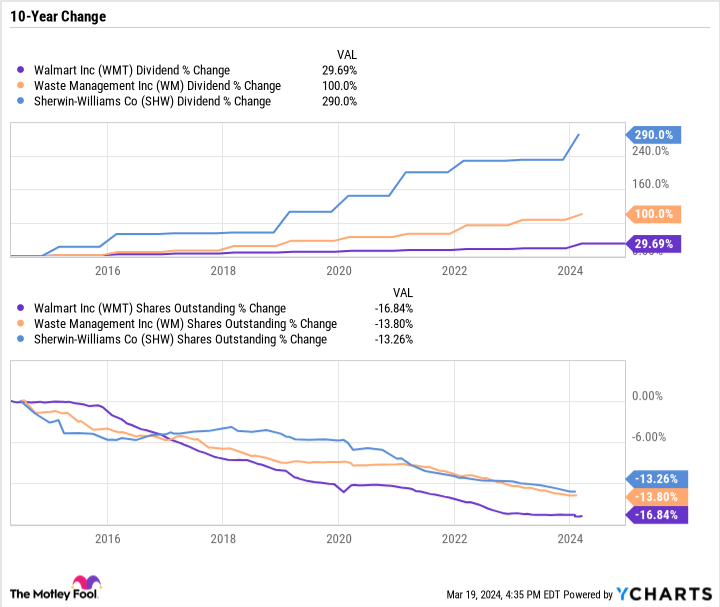

Over the last decade, Sherwin-Williams has increased its dividend by nearly fourfold, WM’s has doubled, and Walmart’s is up less than 30%. However, Walmart has reduced its share count by more than WM or Sherwin-Williams.

Sherwin-Williams is also the best performing of the three, crushing the S&P 500 over the last five years. Pretty good for a paint company in what has been a growth-stock-fueled rally in the broader market.

Sherwin-Williams has achieved breakneck revenue growth while keeping its margins fairly high. The key has been margin growth across its business units, especially its largest segment, the paint stores group (PSG). PSG — which used to be called “the Americas group” — centers around Sherwin-Williams stores that cater to industrial, commercial, and residential customers.

The consumer brands group contains products not under the Sherwin-Williams name, like Cabot, Valspar, and others. The segment boomed during the height of the pandemic as folks undertook DIY projects. The segment’s sales and profits fell in the most recent quarter, but they are still up substantially from a few years ago, which illustrates how the company has been able to grow despite difficult comps.

The performance coatings group is the segment you may be least familiar with since it targets industrial and commercial customers. Sherwin-Williams makes coatings for everything from ships to machinery and equipment, you name it.

Sherwin-Williams’ dividend is up 90% in the last five years, but because the stock has outpaced this growth, the yield has fallen.

Moving past passive income

Walmart, WM, and Sherwin-Williams are excellent examples of how an investment thesis can change for good reasons.

All three companies have grown nicely, put up solid returns for investors, and still have sizable capital return programs with dividends and buybacks. But because the focus is more on growth, these stocks are no longer suitable passive income plays.

That doesn’t mean that they aren’t good investments, but it does mean investors must realign their expectations based on the new direction.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool recommends Sherwin-Williams and Waste Management. The Motley Fool has a disclosure policy.

3 Dividend Stocks That Are Too Successful for Their Own Good was originally published by The Motley Fool