Bitcoin Tests $66K as Analysts Expect More Volatility Before Calm

-

Bitcoin remains volatile, but some market calm is expected soon.

-

Traders are pricing out the possibility of an ether ETF anytime soon, QCP Capital says.

Bitcoin {{BTC}} tested $66,000 during the Asian trading hours on Friday, as market observers expect the leading cryptocurrency to face more volatility ahead.

“Bitcoin remains volatile with the drawdown of 10% we saw this week, with the recent catalyst being driven by spot bitcoin ETF outflows from GBTC of about 300mm on March 20,” Semir Gabeljic, Director of Capital Formation at Pythagoras Investments, said in an email interview.

“The drawdown still remains in line with the expected range of 10-20% as we’ve seen historically that happens right before the BTC halving event. More volatility is expected to come going into the BTC halving,” he continued.

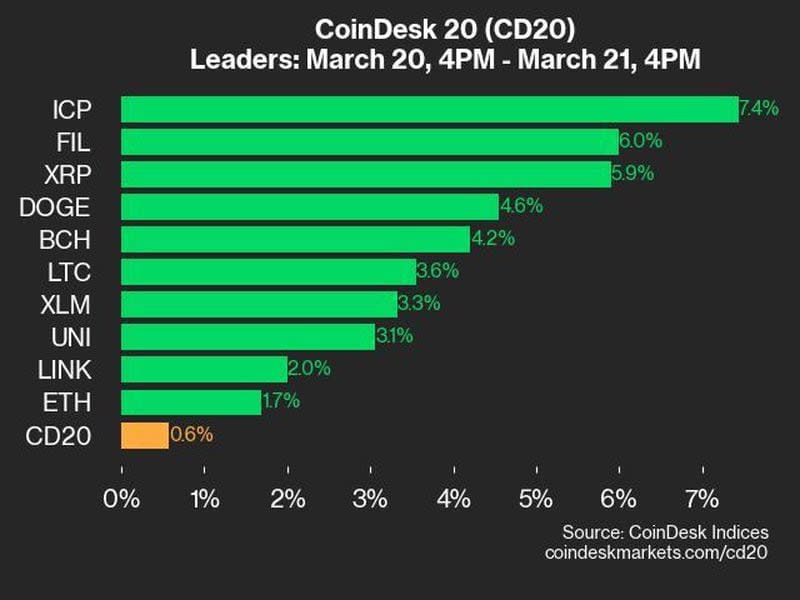

Meanwhile, the CoinDesk 20 (CD20), a measure of the world’s most liquid digital assets, is down 0.5%.

CoinDesk’s Digitization Index (DTZ), which measures the performance of digitization protocols like Ethereum Name Service (ENS), was the best-performing index during Asia trading hours, up 2.7%.

In a note sent out Friday morning Asia time, Singapore-based QCP Capital wrote that the market is consolidating with bitcoin and ether trading in a “relatively tight range” and that the market “might take a break this weekend” after last weekend’s pre-FOMC volatility.

The trading house also noted that the Grayscale Bitcoin Trust (GBTC) continued to see steep outflows, with $358.8 million leaving the fund. QCP expects a fourth consecutive day of BTC spot exchange-traded fund net outflows.

Regarding ether {{ETH}}, QCP says that the market is starting to price out the chances of a spot ether ETF being approved anytime soon.

“The Grayscale ETH discount has widened from -8% to -20% over the past two weeks,” QCP noted.

Prediction markets also reflect this. On Polymarket, a contract asking if an Ethereum ETF will be approved by May 31 is currently trading with a 21% probability that this will be the case.

The Ethereum Foundation is currently being investigated by a state authority, which Fortune says is the Securities and Exchange Commission. The question remains whether the SEC considers ether a security, and the Commission hasn’t been responsive to FOIA requests for key documents that would shed insight into its views on the issue.

Blockchain bettors on Polymarket also believe that the second quarter is when ether will hit its all-time high, but a sizable portion of traders also think there will be no all-time highs in 2024.

Ether is currently trading above $3500, up 1.2%, according to CoinDesk Indices data.