3 Incredible Growth Stocks That Could Skyrocket This Year

You don’t need to chase the latest hot trend in technology to make lots of money in stocks. Buying shares of emerging consumer brands before they are widely recognized is one of the best investment strategies — ask Peter Lynch.

Three Motley Fool contributors were asked to come up with three promising long-term investments that also have near-term upside potential. Here’s why Cava Group (NYSE: CAVA), MercadoLibre (NASDAQ: MELI), and Dutch Bros (NYSE: BROS) made the cut.

The latest fast-casual star

Jeremy Bowman (Cava Group): Cava Group is one of the more intriguing IPOs to come on the market recently. It’s a fast-casual chain that’s drawn comparisons to Chipotle Mexican Grill for good reason.

Cava offers a similar menu to Chipotle, using Mediterranean cuisine instead of Mexican. It serves rolled-up pita wraps that closely resemble burritos, and it also offers bowls. Even its restaurant design resembles Chipotle’s with a minimalist industrial decor.

Cava’s financial results have also been impressive in its brief period as a publicly traded company. In its fourth-quarter earnings report, the company reported a 52.5% increase in revenue to $175.5 million, driven by an 11.4% increase in same-store sales and aggressive store openings, as its store base increased 30% to 309.

Other data points show its restaurants are also popular as average unit volumes, or the average annual revenue from its restaurants, was $2.6 million. That is stronger than most of its peers, and the double-digit comparable sales growth shows that number is rapidly moving higher.

On a generally accepted accounting principles (GAAP) basis, the company is minimally profitable. However, its restaurant-level profit margins are strong at 24.8% for 2023, indicating that GAAP profit margins should ramp up as the company expands and its corporate costs moderate.

Cava also has a strong management pedigree, with Panera Founder Ron Shaich serving as its chairman and one of its early investors.

The stock has already soared this year, up nearly 70%, but it looks like a good bet to keep climbing as its valuation is still reasonable, and its results have easily beaten estimates so far. Investors seem to be recognizing Cava’s long-term growth potential, and the stock should keep gaining as the company executes its growth plan.

One of the biggest opportunities in e-commerce

Jennifer Saibil (MercadoLibre): E-commerce continues to increase as a percentage of overall retail sales, and that shift has retailers of all stripes moving over their operations to meet demand. Some companies have a headstart, and that edge will provide years of growing revenue. E-commerce accounted for 19% of global retail sales in 2023, but it’s expected to reach 24% by 2027. That still leaves years of room to grow.

MercadoLibre is the dominant e-commerce powerhouse in Latin America, serving 85 million customers in 18 countries, with 413 items sold in the 2023 fourth quarter alone. That was a 29% year-over-year increase, and MercadoLibre demonstrates robust growth consistently. Revenue increased 83% over last year (currency neutral) in the fourth quarter, a continuing acceleration.

Almost 50% of shipments are now on the MercadoLibre logistics network, leading to improved delivery times for more orders. More than 75% of shipments were delivered within 48 hours, which might be the fastest e-commerce times anywhere. As MercadoLibre gets products to customers faster, it wins their loyalty and their business, resulting in higher revenue and market share. It also filters down to the bottom line. Net income more than doubled in 2023 to $987 million.

Let’s not forget MercadoLibre’s fintech business, which is a high-margin business growing even faster than e-commerce and has an even bigger opportunity. Total payment volume (TPV) increased 153% year over year in the fourth quarter to $56 billion, and off-platform TPV was up 182%. As for its credit business, an outgrowth of the fintech business, the total portfolio increased 33% over last year to $3.8 billion. That drives net income as well.

MercadoLibre stock plunged after its fourth-quarter report because earnings per share (EPS) came in below Wall Street’s expectations. They took a hit from a one-time tax expense that doesn’t impact its operations, and investors may be losing sight of the trees in the forest with the stock dip. But that creates an opportunity for smart investors, and MercadoLibre stock is flashing a huge buy signal right now.

Another promising restaurant stock

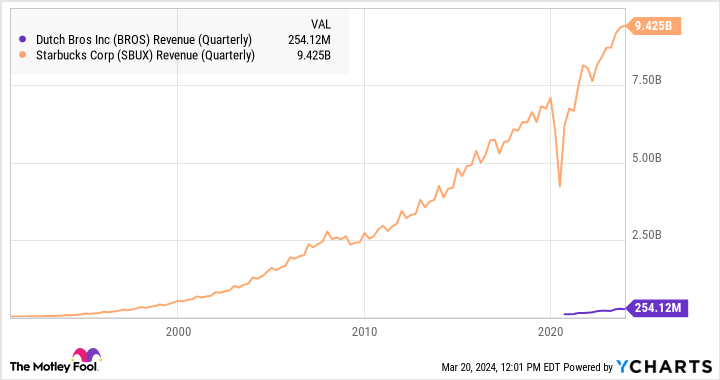

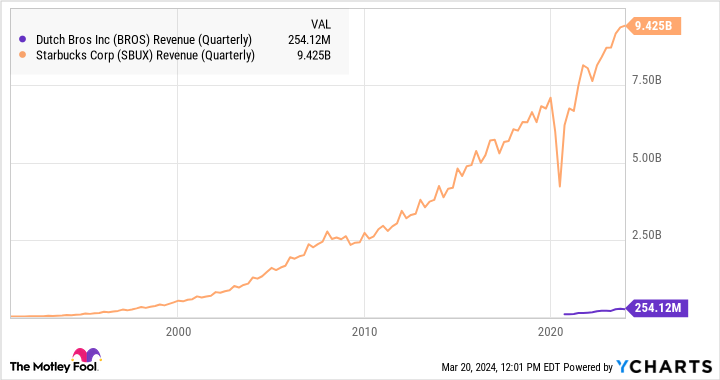

John Ballard (Dutch Bros): Finding fast-growing restaurant chains while they are still small can lead to massive returns. A $1,000 investment in Starbucks at its initial public offering (IPO) would be worth $273,000 today (excluding dividends). Dutch Bros may not grow into a global brand like Starbucks, but it doesn’t have to.

At just $254 million in quarterly revenue across 16 states, Dutch Bros has a long runway of growth just in the U.S. It’s currently at a similar size as Starbucks in the 1990s, and its menu of hot and cold beverages is catching on. Total system same-shop sales increased 5% in the most recent quarter, with total revenue up 26%. It’s just a fraction of the size it could grow into over the next few decades.

Dutch Bros is opening new shops while keeping the business hovering around breakeven. It’s been operating at a slight adjusted profit over the last year. But its low profit sets up an important catalyst for the stock.

Its minuscule profit margin could lead to explosive earnings growth over the next decade as it continues to expand beyond its current footprint in 16 states. Dutch Bros earns a solid contribution margin of 26% across its company-operated shops.

Despite continued growth in the business, the stock was a bit expensive at its 2021 IPO, and it subsequently fell in 2022 as same-shop sales slowed over macroeconomic headwinds. But the stock now looks quite attractive at a lower valuation. The share price is up 7% year to date, but improving earnings results this year could send the stock even higher.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Jennifer Saibil has positions in MercadoLibre. Jeremy Bowman has positions in Chipotle Mexican Grill, MercadoLibre, and Starbucks. John Ballard has positions in MercadoLibre. The Motley Fool has positions in and recommends Chipotle Mexican Grill, MercadoLibre, and Starbucks. The Motley Fool recommends Cava Group. The Motley Fool has a disclosure policy.

3 Incredible Growth Stocks That Could Skyrocket This Year was originally published by The Motley Fool